CO DoR DR 1093 2016 free printable template

Show details

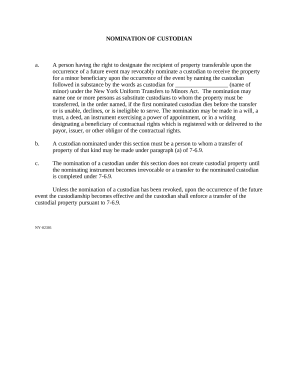

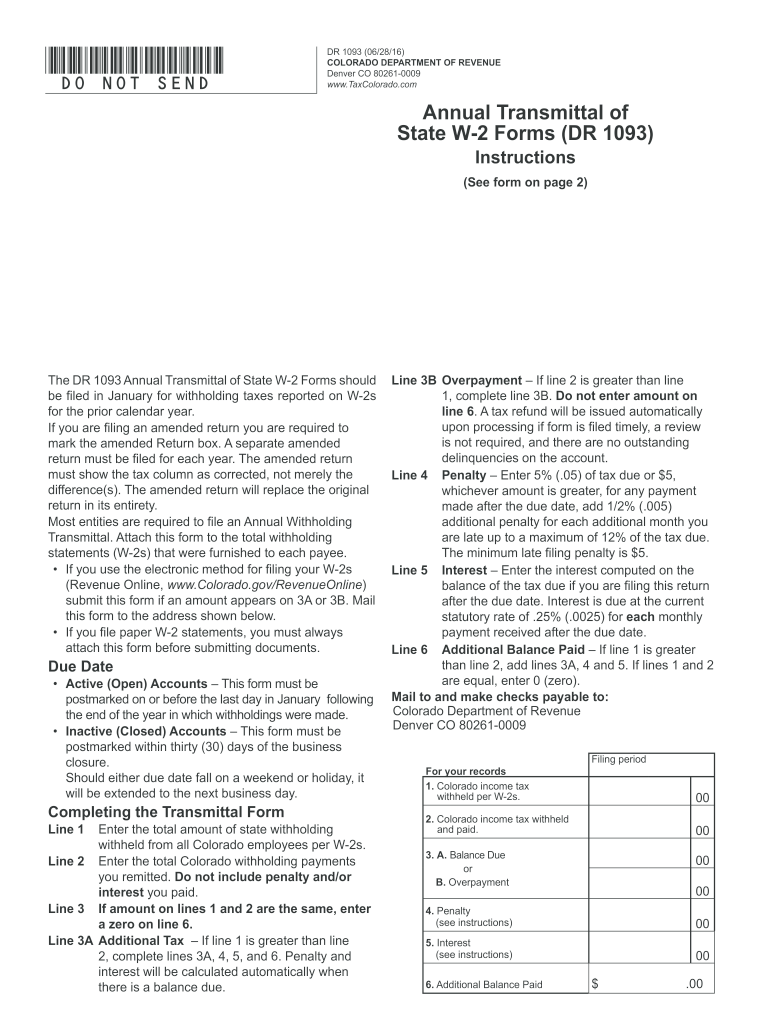

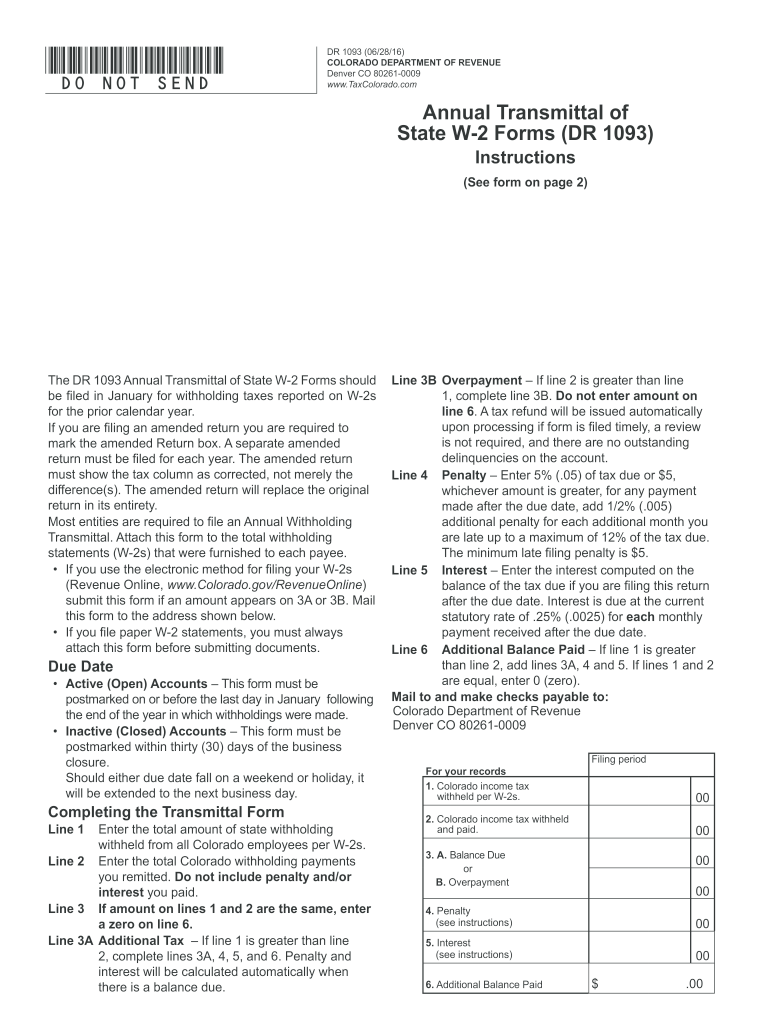

DO NOT SEND DR 1093 06/28/16 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0009 www. TaxColorado. com Annual Transmittal of State W-2 Forms DR 1093 Instructions See form on page 2 The DR 1093 Annual Transmittal of State W-2 Forms should be filed in January for withholding taxes reported on W-2s for the prior calendar year. If you are filing an amended return you are required to mark the amended Return box. A separate amended return must be filed for each year. The amended return must show...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DoR DR 1093

Edit your CO DoR DR 1093 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DoR DR 1093 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DoR DR 1093 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DoR DR 1093. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR DR 1093 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DoR DR 1093

How to fill out CO DoR DR 1093

01

Start by obtaining the CO DoR DR 1093 form from the official website or local office.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide the date and nature of the request or transaction relevant to the form.

04

Complete any required sections detailing the specifics of the matter, ensuring you follow the guidelines provided.

05

Review all information for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the completed form as instructed, either online, by mail, or in person.

Who needs CO DoR DR 1093?

01

Individuals or entities wishing to request or transfer specific records or documents related to the Department of Revenue in Colorado.

02

People who are involved in legal matters requiring documentation from the Colorado Department of Revenue.

03

Taxpayers seeking clarification or assistance regarding their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is a Colorado DR 1093?

Filing Information Employers filing annual wage withholding statements (W-2s) electronically should not also send paper statements to the Department. In addition, the employer filing electronically only needs to complete the Annual Transmittal of State W-2 Form (DR 1093) if paying additional tax or requesting a refund.

What is dr 4709 colorado department of revenue?

The department collects most types of taxes and issues state identification cards and driver licenses and also enforces Colorado laws regarding gaming, liquor, tobacco, racing, auto dealers, and marijuana.

Where do I mail my Colorado extension?

Filing extensions are granted automatically, only return this form if you need to make an additional payment of tax. Return the DR 0158-I with check or money order payable to the “Colorado Department of Revenue”. Mail payments to Colorado Department of Revenue, Denver, Colorado 80261-0008.

How much is Colorado withholding tax?

Coloradans' income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital status.

How do I submit tax withholding?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Where do I mail my DR 1093 Colorado?

Mail your Form W2s along with Form DR-1093 to the following address. Colorado Department of Revenue, Denver, CO 80261-0009. Denver, CO 80217-0087.

What is the 2% withholding tax in Colorado?

Colorado 2% Withholding (DR 1083) This law affects non-Colorado residents or those parties moving out-of-state and not purchasing another primary residence. The amount, if withheld, shall be the lesser of 2% of the sales price of the property or the net proceeds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CO DoR DR 1093 for eSignature?

CO DoR DR 1093 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute CO DoR DR 1093 online?

pdfFiller has made it simple to fill out and eSign CO DoR DR 1093. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit CO DoR DR 1093 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing CO DoR DR 1093 right away.

What is CO DoR DR 1093?

CO DoR DR 1093 is a specific form used in Colorado for reporting certain financial transactions and details related to taxation or regulatory compliance.

Who is required to file CO DoR DR 1093?

Entities or individuals who engage in specific financial activities or transactions as defined by Colorado state regulations are required to file CO DoR DR 1093.

How to fill out CO DoR DR 1093?

To fill out CO DoR DR 1093, individuals must provide accurate financial information, specific transaction details, and any required identification numbers as outlined in the form instructions.

What is the purpose of CO DoR DR 1093?

The purpose of CO DoR DR 1093 is to ensure compliance with state financial regulations and provide the government with necessary information regarding financial activities.

What information must be reported on CO DoR DR 1093?

CO DoR DR 1093 requires reporting of transaction types, amounts, involved parties, and any relevant tax identification data for regulatory purposes.

Fill out your CO DoR DR 1093 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DoR DR 1093 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.