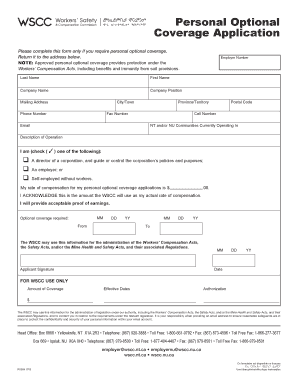

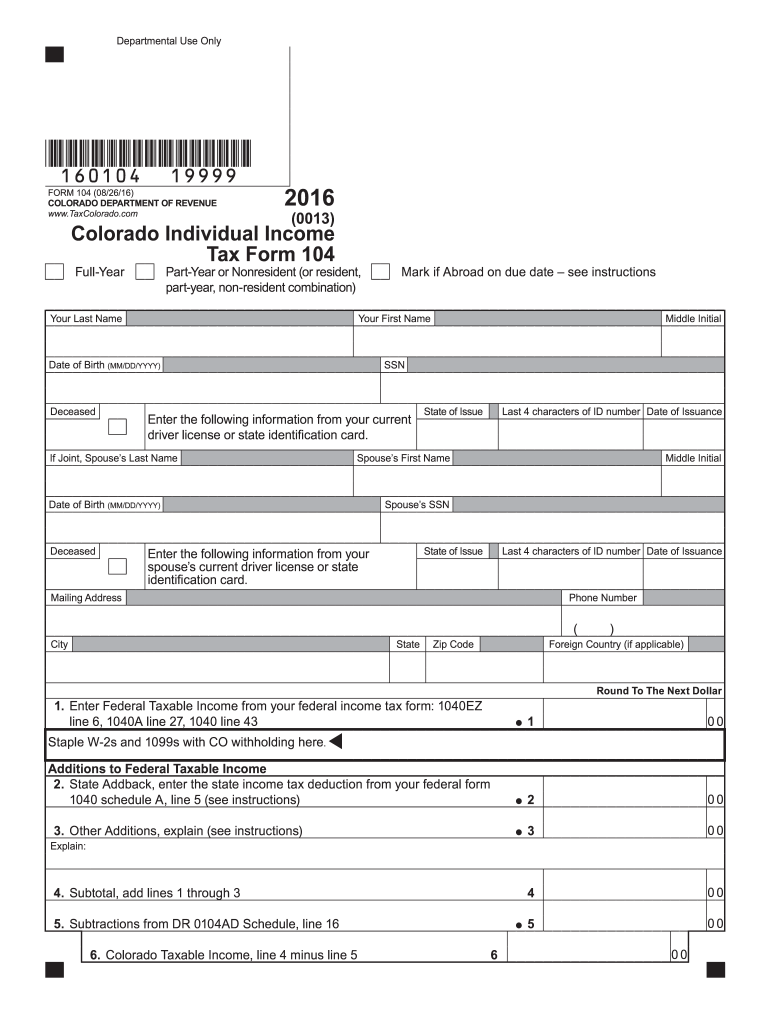

CO DoR 104 2016 free printable template

Instructions and Help about CO DoR 104

How to edit CO DoR 104

How to fill out CO DoR 104

About CO DoR previous version

What is CO DoR 104?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about CO DoR 104

What should I do if I realize I made a mistake on my form 104 2016?

If you discover an error on your form 104 2016 after submission, you should file an amended return using Form 1040-X. This allows you to correct mistakes, including income errors or incorrect deductions. Be sure to follow the specific instructions for filing an amendment to prevent further issues.

How can I check the status of my submitted form 104 2016?

To verify the status of your submitted form 104 2016, you can use the IRS 'Where’s My Refund?' tool if a refund is expected, or call the IRS directly. Common e-file rejection codes can help identify any processing issues, allowing you to take corrective action swiftly.

What are the privacy considerations when filing form 104 2016?

When filing form 104 2016, it is crucial to ensure the protection of your personal and financial information. You should use e-signature where acceptable and retain copies of your submitted forms securely for at least three years. Always be cautious about sharing sensitive information to prevent identity theft.

Can someone else file form 104 2016 on my behalf?

Yes, another person can file your form 104 2016 on your behalf if they have legal authorization, such as a Power of Attorney (POA). It is essential to provide them with the necessary information and documentation to ensure accurate filing and compliance with regulations.

What are some common mistakes to avoid when submitting form 104 2016?

Common errors when submitting form 104 2016 include incorrect Social Security numbers, miscalculating income, and failing to sign the form. Double-check your entries against supporting documents and ensure accurate data to avoid potential delays and rejections.

See what our users say