India GAR-43 free printable template

Show details

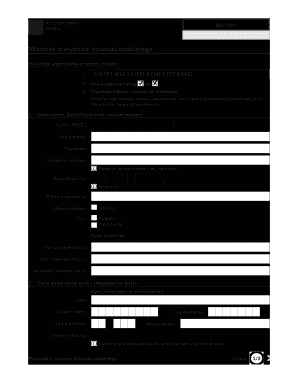

G.A.R.43 See Rule 186(1) APPLICATIONCUMBILL FOR REFUND OF DEPOSIT Bill No. Month Head of Account Original Chillán of Receipt No. & Date 1. Bank/Office in which deposited 2. Name of depositor 3. Amount

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign gar 43 form pdf

Edit your gar 43 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gar 43 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gar 33 form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gar form pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out India GAR-43

How to fill out India GAR-43

01

Obtain the India GAR-43 form from the official tax website or relevant authority.

02

Fill in the basic details such as name, address, and contact information in the designated fields.

03

Provide the appropriate reference number and date required in the form.

04

Ensure to include the details of the transaction or service for which the GAR-43 is being filled out.

05

Check the box for the applicable tax implications and any relevant exemptions.

06

Double-check all entries for accuracy and completeness before submission.

07

Submit the completed GAR-43 form to the appropriate tax authority or governing body.

Who needs India GAR-43?

01

Individuals or businesses making cross-border transactions liable to taxes in India.

02

Taxpayers seeking clarification or exemption from tax withholding on specified transactions.

03

Entities involved in international payments or receipts that require compliance with Indian tax regulations.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute India GAR-43 online?

With pdfFiller, you may easily complete and sign India GAR-43 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit India GAR-43 online?

The editing procedure is simple with pdfFiller. Open your India GAR-43 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete India GAR-43 on an Android device?

Complete your India GAR-43 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is India GAR-43?

India GAR-43 is a form required under the General Anti-Avoidance Rules (GAAR) in India, which aims to provide detailed information about specific transactions and arrangements that may be subject to scrutiny for tax avoidance.

Who is required to file India GAR-43?

Any taxpayer who has entered into specific transactions, arrangements, or agreements that may trigger GAAR provisions, particularly those that are perceived as tax avoidance, is required to file India GAR-43.

How to fill out India GAR-43?

To fill out India GAR-43, the taxpayer must provide accurate details of the transaction, including parties involved, financial information, purpose of the arrangement, and any tax benefits anticipated. It is important to follow the guidelines issued by the tax authorities.

What is the purpose of India GAR-43?

The purpose of India GAR-43 is to enhance transparency and allow tax authorities to assess and scrutinize transactions that could be deemed as contrived or aimed at tax avoidance, thus enabling appropriate tax treatment.

What information must be reported on India GAR-43?

India GAR-43 requires reporting of information such as details of the transaction, nature and value of the arrangement, purpose of the transaction, identification of parties, and any potential tax benefits arising from it.

Fill out your India GAR-43 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India GAR-43 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.