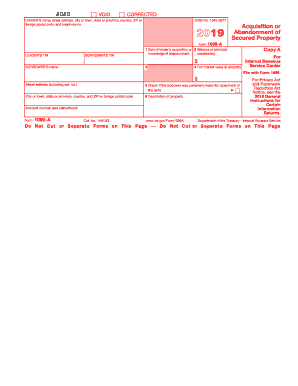

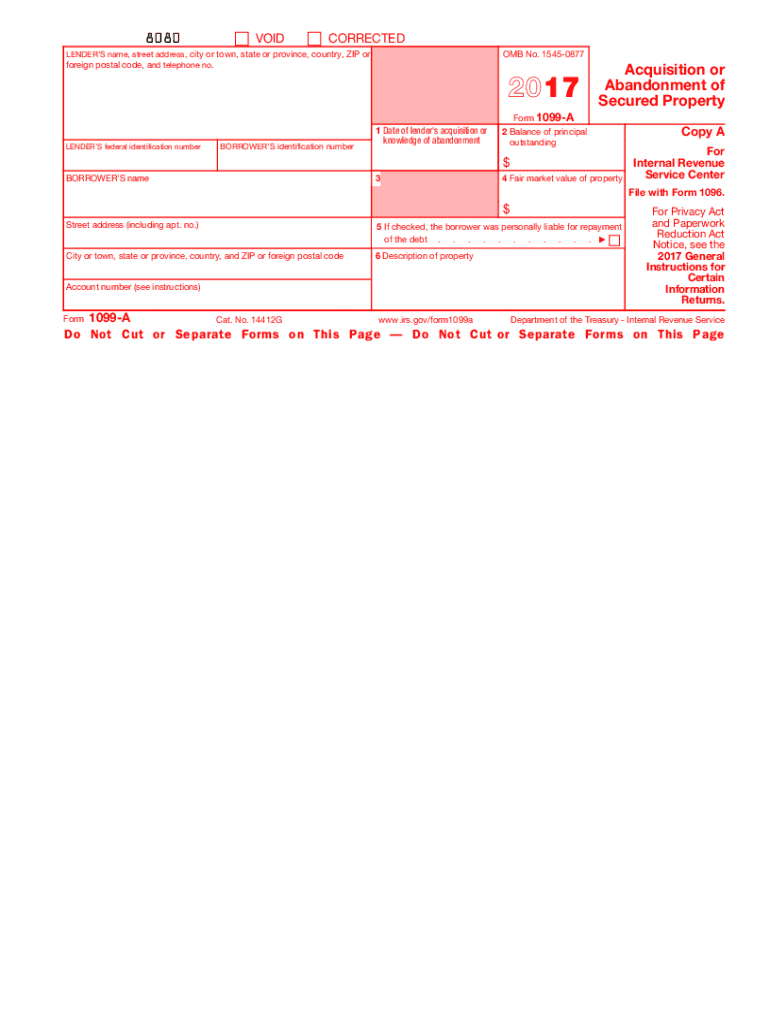

IRS 1099-A 2017 free printable template

Instructions and Help about IRS 1099-A

How to edit IRS 1099-A

How to fill out IRS 1099-A

About IRS 1099-A 2017 previous version

What is IRS 1099-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

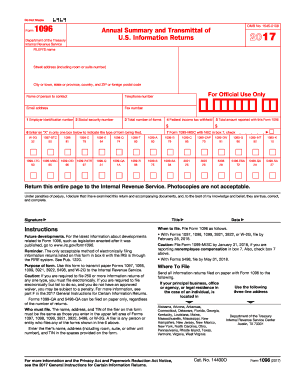

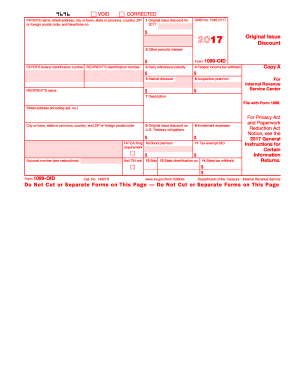

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-A

What should I do if I discover an error after filing my IRS 1099-A?

If you realize a mistake on your IRS 1099-A after submission, you should file a corrected version of the form. Ensure that you mark the checkbox indicating that it is a corrected return and include the correct details to avoid any confusion. Keep copies of both the original and corrected forms for your records.

How can I check the status of my filed IRS 1099-A?

To verify the status of your IRS 1099-A, you can contact the IRS e-File support or check online for their tracking system. It's important to have your details ready, such as the confirmation number received upon submission. If you encounter issues, understanding common e-file rejection codes can be helpful.

What are the privacy and data security measures I should consider when filing IRS 1099-A?

When filing your IRS 1099-A, it's crucial to ensure your data is secure. Utilize encrypted e-filing services, and make sure to store sensitive documents safely. Additionally, be aware of the record retention period to keep your information secure and compliant with IRS regulations.

Can a nonresident file an IRS 1099-A on behalf of someone else?

Yes, a nonresident can file an IRS 1099-A on behalf of someone else, provided they have the appropriate authorization or power of attorney. This ensures that the submission adheres to IRS guidelines, and it is crucial to include any necessary documentation supporting this representation.

What types of common errors should I look out for when submitting IRS 1099-A?

When submitting IRS 1099-A, be vigilant about common errors such as incorrect taxpayer identification numbers, missing signatures, or inaccurate property details. To avoid these mistakes, double-check all entries and ensure the form is completed thoroughly before submission.