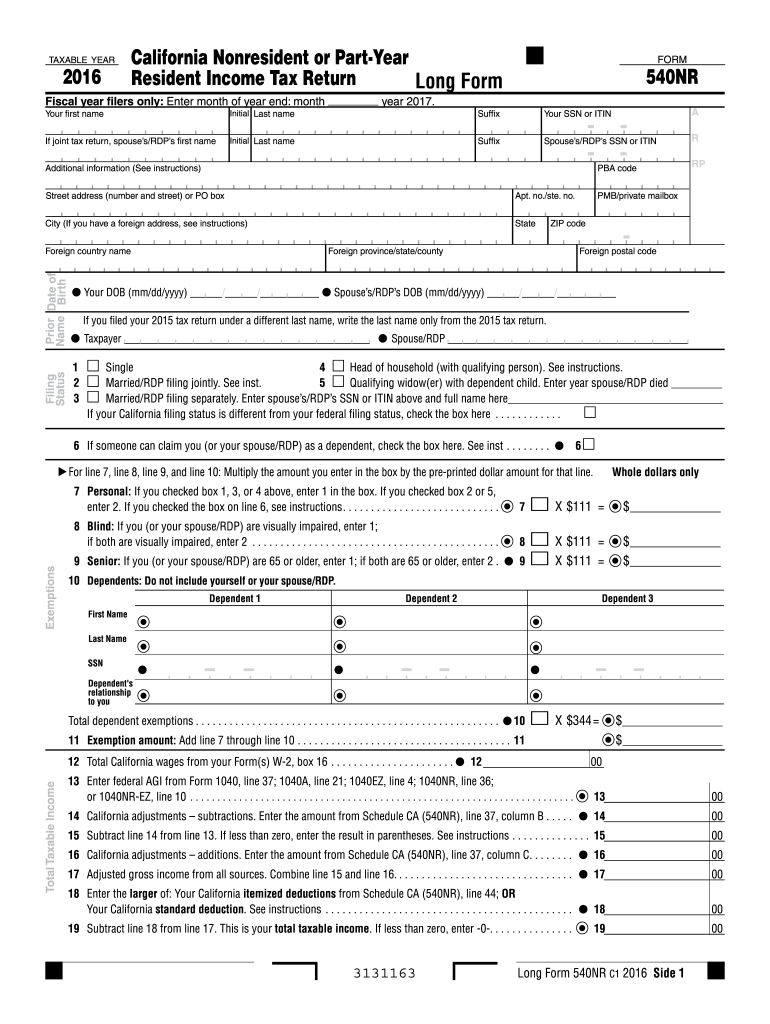

Get the free 2016 form 540nr

Instructions and Help about CA FTB 540NR Long

How to edit CA FTB 540NR Long

How to fill out CA FTB 540NR Long

About CA FTB 540NR Long 2016 previous version

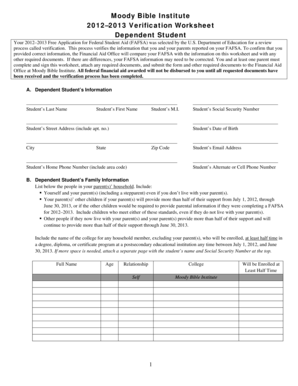

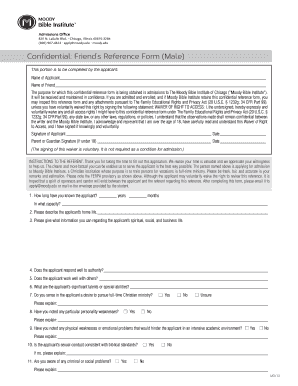

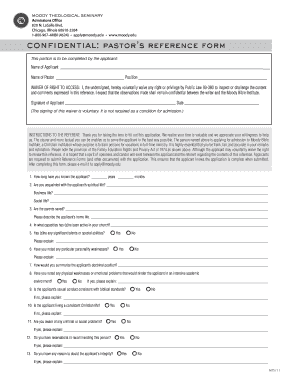

What is CA FTB 540NR Long?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about 2016 form 540nr

How can I correct mistakes on my 2016 form 540nr after filing?

To correct mistakes on your 2016 form 540nr after it has been filed, you will need to submit an amended return using Form 1040X or the California equivalent if available. Ensure you clearly indicate the changes made and provide a brief explanation. It's advisable to keep copies of both the original and amended forms for your records.

How can I verify the receipt of my 2016 form 540nr?

To verify receipt of your 2016 form 540nr, you can check the status through the California Franchise Tax Board's online portal or contact their customer service. Make sure to have your identification details handy. If you filed electronically, you might also receive confirmation via email or within the filing software.

What should I do if I receive an audit notice after submitting my 2016 form 540nr?

If you receive an audit notice after submitting your 2016 form 540nr, carefully read the correspondence for required actions. Gather all relevant documentation supporting your claims on the tax return, and respond within the timeframe provided. It may also be beneficial to consult a tax professional to ensure compliance.

Are there specific technical requirements for e-filing the 2016 form 540nr?

Yes, when e-filing your 2016 form 540nr, ensure your software is compatible and meets the California Franchise Tax Board's technical requirements. This includes using up-to-date web browsers and having a stable internet connection to complete your submission without interruptions.