Get the free 2016 form 540nr

Show details

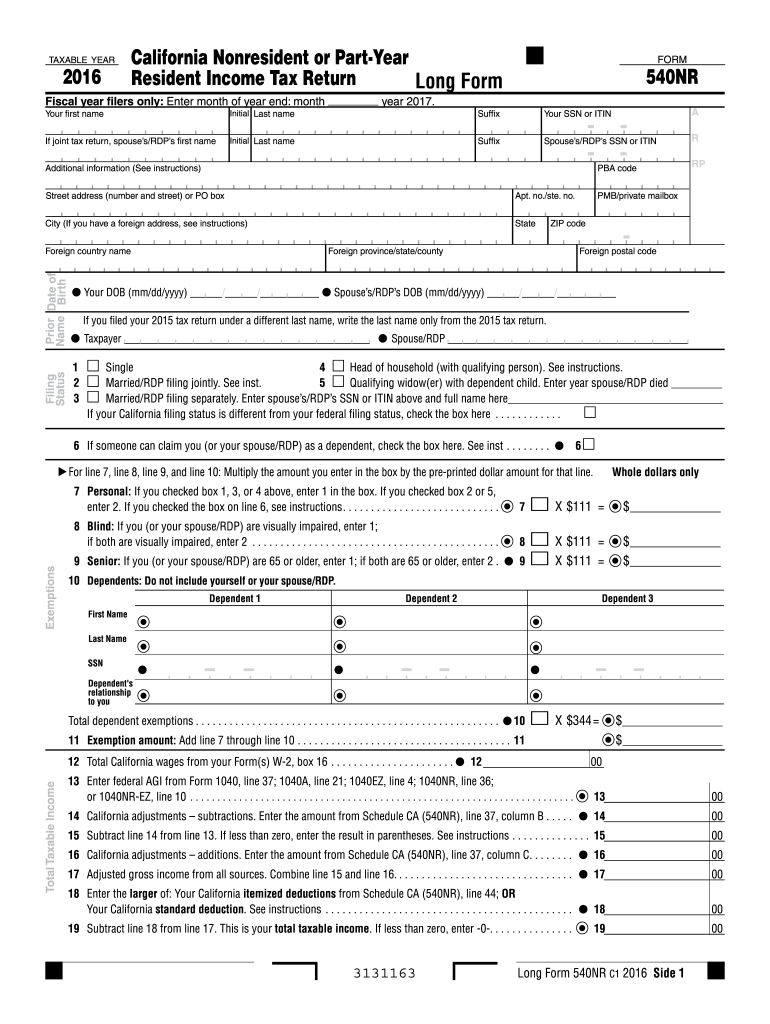

3131163 Long Form 540NR C1 2016 Side 1 Your name Your SSN or ITIN 31 Tax. Check the box if from Tax Table Tax Rate Schedule FTB 3800 FTB 3803. 102 104 Tax due. If line 86 is less than line 74 subtract line 86 from line 74. 104 Side 2 Long Form 540NR C1 2016 Code Amount Alzheimer s Disease/Related Disorders Fund.. 401 Rare and Endangered Species Preservation Program. 403 California Breast Cancer Research Fund. 405 California Firefighters Memorial Fund.. Attach Schedule P 540NR. 72 Mental...Health Services Tax. See instructions. 73 Other taxes and credit recapture. See instructions. 74 Add line 63 line 71 line 72 and line 73. This is your total tax. Payments 81 California income tax withheld. See instructions. 82 2016 CA estimated tax and other payments. See instructions. 83 Withholding Form 592-B and/or 593. If line 86 is more than line 74 subtract line 74 from line 86. 101 102 Amount of line 101 you want applied to your 2017 estimated tax. 102 104 Tax due. If line 86 is less...than line 74 subtract line 86 from line 74. 104 Side 2 Long Form 540NR C1 2016 Code Amount Alzheimer s Disease/Related Disorders Fund.. TAXABLE YEAR California Nonresident or Part-Year Resident Income Tax Return Long Form FORM 540NR Fiscal year filers only Enter month of year end month year 2017. Your first name Initial Last name Suffix Your SSN or ITIN If joint tax return spouse s/RDP s first name A Spouse s/RDP s SSN or ITIN - Additional information See instructions Street address number and...street or PO box Apt. no. /ste. no. City If you have a foreign address see instructions State Filing Status Prior Date of Name Birth Foreign country name RP PBA code PMB/private mailbox ZIP code Foreign province/state/county R Foreign postal code Your DOB mm/dd/yyyy // Spouse s/RDP s DOB mm/dd/yyyy // If you filed your 2015 tax return under a different last name write the last name only from the 2015 tax return* Taxpayer Spouse/RDP 1 Single 4 Head of household with qualifying person. See...instructions. 2 Married/RDP filing jointly. See inst. 5 Qualifying widow er with dependent child. Enter year spouse/RDP died If your California filing status is different from your federal filing status check the box here. 6 If someone can claim you or your spouse/RDP as a dependent check the box here. See inst. For line 7 line 8 line 9 and line 10 Multiply the amount you enter in the box by the pre-printed dollar amount for that line. 7 Personal If you checked box 1 3 or 4 above enter 1 in...the box. If you checked box 2 or 5 enter 2. If you checked the box on line 6 see instructions. 7 Whole dollars only X 111 Exemptions 8 Blind If you or your spouse/RDP are visually impaired enter 1 if both are visually impaired enter 2. 8 9 Senior If you or your spouse/RDP are 65 or older enter 1 if both are 65 or older enter 2. 10 Dependents Do not include yourself or your spouse/RDP. Dependent 1 First Name Last Name SSN relationship to you Total dependent exemptions. 10 X 344 11 Exemption...amount Add line 7 through line 10.

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540NR Long

How to edit CA FTB 540NR Long

How to fill out CA FTB 540NR Long

Instructions and Help about CA FTB 540NR Long

How to edit CA FTB 540NR Long

To edit the CA FTB 540NR Long, first obtain a blank copy of the form. You can access it from the California Franchise Tax Board (FTB) website or various tax preparation resources. Use a PDF editor like pdfFiller to make necessary changes directly on the form. Ensure all edits comply with current tax regulations and double-check for accuracy before saving.

How to fill out CA FTB 540NR Long

To fill out the CA FTB 540NR Long, follow these steps:

01

Download the form from the California FTB website or a tax support website.

02

Provide your personal information, including your Social Security number and address.

03

Complete the income section by reporting all income earned during the tax year, including dividends, interest, and wages.

04

Deduct applicable expenses and credits, ensuring to follow the guidelines provided in the instruction booklet.

05

Review your completed form before submission for any errors or omissions.

About CA FTB 540NR Long 2016 previous version

What is CA FTB 540NR Long?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB 540NR Long 2016 previous version

What is CA FTB 540NR Long?

CA FTB 540NR Long is the California Nonresident or Part-Year Resident Income Tax Return form. This form is specifically designed for individuals who do not reside in California for the entire tax year but have income that is taxable in the state.

What is the purpose of this form?

The purpose of the CA FTB 540NR Long is to report income earned in California as a nonresident or part-year resident. It is essential for determining the amount of state tax liability owed, as it allows the California Franchise Tax Board to assess tax based on income earned within the state.

Who needs the form?

Nonresidents and part-year residents who have earned income in California, such as wages, business income, or rents, need to file the CA FTB 540NR Long. This includes individuals who moved into or out of California during the tax year and earned money while residing in the state.

When am I exempt from filling out this form?

You may be exempt from filling out the CA FTB 540NR Long if your total income from all sources is below the filing threshold set by the California FTB. Additionally, if you had no taxable income sourced from California during the tax year, you are not required to file this form.

Components of the form

The CA FTB 540NR Long includes various sections that require you to provide personal information, income details, deductions, and credits. Key components include sections for wages, interest income, business income, and adjustments for California-specific tax benefits.

What are the penalties for not issuing the form?

Failing to file the CA FTB 540NR Long by the due date may result in penalties and interest charged on any taxes owed. The FTB can impose a failure-to-file penalty, which is a percentage of the unpaid tax amount, as well as additional interest on overdue payments.

What information do you need when you file the form?

When filing the CA FTB 540NR Long, you will need several key pieces of information including:

01

Your Social Security number or Individual Taxpayer Identification Number.

02

Details of income from all sources, including W-2 forms and 1099s.

03

Records of any deductions or credits you are claiming, such as medical expenses or education credits.

04

Bank account information if you choose to receive a refund via direct deposit.

Is the form accompanied by other forms?

The CA FTB 540NR Long is often accompanied by supporting documents, such as W-2s, 1099 forms, and any applicable schedules. In some cases, additional forms may be required if you are claiming specific deductions or credits.

Where do I send the form?

File the completed CA FTB 540NR Long by mail to the address specified in the form instructions. Generally, the mailing address varies depending on whether you are enclosing a payment or are expecting a refund. Always double-check the latest instructions for the most accurate submission address.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.