Get the free AR1000NR Arkansas Indiviual Income Tax Return NR1 2016

Show details

We are not affiliated with any brand or entity on this form

Instructions and Help about ar1000nr arkansas indiviual income

How to edit ar1000nr arkansas indiviual income

How to fill out ar1000nr arkansas indiviual income

Instructions and Help about ar1000nr arkansas indiviual income

How to edit ar1000nr arkansas indiviual income

To edit the ar1000nr arkansas indiviual income form, use a digital document editor like pdfFiller. Simply upload the form, make any necessary adjustments, and save your changes for submission. This ensures that your information is current and accurate before filing.

How to fill out ar1000nr arkansas indiviual income

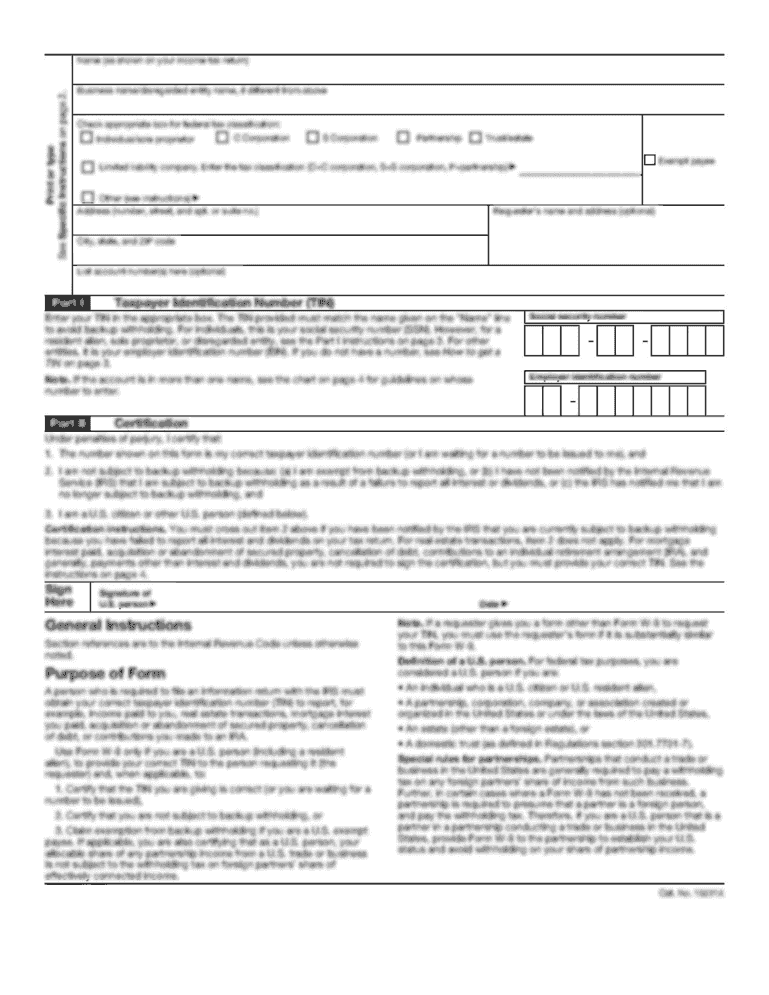

Filling out the ar1000nr arkansas indiviual income form involves a series of steps:

01

Begin by entering your personal information at the top of the form, including your name, address, and Social Security number.

02

Report your income, detailing wages, pensions, and other earnings as specified on the form.

03

Calculate your deductions and credits according to the instructions provided.

04

Determine your total tax owed and any payments made.

05

Review your form for accuracy and completeness before submission.

Latest updates to ar1000nr arkansas indiviual income

Latest updates to ar1000nr arkansas indiviual income

As of the latest tax year, ensure to check for any changes in tax rates, allowable deductions, and updates to filing procedures specific to the ar1000nr arkansas indiviual income form. Always refer to the Arkansas Department of Finance and Administration for the most current guidelines.

All You Need to Know About ar1000nr arkansas indiviual income

What is ar1000nr arkansas indiviual income?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About ar1000nr arkansas indiviual income

What is ar1000nr arkansas indiviual income?

The ar1000nr arkansas indiviual income form is the Arkansas Nonresident Individual Income Tax Return. It is specifically designed for individuals who earn income in Arkansas but are not residents of the state.

What is the purpose of this form?

The purpose of the ar1000nr arkansas indiviual income form is to report income earned by nonresidents in Arkansas. This form allows the state to assess and collect taxes on income generated within its jurisdiction from nonresident individuals.

Who needs the form?

Nonresidents earning income in Arkansas are required to file the ar1000nr arkansas indiviual income form. This includes individuals who work in Arkansas but reside in another state, as well as those with income from Arkansas sources, such as rental properties or business activities.

When am I exempt from filling out this form?

You may be exempt from filing if all of your Arkansas income is derived from sources not subject to tax or if your total income falls below the threshold that necessitates filing. Always verify your tax obligations with the Arkansas Department of Finance and Administration to confirm exemptions.

Components of the form

The ar1000nr arkansas indiviual income form includes various sections that require personal information, income details, deductions, credits, and tax calculations. Each component is crucial for ensuring accurate reporting and compliance with tax laws.

Due date

The due date for filing the ar1000nr arkansas indiviual income form is typically April 15th. If this date falls on a weekend or holiday, the deadline may be extended. Be sure to confirm specific due dates each tax year to avoid penalties.

What are the penalties for not issuing the form?

Failure to file the ar1000nr arkansas indiviual income form can result in penalties, including fines and interest on any taxes owed. The Arkansas Department of Finance and Administration enforces strict compliance measures, and neglecting to file can complicate your tax situation.

What information do you need when you file the form?

When filing the ar1000nr arkansas indiviual income form, you will need personal identification details, income statements such as W-2s or 1099s, and documentation supporting any deductions or credits claimed. Having this information organized will facilitate accurate completion of the form.

Is the form accompanied by other forms?

In some cases, the ar1000nr arkansas indiviual income form may need to be submitted alongside other forms, such as schedules for itemized deductions or forms documenting specific types of income. Check the filing instructions for additional requirements based on your unique situation.

Where do I send the form?

The completed ar1000nr arkansas indiviual income form should be mailed to the Arkansas Department of Finance and Administration. The specific mailing address is provided in the instructions included with the form. Ensure to send it well before the deadline to avoid late penalties.

See what our users say