Get the free Relevant Life Discretionary Trust - aiglife co

Show details

Relevant Life Discretionary Trust

Guidance

We require that the AIG Life Relevant Life Insurance be put into trust before the policy is put on risk. This may be

done via the Relevant Life Discretionary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign relevant life discretionary trust

Edit your relevant life discretionary trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your relevant life discretionary trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit relevant life discretionary trust online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit relevant life discretionary trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

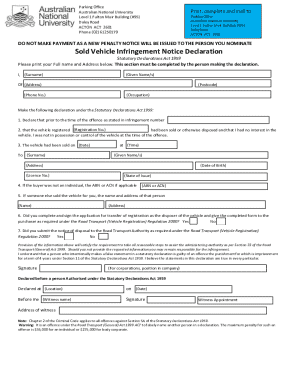

How to fill out relevant life discretionary trust

How to fill out relevant life discretionary trust

01

Step 1: Gather all relevant information about the trust, including the name of the trust, the trust deed, and any applicable trustee information.

02

Step 2: Determine the beneficiaries of the trust and the terms of their entitlement. Consider whether they should have equal or proportional distributions.

03

Step 3: Decide on the powers and duties of the trustees, including their authority to invest and distribute assets, and their potential compensation.

04

Step 4: Prepare the necessary legal documents, such as the trust deed, appointment of trustees, and any additional documents required by local laws.

05

Step 5: Execute the trust documents by signing them in the presence of witnesses and obtaining any necessary certifications or notarization.

06

Step 6: Fund the trust by transferring relevant assets into it. This could include cash, securities, or other properties.

07

Step 7: Maintain proper record-keeping and ensure regular communication between trustees and beneficiaries.

08

Step 8: Consult legal and financial professionals with expertise in trusts to ensure compliance with legal requirements and to handle any ongoing administration tasks.

09

Step 9: Periodically review and update the trust as necessary, taking into account changes in personal circumstances or laws that may affect its effectiveness.

10

Step 10: Keep the trust document in a safe and accessible place, and communicate its existence and details to the relevant parties.

Who needs relevant life discretionary trust?

01

Business owners who want to provide life insurance coverage to key employees

02

High-net-worth individuals who wish to protect and distribute their assets in a tax-efficient manner

03

Parents or guardians who want to secure financial support for their children or dependents

04

People who desire to maintain privacy and avoid probate proceedings

05

Individuals seeking asset protection from potential creditors

06

Those who want to support charitable causes and ensure their assets are used for specific purposes after their demise

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify relevant life discretionary trust without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your relevant life discretionary trust into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find relevant life discretionary trust?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the relevant life discretionary trust. Open it immediately and start altering it with sophisticated capabilities.

How can I edit relevant life discretionary trust on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing relevant life discretionary trust, you need to install and log in to the app.

What is relevant life discretionary trust?

A relevant life discretionary trust is a legal arrangement where the settlor transfers ownership of specific assets to a trustee, who then manages and distributes those assets for the benefit of the beneficiaries.

Who is required to file relevant life discretionary trust?

The trustee of the relevant life discretionary trust is required to file the trust with the appropriate tax authorities.

How to fill out relevant life discretionary trust?

To fill out a relevant life discretionary trust, the trustee must provide information about the settlor, beneficiaries, assets held in the trust, and any distributions made.

What is the purpose of relevant life discretionary trust?

The purpose of a relevant life discretionary trust is to provide a tax-efficient way to pass assets to beneficiaries while allowing the settlor to retain some control over how those assets are distributed.

What information must be reported on relevant life discretionary trust?

Information that must be reported on a relevant life discretionary trust includes details about the trust, the settlor, beneficiaries, trustees, assets held, and distributions made.

Fill out your relevant life discretionary trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Relevant Life Discretionary Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.