Get the free GIS and Tax Information Restaurant

Show details

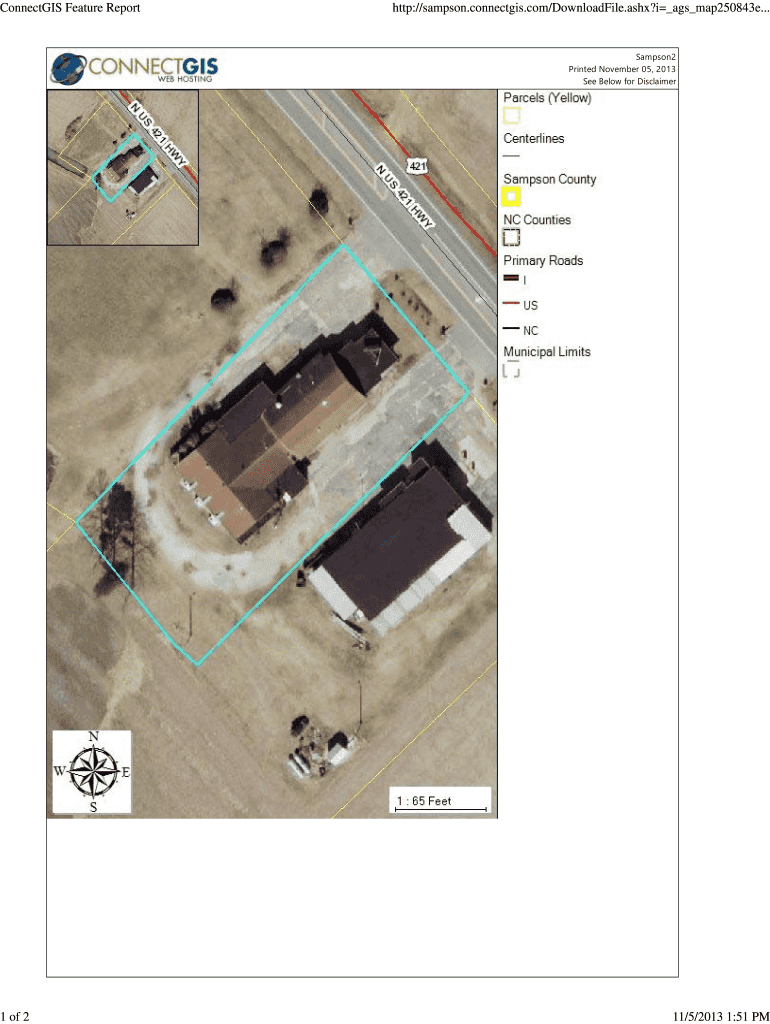

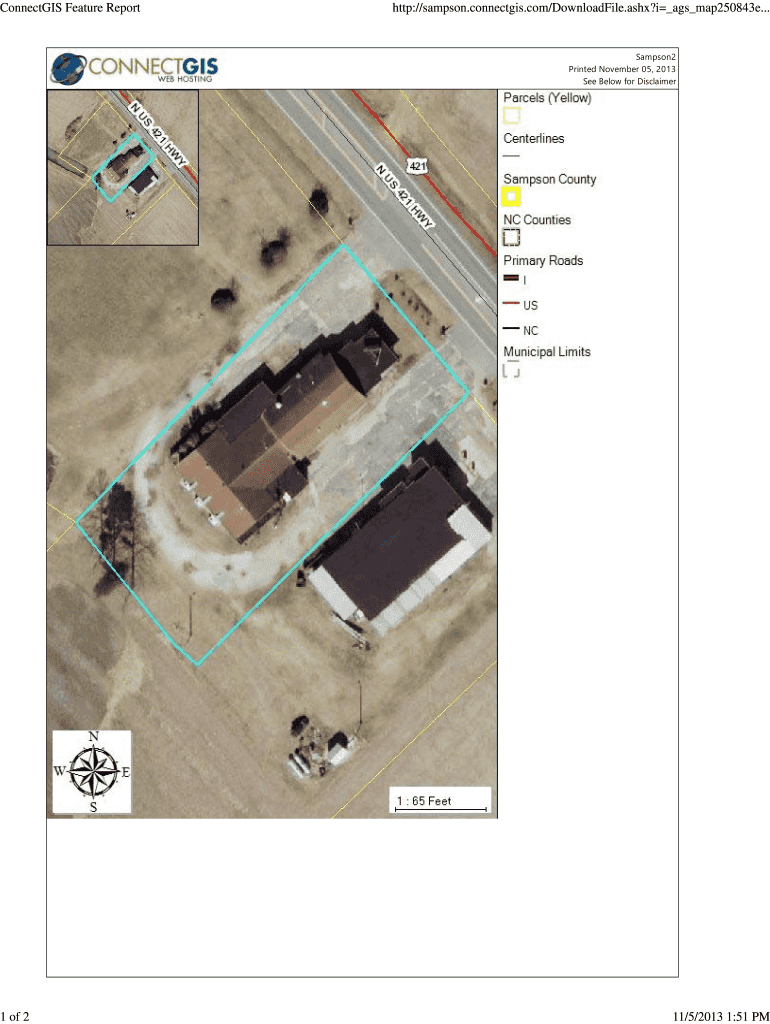

Connect GIS Feature Report 1 of 2 http://sampson.connectgis.com/DownloadFile.ashx?i AGS map250843e... Sampson2 Printed November 05, 2013, See Below for Disclaimer 11/5/2013 1:51 PM Connect GIS Feature

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gis and tax information

Edit your gis and tax information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gis and tax information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gis and tax information online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gis and tax information. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gis and tax information

How to fill out GIS and tax information?

01

Gather all necessary documents: Before filling out GIS and tax information, collect all the relevant documents such as your previous year's tax return, income statements, receipts, and any other supporting documents that may be required.

02

Start with personal information: Begin by providing your personal details such as your full name, date of birth, social security number, and contact information. Ensure accuracy while entering these details as any mistakes can lead to complications.

03

Declare your income: Indicate all sources of income you received during the taxable year. This may include wages, self-employment income, rental income, investment income, or any other form of taxable income. Ensure you have documentation to support the accuracy of these figures.

04

Deductions and credits: Determine if you are eligible for any deductions or credits that can help reduce your taxable income or provide financial benefits. Examples may include deductions for qualified education expenses, mortgage interest, medical expenses, or credits such as the Earned Income Tax Credit or Child Tax Credit.

05

Reporting capital gains or losses: If you have sold any capital assets during the year, report the resulting gains or losses. Fill out the appropriate sections for capital gains or losses, including details like the purchase and sale dates, proceeds from the sale, and the cost basis of the asset.

06

Complete the GIS section: If you are eligible for the Guaranteed Income Supplement (GIS), ensure that you accurately fill out the required information. This may include information about your marital status, residency, and income details to determine your eligibility.

07

Review and double-check: Before submitting your GIS and tax information, carefully review all the entered information to ensure accuracy and completeness. Check for any errors, missing information, or discrepancies that need to be addressed. This step is crucial to avoid potential issues with your tax return.

Who needs GIS and tax information?

01

Individuals with taxable income: Anyone with a source of taxable income, such as wages, self-employment income, or investment income, needs to provide GIS and tax information.

02

Eligible recipients of the Guaranteed Income Supplement: The GIS is a government assistance program in Canada, specifically designed for low-income seniors. Individuals who meet the eligibility criteria for GIS benefits need to provide the necessary information to apply for or renew their benefits.

03

Those claiming deductions and credits: Individuals who want to claim deductions or credits to reduce their taxable income or avail financial benefits, such as deductions for educational expenses, medical expenses, or credits like the Earned Income Tax Credit, need to provide GIS and tax information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gis and tax information?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific gis and tax information and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute gis and tax information online?

pdfFiller has made it simple to fill out and eSign gis and tax information. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit gis and tax information on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign gis and tax information right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is gis and tax information?

GIS stands for Geographic Information System which is a system designed to capture, store, manipulate, analyze, manage, and present all types of geographical data. Tax information refers to the data related to an individual or organization's income, expenses, deductions, and tax liabilities.

Who is required to file gis and tax information?

Individuals and organizations who own property or conduct business in a specific geographic area may be required to file GIS and tax information with the relevant authorities.

How to fill out gis and tax information?

GIS and tax information can be filled out manually by providing accurate and detailed information about the property or business, or it can be submitted electronically through online platforms provided by the authorities.

What is the purpose of gis and tax information?

The purpose of GIS and tax information is to help local authorities keep track of property ownership, property values, and tax liabilities within their jurisdiction.

What information must be reported on gis and tax information?

The information that must be reported on GIS and tax information may include property ownership details, property value assessments, income and expense records, and details about tax deductions and liabilities.

Fill out your gis and tax information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gis And Tax Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.