Get the free PRIVATE DEBT - Equity Institutional

Show details

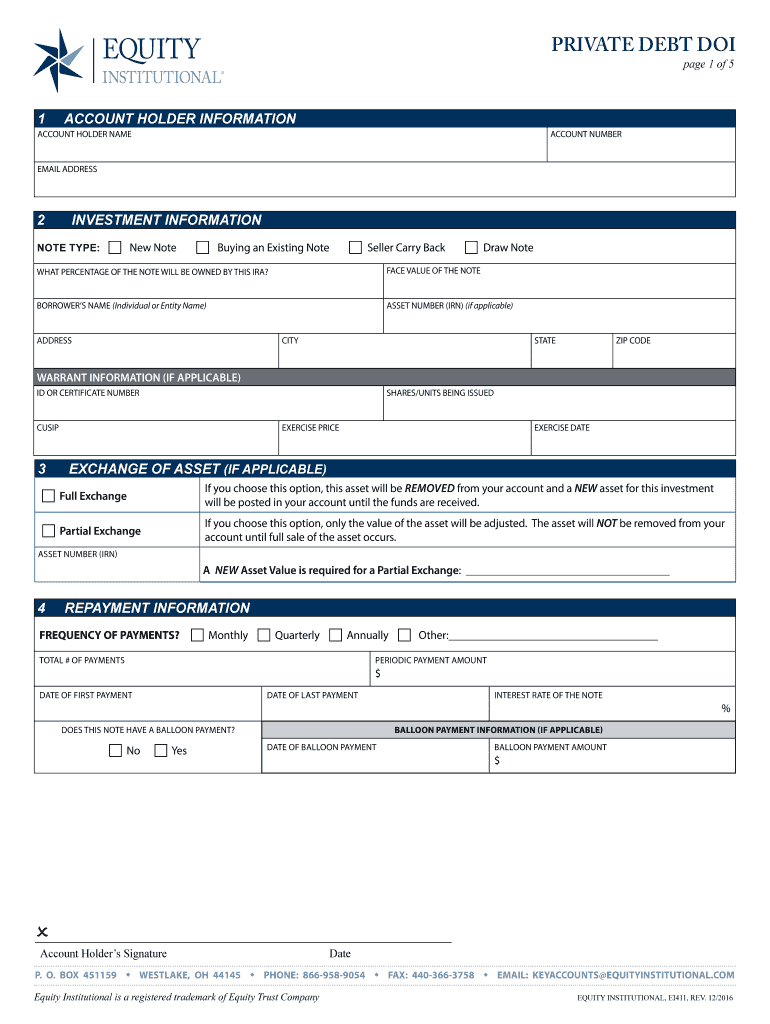

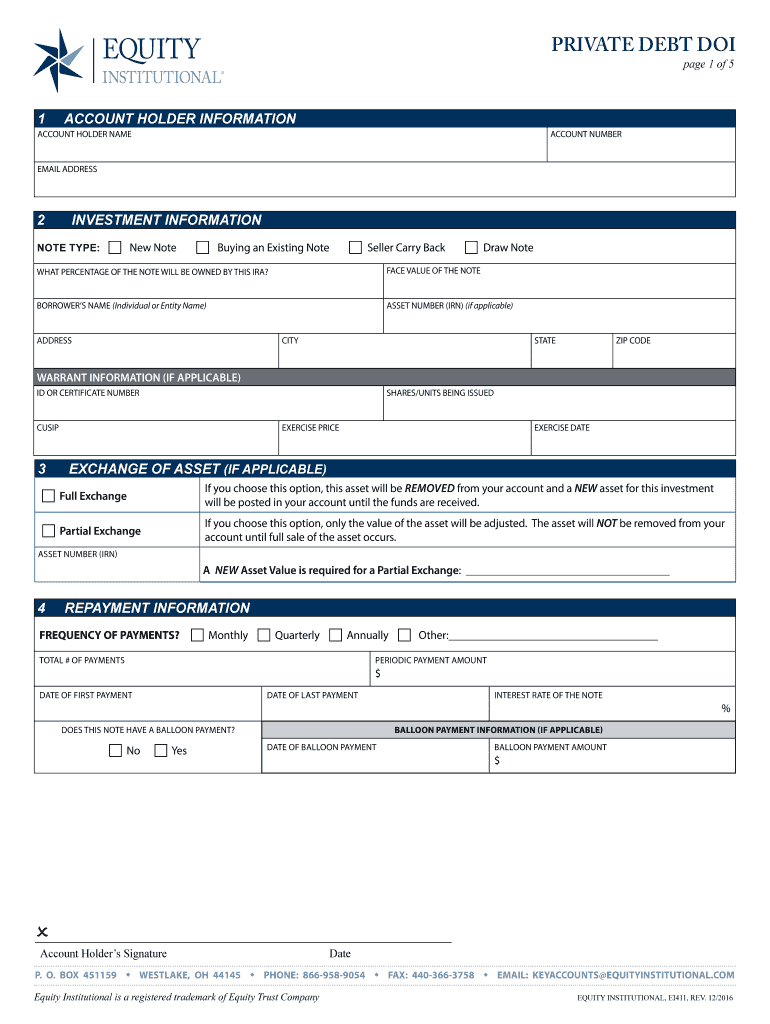

... REV. 12/2016 DO NOT FAX OR MAIL THIS COVER PAGE ... To add, change, or update a credit card please complete and submit the Credit Card Form. 9 PAYMENT OF FEES.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private debt - equity

Edit your private debt - equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private debt - equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private debt - equity online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit private debt - equity. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private debt - equity

How to fill out private debt - equity

01

Understand the concept of private debt-equity: Private debt-equity refers to the financing structure that combines both debt and equity components. It is commonly used in private transactions or investments where traditional forms of financing may not be readily available.

02

Determine your funding needs: Evaluate the financial requirements of your business or project to determine how much private debt-equity funding you require. This may involve assessing the amount of capital needed, the purpose of the funding, and the potential risks involved.

03

Identify potential private debt-equity sources: Research and identify potential sources for private debt-equity funding. This could involve contacting private equity firms, venture capitalists, or angel investors who specialize in providing such financing.

04

Prepare a comprehensive business plan: Develop a well-structured business plan that clearly outlines your business concept, financial projections, and the potential return on investment for private debt-equity providers. This will help attract interest from potential investors and lenders.

05

Present your proposal: Arrange meetings or presentations with potential private debt-equity providers to showcase your business plan and discuss the terms of the financing. Be prepared to answer questions and provide additional information as requested.

06

Negotiate terms and agreements: If a private debt-equity provider shows interest, engage in negotiations to determine the terms and agreements of the financing arrangement. This may include discussing the interest rates, repayment terms, equity ownership, and any associated fees or collateral requirements.

07

Execute the financing agreement: Once both parties reach a mutually beneficial agreement, formalize the private debt-equity financing arrangement by executing the necessary legal and financial documents. Consult with a professional attorney or financial advisor to ensure compliance with all legal and regulatory requirements.

08

Monitor and repay the debt: Once the funding is received, diligently monitor your business operations and financial performance to fulfill the obligations outlined in the financing agreement. Make timely repayments of the debt as agreed upon to maintain a good relationship with the private debt-equity provider.

09

Leverage the equity component: Explore opportunities to leverage the equity component of the financing to access additional resources, expertise, or networks provided by the private debt-equity provider. This can help grow your business and enhance its overall value.

10

Assess the impact of private debt-equity: Continuously assess the impact of the private debt-equity financing on your business. Evaluate the benefits and drawbacks of this financing structure and make necessary adjustments or refinements as required.

Who needs private debt - equity?

01

Startups and early-stage businesses: Private debt-equity can be beneficial for startups and early-stage businesses that may struggle to obtain traditional financing due to their limited operating history or lack of assets for collateral.

02

Growth-oriented businesses: Businesses with high growth potential or expansion plans may utilize private debt-equity to secure additional funding for acquisitions, new product development, market expansion, or entering new geographical areas.

03

Distressed businesses: Companies facing financial distress or temporary cash flow issues may turn to private debt-equity as a short-term solution to bridge the funding gap or provide working capital until the business stabilizes.

04

Real estate developers: Private debt-equity is often sought after by real estate developers who require substantial capital for property acquisitions, construction projects, or property renovations. This form of financing can offer flexibility and faster access to funds compared to traditional lenders.

05

Entrepreneurs and innovators: Individuals with innovative business ideas or unique projects that may not fit traditional financing models can benefit from private debt-equity. It provides an opportunity to attract investors who are more willing to take higher risks in exchange for potential higher returns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in private debt - equity?

With pdfFiller, the editing process is straightforward. Open your private debt - equity in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the private debt - equity in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your private debt - equity and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete private debt - equity on an Android device?

Use the pdfFiller Android app to finish your private debt - equity and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is private debt - equity?

Private debt - equity refers to the combination of debt financing and equity financing in a privately held company.

Who is required to file private debt - equity?

Companies that utilize private debt - equity in their financing structure are required to file this information.

How to fill out private debt - equity?

Private debt - equity can be filled out by providing details of the amount of debt and equity used, interest rates, payment terms, and any other relevant information.

What is the purpose of private debt - equity?

The purpose of private debt - equity is to provide companies with a flexible financing option that combines the benefits of both debt and equity financing.

What information must be reported on private debt - equity?

Information such as the amount of debt and equity used, interest rates, payment terms, and any other relevant details must be reported on private debt - equity.

Fill out your private debt - equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Debt - Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.