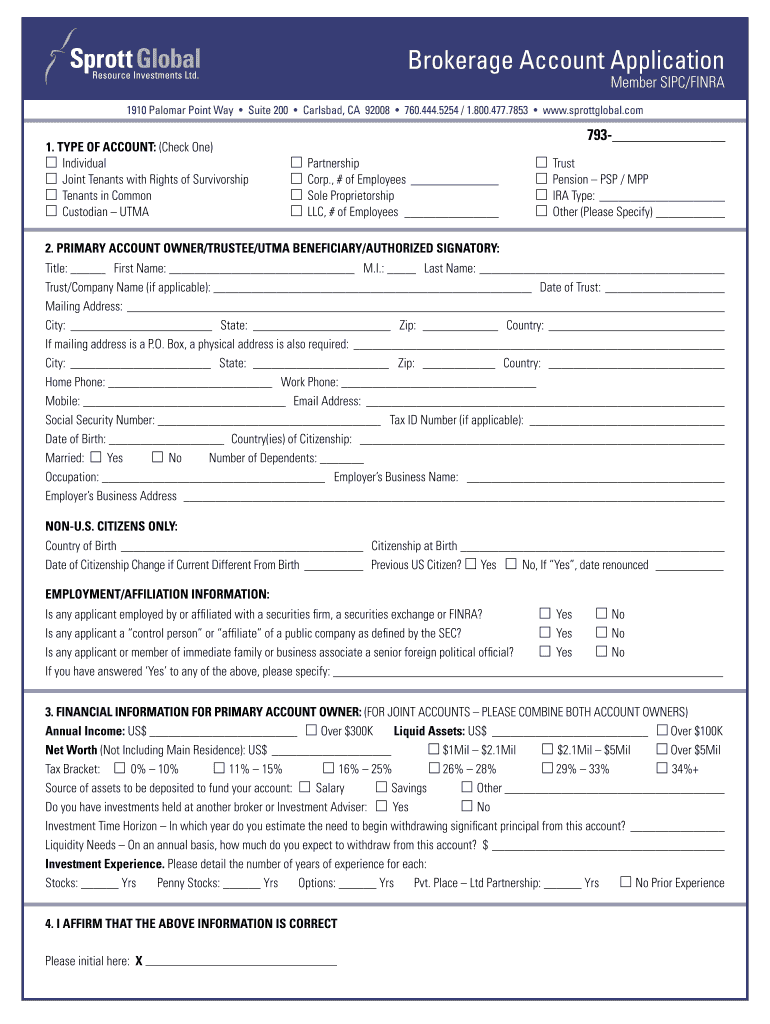

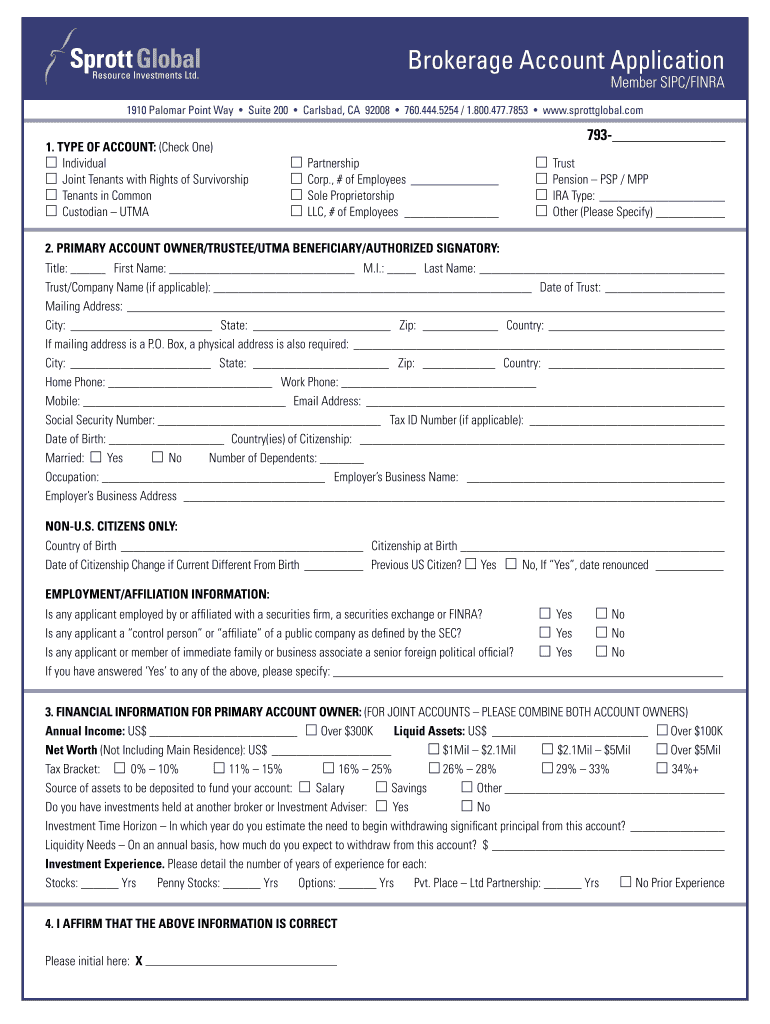

Get the free Brokerage Account Application - sprottglobal.com

Show details

Country of Citizenship: US ... B-The United States or ... Contacting Us If after a significant business disruption you cannot contact us as you usually do at 800-477 ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign brokerage account application

Edit your brokerage account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your brokerage account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing brokerage account application online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit brokerage account application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out brokerage account application

How to fill out brokerage account application

01

Review the requirements: Before filling out the brokerage account application, make sure you meet the requirements set by the brokerage firm. These requirements may include age restrictions, minimum investment amounts, and citizenship status.

02

Gather necessary documents: Collect all the necessary documents, such as identification proof (passport, driver's license, etc.), proof of address (utility bill, bank statement, etc.), and Social Security Number (SSN) or Tax Identification Number (TIN).

03

Choose a brokerage firm: Research and select a reputable brokerage firm that suits your investment needs. Consider factors like fees, customer service, investment options, and trading platforms.

04

Access the application form: Visit the brokerage firm's website or contact their customer support to obtain the brokerage account application form.

05

Provide personal information: Fill in the required personal information accurately, including your name, date of birth, contact details, and employment information.

06

Submit identification documents: Attach copies of your identification proof, proof of address, and SSN/TIN along with the application form. Ensure the documents are valid and legible.

07

Select account type: Choose the type of brokerage account you want to open, such as individual account, joint account, retirement account, or custodial account.

08

Answer additional questions: Some brokerage firms may ask supplementary questions about your investment experience, risk tolerance, and financial goals. Provide honest answers as they help in tailoring investment recommendations.

09

Read and understand the terms: Carefully read the terms and conditions, as well as any agreements or disclosures provided by the brokerage firm. Ensure you comprehend the fees, trading policies, and other contractual details.

10

Review and sign: Double-check all the information provided in the application form for accuracy. Sign the form using your legal signature and date it.

11

Submit the application: Follow the brokerage firm's instructions for submitting the application form. This can usually be done online, by mail, or in person at a local branch.

12

Await approval: After submitting the application, wait for the brokerage firm to review and process it. This may take a few days to weeks, depending on the firm's procedures.

13

Fund your account: Once your application is approved, you will receive instructions on how to fund your brokerage account. Follow those instructions to deposit the desired amount and start investing.

Who needs brokerage account application?

01

Individuals interested in investing: Anyone who wants to start investing in the stock market, mutual funds, ETFs, bonds, or other securities would need a brokerage account application.

02

Experienced traders: Professional traders who actively buy and sell securities would require a brokerage account to access the markets and execute trades.

03

Retirement savers: Individuals planning for retirement can open a retirement account, such as an Individual Retirement Account (IRA), through a brokerage firm.

04

Minors with custodial accounts: Parents or legal guardians can open custodial accounts on behalf of their children to invest for their future.

05

Joint account holders: Couples, family members, or business partners who want to open a shared investment account can utilize a brokerage account application.

06

Those seeking diversification: Investors looking to diversify their portfolio by including various investment options would benefit from a brokerage account.

07

Individuals interested in financial planning: Many brokerage firms offer financial planning services, and an account application is necessary to access these services.

08

Students or researchers: Students or researchers who wish to analyze or study the financial markets might need a brokerage account for data access and research purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit brokerage account application straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing brokerage account application right away.

How do I fill out the brokerage account application form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign brokerage account application and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete brokerage account application on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your brokerage account application. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is brokerage account application?

A brokerage account application is a form that individuals or entities use to open a brokerage account with a financial institution.

Who is required to file brokerage account application?

Any individual or entity looking to open a brokerage account with a financial institution is required to file a brokerage account application.

How to fill out brokerage account application?

To fill out a brokerage account application, individuals or entities must provide personal information, financial details, and agree to the terms and conditions set by the financial institution.

What is the purpose of brokerage account application?

The purpose of a brokerage account application is to establish a legal relationship between the account holder and the financial institution, allowing for the purchase and sale of securities.

What information must be reported on brokerage account application?

Information such as personal details, financial information, investment experience, and risk tolerance must be reported on a brokerage account application.

Fill out your brokerage account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Brokerage Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.