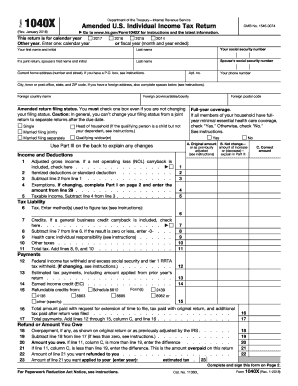

IL DoR IL-1040-X 2016 free printable template

Show details

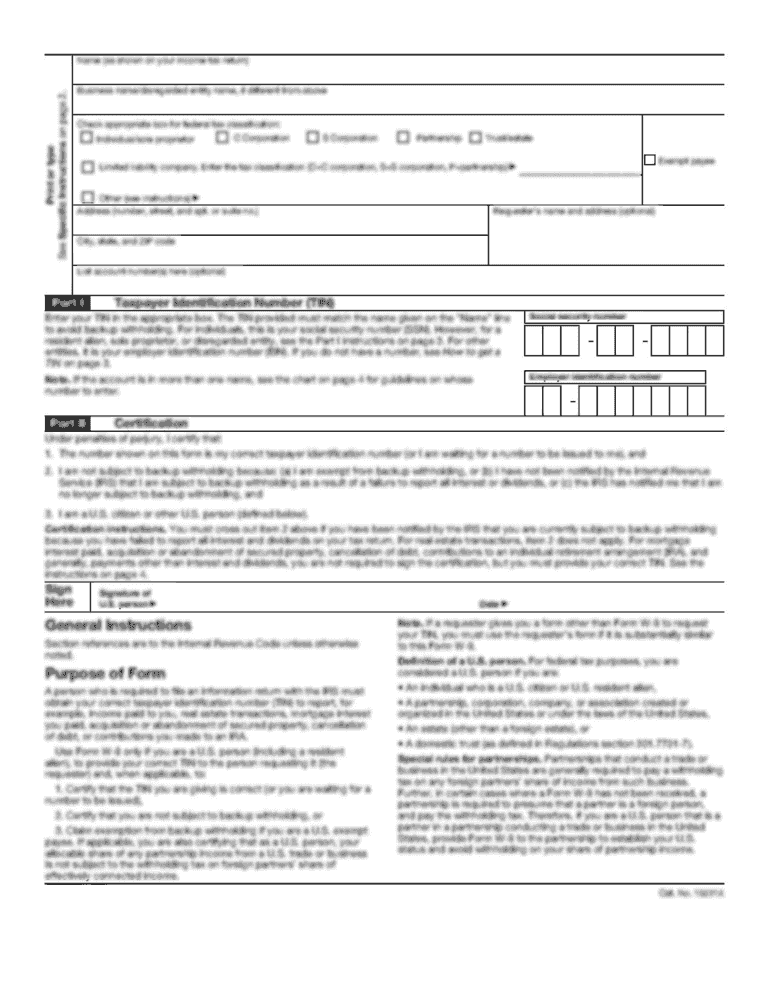

9 Illinois base income. Subtract Line 8 from Line 4. Corrected figures Staple your check and IL-1040-X-V here. Illinois Department of Revenue 2016 Form IL-1040-X Amended Individual Income Tax Return REV 12 Do not write above this line. Attach federal Form 1040 or 1040A page 1 with amended figures. Base 6 Illinois Income Tax overpayment included in federal Form 1040 Line 10. Designee s Designee s Name please print Phone number Mail to Illinois Department of Revenue P. O. Box 19007 Springfield...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-1040-X

Edit your IL DoR IL-1040-X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-1040-X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR IL-1040-X online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL DoR IL-1040-X. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-1040-X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-1040-X

How to fill out IL DoR IL-1040-X

01

Obtain a copy of the IL DoR IL-1040-X form from the Illinois Department of Revenue website or your local tax office.

02

Enter your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year you are amending in the designated area.

04

Complete Section A, detailing the changes you are making to your original IL-1040 form.

05

In Section B, provide the updated income, deductions, and tax calculations as necessary.

06

Explain the reasons for the amendment in Section C.

07

Calculate the difference in tax owed or refund due, and fill in the relevant boxes.

08

Sign and date the form before submitting it to the Illinois Department of Revenue.

Who needs IL DoR IL-1040-X?

01

Individuals who have made errors or omissions on their original IL-1040 tax return.

02

Taxpayers who have had changes in their income, deductions, or credits after filing their original return.

03

People who are attempting to claim a refund or adjust their tax liability.

04

Taxpayers addressing discrepancies identified by the Illinois Department of Revenue.

Instructions and Help about IL DoR IL-1040-X

Laws dot-com legal forms guide form IL — 104—

Fill

form

: Try Risk Free

People Also Ask about

Who do I make my Illinois state tax check out to?

Make your check payable to the Illinois Department of Revenue. Write your Social Security number, your spouse's Social Security number if filing jointly, and the tax year in the lower left-hand corner of your payment.

What is the difference between W-2 and 1040?

The W-2 is the tax document that your wages are reported on. The 1040 (or form 1040) is the tax return in which reports all of your tax documents on (i.e. W-2, investment income, mortgage interest,etc).

Do I need to file an IL-1040?

You must file a Form IL-1040, Individual Income Tax Return, if you are an Illinois resident and: You were required to file a federal income tax return.

Who files a form IL-1040?

You must file a Form IL-1040, Individual Income Tax Return, if you are an Illinois resident and: You were required to file a federal income tax return. You were not required to file a federal return, but your Illinois base income is greater than your exemption allowance.

When Should Form 1040 be used?

Form 1040 is used for personal federal income tax returns. It is used to report your filing status, personal information, and the tax identification number for yourself, spouse, and dependents to the IRS.

Does everyone fill out a 1040?

While people with more complicated tax situations may need more forms and schedules, everyone filing taxes will need to fill out Form 1040 in order to file their taxes.

Who fills out IL-1040?

Taxpayers are eligible to file Form IL-1040 if they have not previously filed an individual income tax return for the year, are an established Illinois taxpayer or have a current Illinois driver's license or state ID, and have a Social Security number or taxpayer identification number.

Who needs to fill out a 1040 form?

Almost everyone in the United States needs to file IRS Form 1040. But for business owners, independent contractors, and the self-employed, there are some specific details you should know about. Read on for the information you need for a stress-free tax filing.

Why do I need to file a 1040 form?

What is the purpose of a 1040 form? Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. One of the first steps is to calculate Adjusted Gross Income (AGI) by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions.

Do I need to file Illinois tax return if I owe nothing?

If you are required to file a federal tax return, you are required to file an Illinois tax return, even if you owe nothing.

What is an Illinois form IL-1040?

IL-1040 Individual Income Tax Return - Income Tax Forms.

Who must file IL-1040?

You must file a Form IL-1040, Individual Income Tax Return, if you are an Illinois resident and: You were required to file a federal income tax return. You were not required to file a federal return, but your Illinois base income is greater than your exemption allowance.

What is an IL-1040?

IL-1040 Individual Income Tax Return - Income Tax Forms.

What is the IL-1040 used for?

IL-1040 Individual Income Tax Return - Income Tax Forms.

What is a 1040 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Who is required to file Illinois state tax return?

You must file an Illinois tax return if: You were required to file a federal return, or. You were not required to file a federal return but your Illinois income exceeds your exemption allowance.

Who has to file Illinois taxes?

Who Pays Illinois Tax? If you earn an income or live in Illinois, you must pay Illinois income taxes. As a traditional W-2 employee, your Illinois taxes will be withheld and deposited from each paycheck automatically. You will see this on your paycheck, near or next to the federal taxes.

Do non residents have to file an Illinois tax return?

You must file Form IL-1040, Individual Income Tax Return, and Schedule NR, Nonresident and Part-year resident Computation of Illinois Tax, if you: earned income from any source while you were a resident, earned income from any Illinois sources while you were not a resident, or.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IL DoR IL-1040-X?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific IL DoR IL-1040-X and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit IL DoR IL-1040-X straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IL DoR IL-1040-X.

How do I complete IL DoR IL-1040-X on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IL DoR IL-1040-X. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IL DoR IL-1040-X?

IL DoR IL-1040-X is an amended individual income tax return form used in Illinois to correct errors or make adjustments to a previously filed IL-1040 tax return.

Who is required to file IL DoR IL-1040-X?

Taxpayers who need to correct mistakes or report changes to their income, deductions, or credits on their original IL-1040 tax return are required to file IL DoR IL-1040-X.

How to fill out IL DoR IL-1040-X?

To fill out IL DoR IL-1040-X, you need to provide personal information, the reason for the amendment, the changes being made to income and deductions, and any supporting documentation for the adjustments.

What is the purpose of IL DoR IL-1040-X?

The purpose of IL DoR IL-1040-X is to allow taxpayers to amend their previously filed Illinois income tax returns to correct errors or update information.

What information must be reported on IL DoR IL-1040-X?

IL DoR IL-1040-X must include the taxpayer's name, address, Social Security Number, details of the original return, changes being made, and the reason for those changes.

Fill out your IL DoR IL-1040-X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-1040-X is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.