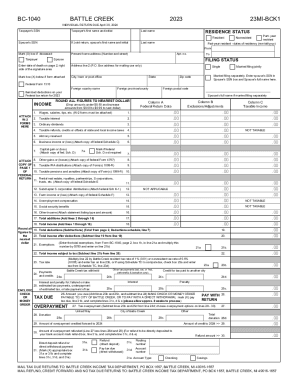

MI BC-1040 - Battle Creek 2016 free printable template

Get, Create, Make and Sign form creek tax 2016

How to edit form creek tax 2016 online

Uncompromising security for your PDF editing and eSignature needs

MI BC-1040 - Battle Creek Form Versions

How to fill out form creek tax 2016

How to fill out MI BC-1040 - Battle Creek

Who needs MI BC-1040 - Battle Creek?

Instructions and Help about form creek tax 2016

It's me it's you it's us it's every single one of us we're all the same connected and interdependent United what I do today impact you tomorrow just think about what's possible providing children with a high quality education and the necessary supports can change their entire future one job opportunity can fuel a lifetime of success access to affordable health care can increase productivity and just one helping hand during a crisis can help keep families together the United Way of the Battle Creek and Kalamazoo region invites you to be part of the change together we can help more children we can build financial stability in our community we can ensure that more people have access to health care, and we can help people get their basic needs met it's time to give to advocate to volunteer it's time to live united it's time to change the story when you're living from paycheck to paycheck what happens when your car breaks down when a family member gets sick when you lose your job preparing a career ready workforce ensuring that people are financially literate and individuals and families have safe and affordable housing benefits us all the United Way of the Battle Creek in Kalamazoo region continues to support programs and initiatives that teach residents to budget and save that prevent homelessness and that assist in preparing taxes for qualified individuals and families we are removing obstacles we're moving the needle we're making a difference we're changing the story I'm Site bell and I live United I'm Robert lighter and I live United me mo recent Lucas to Vito we neither United Way is stepped up as one of our largest funny contributors as well as one of our biggest community supporters the most important thing I think that community action does is it connects people to important anti-poverty programs and United Way brings those organizations together United Way helps us connect and one of those is the Vita program Noida is the Volunteer Income Tax Assistance Program, and it's sponsored by the IRS it provides free income tax assistance to low-income families here in Battle Creek that actually accounts for about sixty percent of our household vitae and the program similar to it are important because people are not always aware of programs or money that are available to help them meet the needs that they have in their life, and we are always aware of the needs that other people have until we get out into a situation like that and begin to see what other people have to go through just to make ends meet we found that if we take the vitae program to residents we get a higher percentage they might not know about it because if we're located just at one site they might not care about that where if we go into the schools for example we went to Battle Creek central high school or the financial institutes when we're in those organizations we're meeting the residents where they are in their day-to-day life, and so they're more apt to take advantage of the...

People Also Ask about

Do I have to pay Battle Creek city tax?

What is the CF 1040 form?

What is the income tax in Battle Creek Michigan?

Where to get Michigan tax forms?

Do I have to pay local taxes if I work remotely?

Does Battle Creek have city tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form creek tax 2016 for eSignature?

How do I execute form creek tax 2016 online?

How do I edit form creek tax 2016 online?

What is MI BC-1040 - Battle Creek?

Who is required to file MI BC-1040 - Battle Creek?

How to fill out MI BC-1040 - Battle Creek?

What is the purpose of MI BC-1040 - Battle Creek?

What information must be reported on MI BC-1040 - Battle Creek?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.