Get the free COLORADO DEPARTMENT OF REVENUE LIQUOR ENFORCEMENT DIVISION ...

Show details

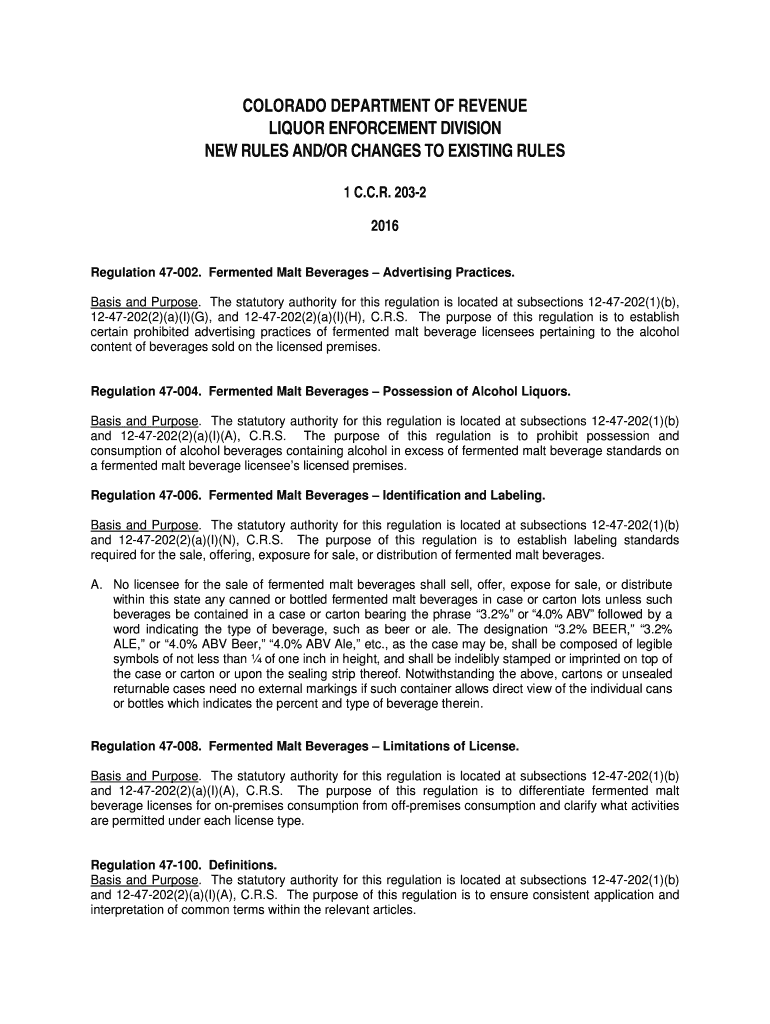

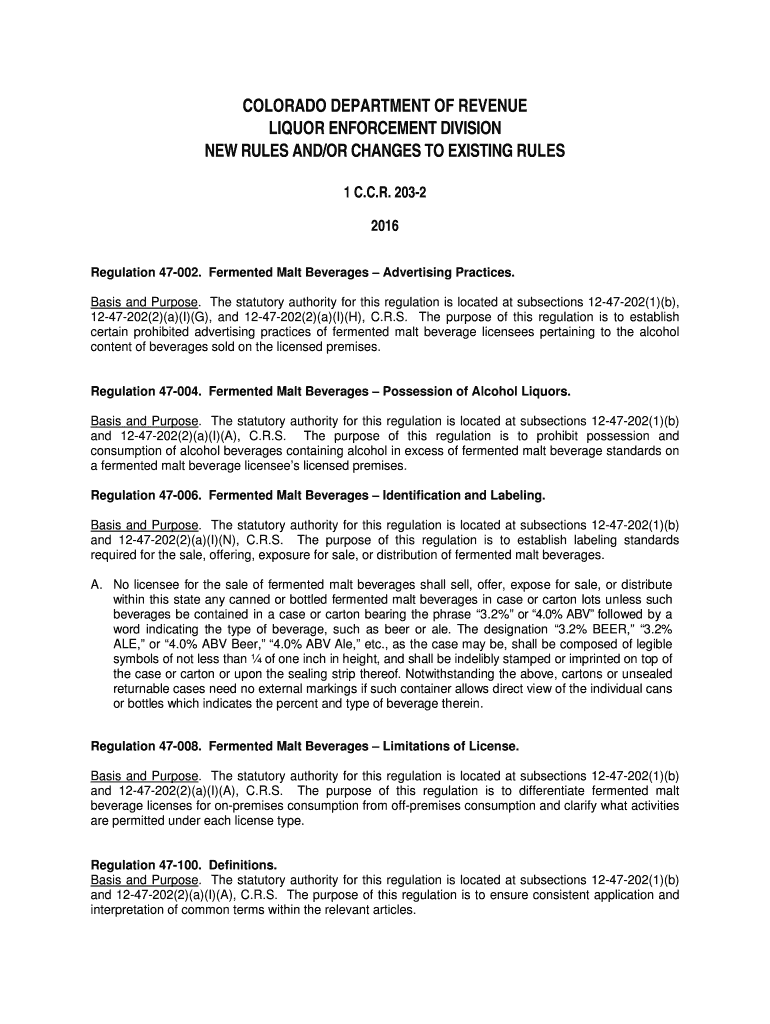

COLORADO DEPARTMENT OF REVENUE LIQUOR ENFORCEMENT DIVISION NEW RULES AND/OR CHANGES TO EXISTING RULES 1 C.C.R. 2032 2016 Regulation 47002. Fermented Malt Beverages Advertising Practices. Basis and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign colorado department of revenue

Edit your colorado department of revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado department of revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing colorado department of revenue online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit colorado department of revenue. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out colorado department of revenue

How to fill out colorado department of revenue

01

Step 1: Start by gathering all the necessary information and documents required to fill out the Colorado Department of Revenue forms. This may include your personal information, income statements, tax identification number, and any other relevant documentation.

02

Step 2: Visit the Colorado Department of Revenue website or a local office to obtain the necessary forms for filing. These forms can often be downloaded from the website or picked up in person.

03

Step 3: Read the instructions provided with the forms carefully to ensure that you understand the requirements and the proper way to fill them out.

04

Step 4: Begin filling out the forms, following the instructions and providing accurate information. Take your time and double-check your entries to avoid any errors.

05

Step 5: If you have any questions or need assistance while filling out the forms, consider seeking help from a tax professional or contacting the Colorado Department of Revenue directly.

06

Step 6: Once you have completed filling out the forms, review them once again to make sure all information is accurate and nothing has been missed.

07

Step 7: Sign and date the forms where required. Keep copies of the completed forms for your records.

08

Step 8: Submit the completed forms to the Colorado Department of Revenue either by mail or through their online filing system, depending on the instructions provided.

09

Step 9: Make sure to pay any required fees or taxes as instructed by the Colorado Department of Revenue.

10

Step 10: Keep track of any correspondence or notifications received from the Colorado Department of Revenue regarding your submission. Follow up if necessary.

Who needs colorado department of revenue?

01

Individuals residing in or conducting business in the state of Colorado may need to interact with the Colorado Department of Revenue.

02

Colorado residents who are required to file state income taxes need to engage with the Department of Revenue.

03

Businesses operating in Colorado need to fulfill their tax obligations through the Colorado Department of Revenue.

04

People who own real estate in Colorado may have property tax obligations that involve the Department of Revenue.

05

Individuals and businesses involved in the sale or purchase of goods and services subject to sales tax in Colorado must interact with the Department of Revenue.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send colorado department of revenue for eSignature?

When your colorado department of revenue is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the colorado department of revenue in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your colorado department of revenue in seconds.

How do I edit colorado department of revenue on an Android device?

You can make any changes to PDF files, such as colorado department of revenue, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is colorado department of revenue?

The Colorado Department of Revenue is a government agency responsible for overseeing state taxes, driver's licenses, vehicle registrations, and other revenue-related activities in Colorado.

Who is required to file colorado department of revenue?

Anyone who earns income in Colorado, owns property in Colorado, or conducts business in Colorado may be required to file with the Colorado Department of Revenue.

How to fill out colorado department of revenue?

You can fill out forms for the Colorado Department of Revenue online, by mail, or in person at one of their service centers.

What is the purpose of colorado department of revenue?

The purpose of the Colorado Department of Revenue is to collect state taxes, regulate industries, and administer programs to benefit Colorado residents.

What information must be reported on colorado department of revenue?

Income, expenses, deductions, credits, and other financial information must be reported on forms filed with the Colorado Department of Revenue.

Fill out your colorado department of revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado Department Of Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.