Get the free Rental/Leasing Tax Return

Show details

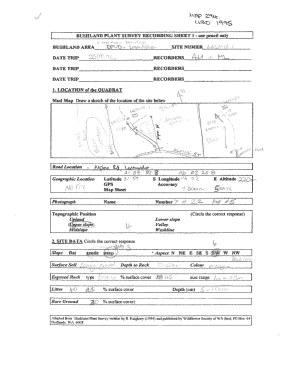

Danville 9343 Elba 9385 Floral 9624 Hollywood 9465 Homewood 9491 Lincoln 9403 Selma 9320 CITY CODE Auto. (2%) Linen/Garments (2%) Other (2%) Auto. (11/2%) Linen/Garments (2%) Other (3%) Auto. (5%)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rentalleasing tax return

Edit your rentalleasing tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rentalleasing tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rentalleasing tax return online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit rentalleasing tax return. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rentalleasing tax return

How to fill out rentalleasing tax return

01

Gather all the necessary documents for your rental leasing tax return, such as rental income statements, expense receipts, and any other relevant financial records.

02

Start by filling out the required personal information section, including your name, address, and Social Security number.

03

Proceed to the rental income section and accurately report all rental income received during the tax year. Include any rental payments, security deposits, or other forms of rental income.

04

Next, move on to the expenses section and list all the eligible expenses related to your rental property. This may include mortgage interest, property taxes, insurance, repairs, and maintenance costs.

05

Make sure to properly categorize and document each expense to support your deductions.

06

Calculate the net income or loss from your rental leasing activities by subtracting the total expenses from the rental income.

07

Transfer the final net income/loss amount to the appropriate section on your main tax return form.

08

Review your completed rentalleasing tax return for accuracy and make any necessary corrections or adjustments.

09

Sign and date the form, and include any required attachments or supporting documentation.

10

File the rentalleasing tax return by the deadline, usually April 15th, or the designated tax year-end date if different in your country.

11

Keep a copy of your completed tax return and all supporting documents for your records.

12

Consider consulting a tax professional or using tax software for assistance to ensure compliance and optimize your tax outcome.

Who needs rentalleasing tax return?

01

Anyone who earns rental income from leasing properties needs to file a rentalleasing tax return.

02

Individuals who own and lease out residential properties, commercial spaces, or any other type of real estate property are typically required to report their rental income and expenses to the tax authorities.

03

This includes landlords, property owners, real estate investors, and individuals who rent out vacation homes or short-term rentals on platforms like Airbnb or VRBO.

04

It is important to note that the specific requirements for filing a rentalleasing tax return may vary depending on the jurisdiction and local tax laws. Therefore, it is advisable to consult with a tax professional or refer to the tax authority's guidelines for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute rentalleasing tax return online?

pdfFiller makes it easy to finish and sign rentalleasing tax return online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit rentalleasing tax return online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your rentalleasing tax return and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit rentalleasing tax return on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute rentalleasing tax return from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is rentalleasing tax return?

Rental/leasing tax return is a form or document that individuals or businesses are required to file to report their rental or leasing income and expenses for tax purposes.

Who is required to file rentalleasing tax return?

Individuals or businesses that earn income from renting or leasing property are required to file rental/leasing tax return.

How to fill out rentalleasing tax return?

You can fill out rental/leasing tax return by documenting all income and expenses related to renting or leasing property, and submitting the information to the relevant tax authority.

What is the purpose of rentalleasing tax return?

The purpose of rental/leasing tax return is to accurately report rental or leasing income and expenses, calculate the taxable income, and determine the tax liability.

What information must be reported on rentalleasing tax return?

Information such as rental income, expenses, depreciation, repairs, and other relevant financial details must be reported on rental/leasing tax return.

Fill out your rentalleasing tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rentalleasing Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.