Get the free NET PROCEEDS OF MINERALS TAX

Show details

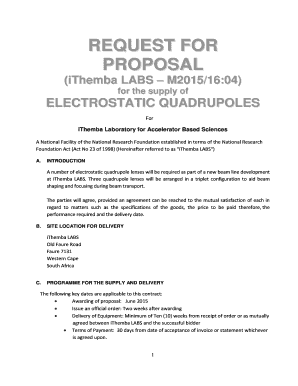

NEVADA DEPARTMENT OF TAXATION NET PROCEEDS OF MINERALS TAX FISCAL YEAR 199199 PER NRS 362.145 AUGUST 1, 199 PAYMENT: Actual geothermal production for 01/01/9 06/30/9Allowable Deductions: Cost of Extraction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign net proceeds of minerals

Edit your net proceeds of minerals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your net proceeds of minerals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit net proceeds of minerals online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit net proceeds of minerals. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out net proceeds of minerals

How to fill out net proceeds of minerals

01

Start by gathering all the necessary documentation related to the minerals you own or are entitled to the net proceeds from.

02

Identify the specific minerals or royalties that are generating the proceeds.

03

Determine the total gross amount of proceeds received for the specific minerals or royalties.

04

Calculate and deduct any applicable expenses or costs incurred in the production, extraction, or sale of the minerals.

05

Review any contractual agreements or obligations regarding the sharing or distribution of the net proceeds.

06

Allocate and distribute the net proceeds among the relevant parties as per the contractual agreements or ownership rights.

07

Ensure accurate record-keeping of all transactions and distributions for future reference or auditing purposes.

08

Consider seeking professional advice or consulting with an accountant or tax specialist to ensure compliance with any tax or legal obligations.

09

Regularly review and update the net proceeds calculations to reflect any changes in the production or market conditions.

10

Monitor and track the net proceeds to ensure proper and timely distribution to the entitled parties.

Who needs net proceeds of minerals?

01

Individuals or companies who own mineral rights and receive income from the production or extraction of minerals.

02

Mineral rights owners who want to understand the financial aspect of their ownership and ensure accurate distribution of net proceeds.

03

Mineral owners who are obligated to share or distribute the net proceeds with other parties as per contractual agreements.

04

Investors or stakeholders who have a financial interest in the net proceeds generated from minerals.

05

Government bodies or regulatory authorities involved in monitoring and overseeing the mineral extraction industry.

06

Accountants, tax specialists, or financial advisors who provide services related to the calculation and distribution of net proceeds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my net proceeds of minerals directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your net proceeds of minerals and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find net proceeds of minerals?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific net proceeds of minerals and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I sign the net proceeds of minerals electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your net proceeds of minerals in minutes.

What is net proceeds of minerals?

Net proceeds of minerals refers to the revenue generated from the sale of minerals extracted from the ground.

Who is required to file net proceeds of minerals?

Individuals or companies engaged in the extraction and sale of minerals are required to file net proceeds of minerals.

How to fill out net proceeds of minerals?

Net proceeds of minerals can typically be filled out through a designated form provided by the relevant tax authority.

What is the purpose of net proceeds of minerals?

The purpose of net proceeds of minerals is to ensure accurate reporting and taxation of income derived from mineral extraction activities.

What information must be reported on net proceeds of minerals?

Information such as the amount of minerals sold, sale price, production costs, and any relevant deductions must be reported on net proceeds of minerals.

Fill out your net proceeds of minerals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Net Proceeds Of Minerals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.