Get the free Fair market value (FMV) of assets at end of tax year

Show details

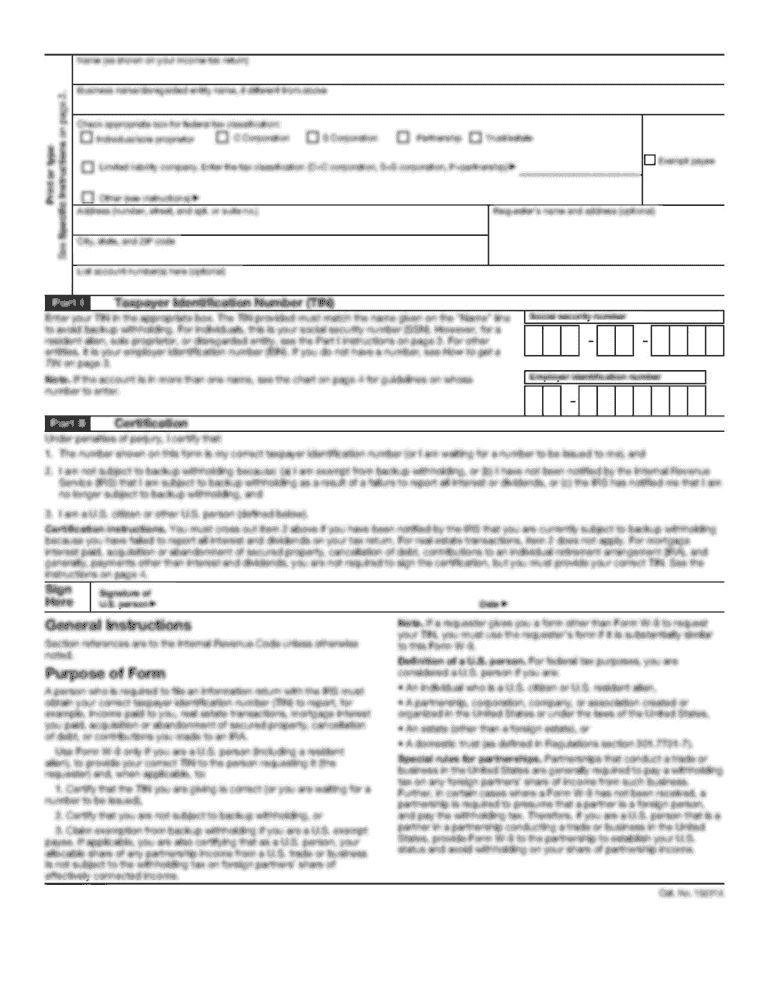

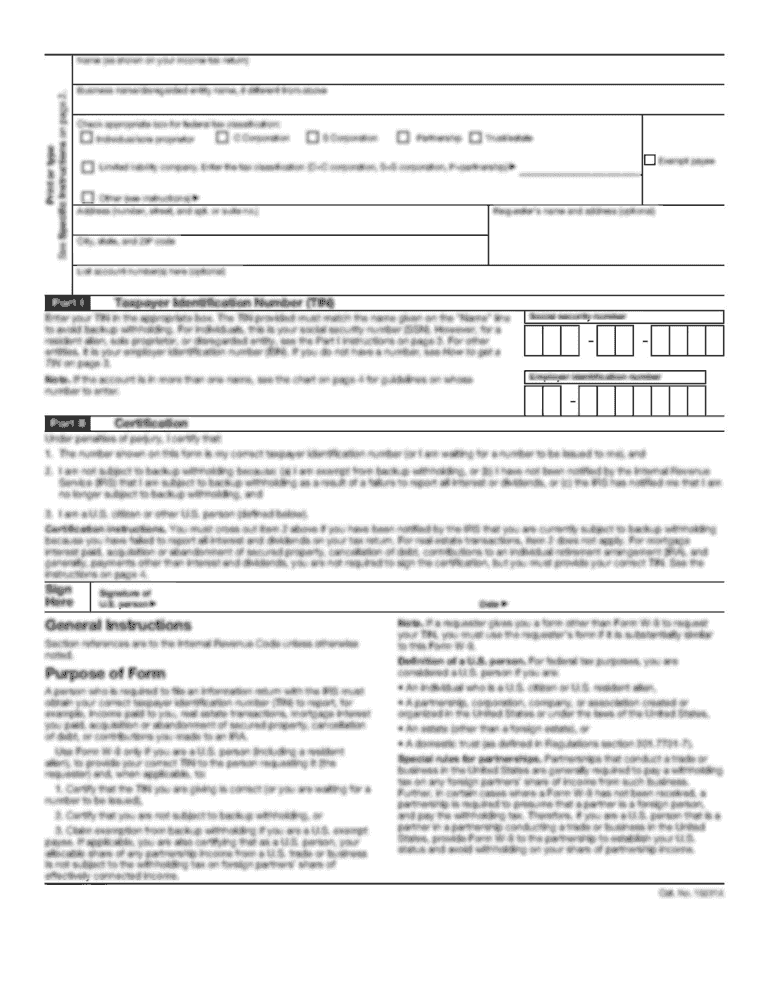

Form 5227 OMB No. 15450196 SplitInterest Trust Information Return Department of the Treasury Internal Revenue Service 2002 See separate instructions. Full name of trust A Employer identification number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fair market value fmv

Edit your fair market value fmv form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair market value fmv form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fair market value fmv online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fair market value fmv. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair market value fmv

How to fill out fair market value fmv

01

To fill out fair market value (FMV), follow these steps:

02

Determine the purpose of the FMV. Are you calculating it for tax purposes, selling a property, or for insurance?

03

Gather all relevant information about the asset or property you are valuing. This may include its condition, age, location, comparable sales data, and any unique features or characteristics.

04

Research the market value of similar assets or properties in the same area. This can be done by consulting real estate agents, appraisers, or online databases.

05

Consider any factors that may affect the value, such as market trends, economic conditions, or legal regulations.

06

Apply the appropriate valuation method for the asset or property. This could involve comparing it to similar sales, using an income or cost approach, or consulting industry experts.

07

Document your findings and calculations in a clear and organized manner, ensuring all necessary details are included.

08

Double-check your work for any errors or inconsistencies before finalizing the fair market value.

09

Keep in mind that FMV is subjective and may vary depending on the purpose and context of the valuation. It is always a good idea to seek professional advice if needed.

Who needs fair market value fmv?

01

Various individuals and entities may need fair market value (FMV) for different purposes:

02

- Individuals selling or buying real estate or other assets to determine a fair selling or purchase price.

03

- Taxpayers calculating the value of charitable donations or determining capital gains or losses.

04

- Insurance companies assessing the value of insured assets for coverage purposes.

05

- Financial institutions using FMV to evaluate collateral for loans or other financial transactions.

06

- Legal professionals involved in estate planning, divorce settlements, or property disputes.

07

Overall, anyone involved in transactions, legal matters, taxation, or insurance that require accurate asset or property valuation can benefit from understanding and utilizing fair market value.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fair market value fmv in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your fair market value fmv and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the fair market value fmv electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete fair market value fmv on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your fair market value fmv. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is fair market value fmv?

Fair market value (FMV) is the price that a willing buyer would pay to a willing seller for a property or asset.

Who is required to file fair market value fmv?

Individuals and entities who are involved in transactions involving property or assets that require reporting of FMV.

How to fill out fair market value fmv?

To fill out FMV, one must assess the property or asset's value based on current market conditions and provide accurate information on the designated form.

What is the purpose of fair market value fmv?

The purpose of FMV is to ensure transparency and accuracy in reporting the value of property or assets for tax or financial purposes.

What information must be reported on fair market value fmv?

Information such as the description of the property or asset, the valuation method used, and the calculated FMV must be reported on FMV forms.

Fill out your fair market value fmv online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Market Value Fmv is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.