Get the free for Estates of Persons Who Died On or

Show details

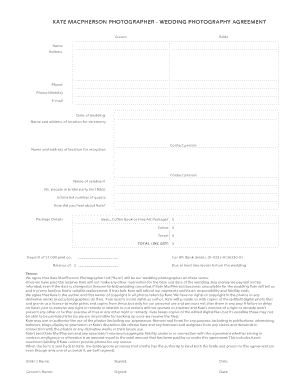

NEBRASKA ESTATE TAX RETURN FORM for Estates of Persons Who Died On or After January 1, 2003, and Before July 1, 2003, Read instructions on reverse side né DEP of Nebraska department of revenue 706NT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for estates of persons

Edit your for estates of persons form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for estates of persons form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing for estates of persons online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit for estates of persons. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for estates of persons

How to fill out for estates of persons

01

Gather all necessary documents and information, including the person's will, death certificate, and any relevant financial information.

02

Identify and notify the appropriate authorities, such as the probate court or estate lawyer, about the person's passing.

03

Appoint an executor or personal representative to handle the estate administration.

04

Prepare an inventory of the person's assets and liabilities, ensuring to include real estate, bank accounts, investments, and any debts.

05

Notify all interested parties, such as beneficiaries, heirs, and creditors, about the estate.

06

Work with professionals, such as lawyers and accountants, to properly value and distribute the assets, pay off debts, and handle any tax obligations.

07

Follow the necessary legal procedures and guidelines for filing tax returns, distributing assets, and closing the estate.

08

Keep detailed records of all transactions and communications related to the estate.

09

Ensure all legal requirements and deadlines are met throughout the probate process.

10

Finalize the estate by distributing the remaining assets to the beneficiaries according to the person's will or applicable laws.

Who needs for estates of persons?

01

The heirs or beneficiaries of a deceased person's estate need to understand the process of filling out for estates of persons.

02

Estate lawyers or probate attorneys require knowledge about filling out for estates of persons in order to assist their clients.

03

Financial institutions or banks may need information about the deceased person's estate to settle any outstanding accounts or debts.

04

Any individual appointed as an executor or personal representative of an estate needs to be familiar with filling out for estates of persons.

05

Creditors and debtors involved with the deceased person's estate need to understand the process of estate administration.

06

Government agencies, such as the probate court, may require information about the deceased person's estate for legal purposes.

07

Any individual who wants to ensure a smooth and legal distribution of their assets after their passing can benefit from understanding the process of filling out for estates of persons.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find for estates of persons?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the for estates of persons in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the for estates of persons electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your for estates of persons in seconds.

How do I fill out for estates of persons using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign for estates of persons and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is for estates of persons?

Estates of persons refers to the assets and liabilities left behind by a deceased individual.

Who is required to file for estates of persons?

The executor or administrator of the deceased person's estate is required to file for estates of persons.

How to fill out for estates of persons?

To fill out for estates of persons, one must gather all relevant financial information, including assets and debts, and accurately report them on the required forms.

What is the purpose of for estates of persons?

The purpose of filing for estates of persons is to ensure that the deceased individual's assets are distributed according to their will or state laws.

What information must be reported on for estates of persons?

Information such as the deceased person's assets, debts, beneficiaries, and any relevant tax information must be reported on for estates of persons.

Fill out your for estates of persons online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Estates Of Persons is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.