Get the free form 6863a

Show details

Este documento es un formulario utilizado para solicitar el pago de gastos relacionados con citaciones administrativas, incluyendo la recuperación de documentos y costos asociados.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 6863a

Edit your form 6863a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 6863a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 6863 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 6863. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 6863a

How to fill out form 6863a

01

Obtain form 6863a from the official website or relevant office.

02

Read the instructions carefully before filling out the form.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide any relevant identification numbers or codes as required.

05

Complete the sections that apply to your situation or purpose for using the form.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form according to the provided instructions, whether online or by mail.

Who needs form 6863a?

01

Individuals applying for specific benefits or services that require this form.

02

Anyone who has been instructed to complete form 6863a by an agency or authority.

03

Individuals seeking assistance or proof related to eligibility for programs requiring this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS summons power?

The IRS has the authority to issue summonses to seek information from taxpayers during an examination and to pursue payment of taxes. In an effort to limit this broad power, IRC section 7609 generally requires the IRS to provide notice of any summons issued to a third party, to the target identified in the summons.

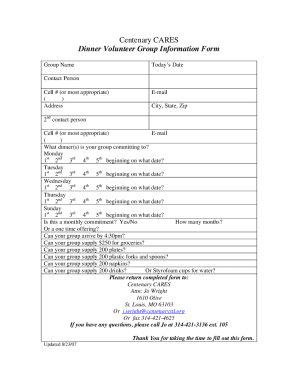

What is form 6863?

Instructions For Using Form 6863 - Invoice and Authorization For Payment. of Administrative Summons Expenses.

What happens if I don't respond to IRS?

So, one IRS employee won't be contacting you to handle the case and follow up. In fact, if you don't respond, respond late, or respond incompletely, the IRS will likely just disallow the items it's questioning on your return and send you a tax bill – plus penalties and interest. Multiple responses confuse the IRS.

How much is the IRS installment agreement reinstatement fee?

For most people, it's practical to get into a streamlined installment agreement. If you reassure the IRS that you won't owe again and you agree to direct-debit payments, the IRS will often allow you to reinstate your agreement. The only cost is the reinstatement fee of $89.

What is the quash period for IRS summons?

On or before the third day a summons is served, the taxpayer and any other person mentioned in the summons is entitled to notification of the summons within three days from which the summons is served. The taxpayer has no longer than the 20th day after the notice is served to begin a proceeding to “quash” the summons.

What happens if you ignore an IRS summons?

If you ignore a summons, the IRS will show the courts that the requested information is relevant to a legitimate investigation. IRS agents must follow strict rules when sending out a summons. They tend to follow the rules closely, and by extension, the courts hold up most summonses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 6863a?

Form 6863A is a specific form used for certain administrative processes, often related to tax filings or benefits applications.

Who is required to file form 6863a?

Individuals or entities that meet specific criteria set forth by the governing authority are required to file Form 6863A.

How to fill out form 6863a?

To fill out Form 6863A, you should gather necessary information and documentation, follow the instructions provided on the form, and ensure that all required sections are accurately completed.

What is the purpose of form 6863a?

The purpose of Form 6863A is to collect necessary information for administrative procedures, enabling the governing authority to process applications or claims effectively.

What information must be reported on form 6863a?

Information that must be reported on Form 6863A typically includes personal identification details, financial information, and any applicable supporting documentation as specified in the form's instructions.

Fill out your form 6863a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 6863 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.