Get the free International Fuel Tax Agreement, Publication 50

Show details

C A L I F O R N I A I F TA u CALIFORNIA STATE BOARD OF EQUALIZATION (Board Member Names Updated 2007) BETTY T. YES First District San Francisco BILL LEONARD Second District Ontario/Sacramento MICHELLE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international fuel tax agreement

Edit your international fuel tax agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international fuel tax agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit international fuel tax agreement online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit international fuel tax agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

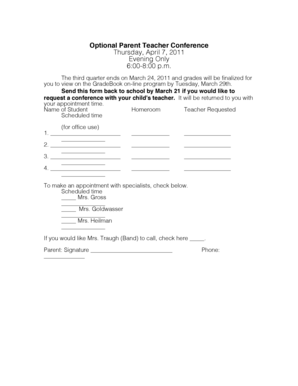

How to fill out international fuel tax agreement

How to fill out international fuel tax agreement

01

Obtain the necessary forms: You will need to obtain the International Fuel Tax Agreement (IFTA) application forms from the appropriate authority in your jurisdiction.

02

Gather required information: Before filling out the IFTA forms, gather all the necessary information such as your company details, vehicle information, trip details, and fuel consumption records.

03

Complete the application forms: Fill out the IFTA application forms accurately and completely. Provide all the requested information, including your contact details, vehicle identification numbers, and fuel consumption data.

04

Calculate fuel tax liability: Use the provided instructions to calculate your fuel tax liability for each jurisdiction you operate in. This typically involves determining the total miles traveled and the gallons of fuel consumed in each jurisdiction.

05

Submit the forms and payment: Once you have completed the forms and calculated your fuel tax liability, submit the forms along with the required payment to the appropriate authority in your jurisdiction.

06

Maintain records: It is essential to keep accurate records of fuel purchases, mileage, and trip details for each vehicle. These records may be subject to audit, so ensure they are organized and readily accessible.

07

File periodic IFTA reports: Depending on your jurisdiction's requirements, you may need to file IFTA reports on a quarterly or monthly basis. Make sure you meet the filing deadlines and provide accurate information.

08

Adhere to IFTA regulations: Familiarize yourself with the IFTA regulations and ensure compliance with all requirements, including record-keeping, reporting, and payment of fuel taxes.

09

Renew your IFTA credentials: International Fuel Tax Agreements typically need to be renewed annually. Keep track of the expiration date and submit the necessary renewal forms and fees to maintain compliance.

10

Seek professional assistance if needed: If you are unsure about how to fill out the International Fuel Tax Agreement forms or have complex operations, consider seeking professional assistance from a tax consultant or legal expert.

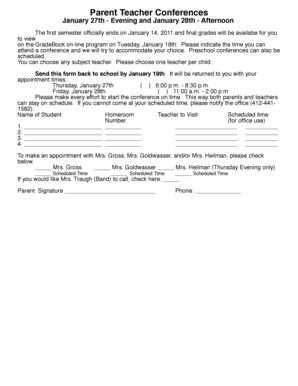

Who needs international fuel tax agreement?

01

Interstate motor carriers: International Fuel Tax Agreements are primarily required for motor carriers operating across different jurisdictions, such as states or provinces.

02

Commercial vehicle operators: Individuals or companies operating commercial vehicles for the transportation of goods or passengers are generally required to have an International Fuel Tax Agreement.

03

Vehicles over a certain weight limit: In many jurisdictions, the requirement for an International Fuel Tax Agreement applies to vehicles with a gross vehicle weight rating (GVWR) or registered gross vehicle weight (RGVW) over a specified threshold.

04

Vehicles with three or more axles: Some jurisdictions impose the requirement for an International Fuel Tax Agreement on vehicles with three or more axles, irrespective of their weight.

05

Cross-border operations: If your operations involve crossing international borders, such as between the United States and Canada, you may need an International Fuel Tax Agreement to ensure compliance with fuel tax obligations in both countries.

06

Non-exempt vehicles: Certain vehicles, such as government-owned vehicles or vehicles used exclusively for agriculture, may be exempt from the International Fuel Tax Agreement requirement. Check your jurisdiction's specific regulations to determine if you qualify for an exemption.

07

Compliance with fuel tax laws: Those who want to ensure compliance with fuel tax laws and avoid penalties or legal consequences should obtain an International Fuel Tax Agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete international fuel tax agreement online?

Completing and signing international fuel tax agreement online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit international fuel tax agreement online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your international fuel tax agreement and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit international fuel tax agreement on an Android device?

The pdfFiller app for Android allows you to edit PDF files like international fuel tax agreement. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is international fuel tax agreement?

The International Fuel Tax Agreement (IFTA) is an agreement among the lower 48 states of the United States and Canadian provinces, to simplify the reporting of fuel taxes by interstate motor carriers.

Who is required to file international fuel tax agreement?

Interstate motor carriers who operate qualified motor vehicles in more than one jurisdiction are required to file international fuel tax agreements.

How to fill out international fuel tax agreement?

To fill out an International Fuel Tax Agreement, carriers must report the total amount of fuel consumed and mileage traveled in each jurisdiction.

What is the purpose of international fuel tax agreement?

The purpose of the International Fuel Tax Agreement is to simplify and streamline the reporting of fuel taxes for interstate motor carriers operating in multiple jurisdictions.

What information must be reported on international fuel tax agreement?

On the International Fuel Tax Agreement, carriers must report the total fuel consumed and mileage traveled in each jurisdiction.

Fill out your international fuel tax agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Fuel Tax Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.