Get the free of a Partnership to be

Show details

The fee to file the Certificate of Correction of Limited Partnership is $200.00. You will ... Please make your check payable to the Delaware Secretary of State. ... filed pursuant to Section 17213(a).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign of a partnership to

Edit your of a partnership to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of a partnership to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

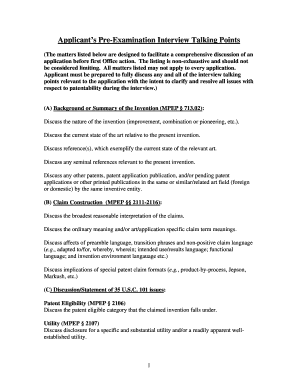

Editing of a partnership to online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit of a partnership to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out of a partnership to

How to fill out of a partnership to

01

Start by gathering all relevant information and documents related to the partnership.

02

Clearly define the objectives and goals of the partnership.

03

Identify potential partners who align with your objectives and can contribute to the partnership.

04

Reach out to the potential partners and initiate discussions to gauge their interest.

05

Negotiate and draft a partnership agreement that outlines the rights, responsibilities, and obligations of each party.

06

Ensure that the partnership agreement includes provisions for sharing resources, profits, and decision-making.

07

Review the partnership agreement with legal counsel to ensure compliance with applicable laws and regulations.

08

Once the agreement is finalized, sign the partnership agreement with all involved parties.

09

Regularly communicate and collaborate with the partners to ensure the partnership's success.

10

Monitor the progress and performance of the partnership and make necessary adjustments as needed.

Who needs of a partnership to?

01

Entrepreneurs who wish to combine resources and expertise to launch or grow a business.

02

Non-profit organizations seeking to collaborate with other entities to achieve common goals.

03

Small businesses looking to expand their market reach and access new opportunities.

04

Government agencies aiming to leverage private sector partnerships to implement projects and initiatives.

05

Startup founders who want to share risks and costs with others while pursuing common objectives.

06

Individuals or organizations with complementary skills and resources who can achieve more together than individually.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my of a partnership to in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your of a partnership to and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute of a partnership to online?

Completing and signing of a partnership to online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit of a partnership to online?

The editing procedure is simple with pdfFiller. Open your of a partnership to in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is of a partnership to?

A partnership tax return is a form that must be filed by a partnership to report their income, deductions, credits, and other tax-related information to the IRS.

Who is required to file of a partnership to?

All partnerships are required to file a partnership tax return, regardless of whether they have any income or not.

How to fill out of a partnership to?

Partnerships can fill out Form 1065 to report their income, deductions, credits, and other tax-related information to the IRS.

What is the purpose of of a partnership to?

The purpose of a partnership tax return is to report the partnership's financial activities to the IRS and to calculate the partnership's tax liability.

What information must be reported on of a partnership to?

Partnerships must report their income, deductions, credits, and other tax-related information on a partnership tax return.

Fill out your of a partnership to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Of A Partnership To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.