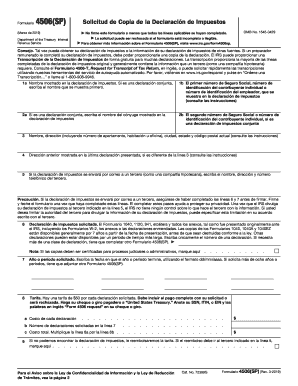

IRS 872-B 2004-2026 free printable template

Show details

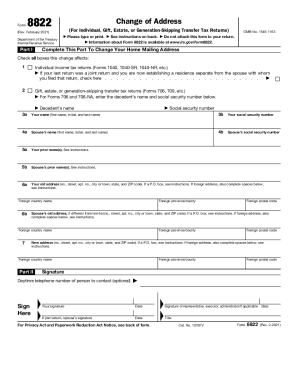

Consent to Extend the Time to Assess Tax ... Form 872 (Rev. 12-2004). Catalog Number 20755I and the Commissioner of Internal Revenue consent and agree ...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 872-B

Edit your IRS 872-B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 872-B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 872-B online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 872-B. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 872-B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 872-B

How to fill out IRS 872-B

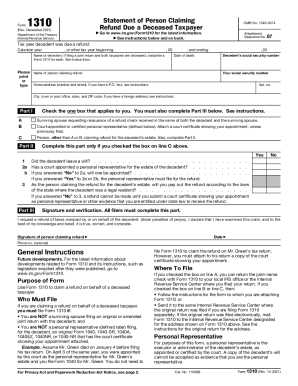

01

Obtain Form 872-B from the IRS website or request it from your tax professional.

02

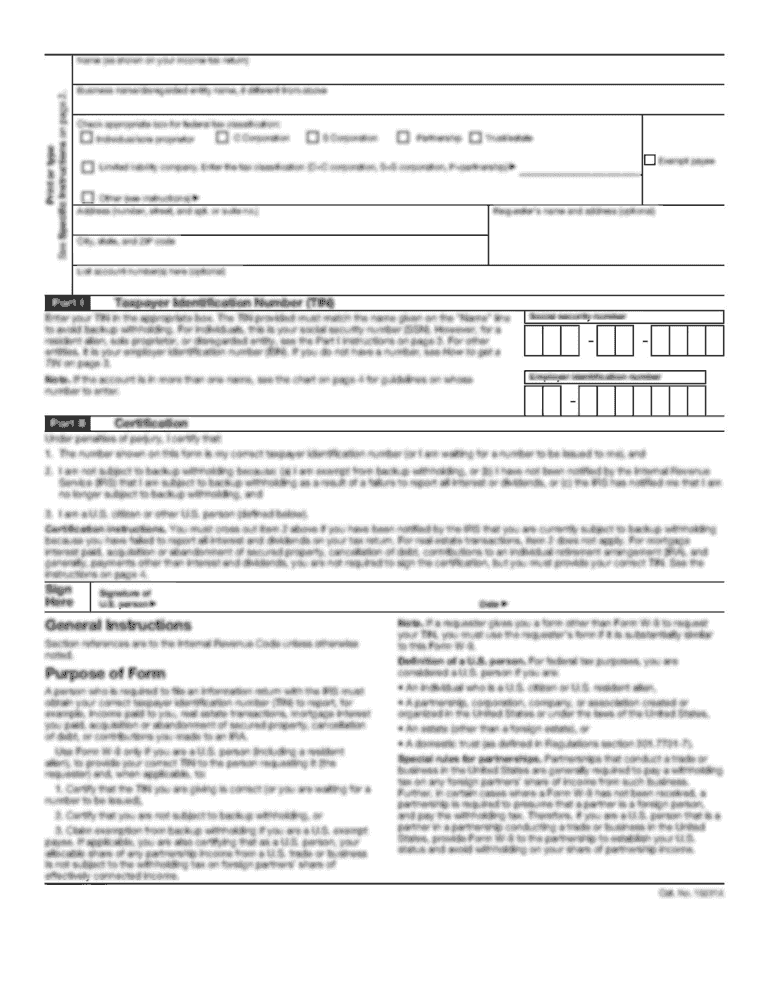

Fill out the taxpayer's name and address in the designated fields.

03

Specify the type of tax involved (e.g., income, estate, etc.).

04

Indicate the specific tax period for which the agreement applies.

05

Review the terms and conditions section and ensure you understand the implications of the agreement.

06

Sign and date the form as the taxpayer, and have your tax representative sign if applicable.

07

Send the completed form to the appropriate IRS office as indicated in the instructions.

Who needs IRS 872-B?

01

Taxpayers who are under audit or review by the IRS and wish to extend the period for which the IRS can assess additional tax liabilities.

02

Individuals or businesses seeking to agree to the IRS's right to complete the audit without the risk of having the limitations period expire.

03

Taxpayers who want to negotiate or clarify their tax situation with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Do I need a W-2 if I have a 1040?

Yes, you can still file taxes without a W-2 or 1099. Usually, if you work and want to file a tax return , you need Form W-2 or Form 1099, provided by your employer. If you did not receive these forms or misplaced them, you can ask your employer for a copy of these documents.

Is a 1040 the same as a w2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

What is a 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is a 1040 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is a tax form 15103?

If the IRS believes that you haven't filed your tax returns, the agency may send you Form 15103 (Form 1040 Return Delinquency). The IRS usually sends this form with Notice CP56, CP59, or CP516, but you may receive it with another notice.

What is the tax delay form?

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS 872-B?

The editing procedure is simple with pdfFiller. Open your IRS 872-B in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in IRS 872-B without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing IRS 872-B and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out IRS 872-B on an Android device?

Use the pdfFiller app for Android to finish your IRS 872-B. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is IRS 872-B?

IRS Form 872-B is a consent form used by the IRS that allows taxpayers to extend the time for the IRS to assess tax deficiencies. It is specifically related to the taxpayer's agreement to the extension of the statute of limitations for tax assessments.

Who is required to file IRS 872-B?

Taxpayers who are involved in an audit or who have ongoing tax issues may be required to file IRS Form 872-B if they agree to extend the time the IRS has to assess additional taxes.

How to fill out IRS 872-B?

To fill out IRS Form 872-B, taxpayers must provide their personal information, such as name, address, and taxpayer identification number, along with details related to the tax year in question. The authorized representative must also sign the form.

What is the purpose of IRS 872-B?

The purpose of IRS Form 872-B is to formally consent to an extension of the time period in which the IRS can assess tax due to audits, allowing both parties to have time to resolve tax issues.

What information must be reported on IRS 872-B?

The information required on IRS Form 872-B includes the taxpayer's identification details, the specific tax year for which the extension is granted, and the signature of the taxpayer or their authorized representative.

Fill out your IRS 872-B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 872-B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.