REV-1549 2010-2025 free printable template

Show details

REV1549 EX (0710) (I) 1549010101 Commonwealth of Pennsylvania Department of Revenue Bureau of Individual Taxes PO BOX 280601 Harrisburg, PA 171280601 Phone: 7177878327 NOTICE OF DECEDENT ACCOUNT STATUS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxes federal income form

Edit your tax federal rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal rate tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue agencies online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit federal tax form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal tax form

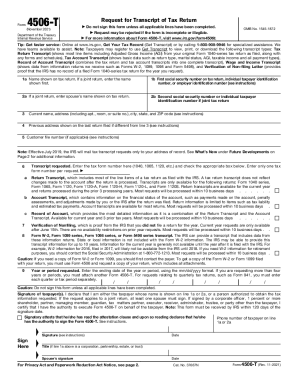

How to fill out REV-1549

01

Obtain the REV-1549 form from the relevant tax authority or their website.

02

Fill in your personal information, including your name, address, and taxpayer identification number.

03

Specify the tax year for which you are filing the form.

04

Provide details about your income, deductions, and credits as required in the appropriate sections.

05

Review all entered information for accuracy and completeness.

06

Sign and date the form.

07

Submit the form to the appropriate tax authority by the deadline, either electronically or via mail.

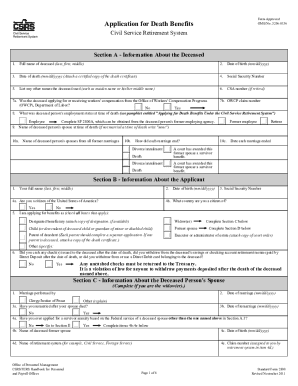

Who needs REV-1549?

01

Individuals or businesses that need to amend their tax returns.

02

Taxpayers seeking to claim specific tax credits or deductions.

03

Those who have received a notice from the tax authority requiring clarification or correction.

Fill

form

: Try Risk Free

People Also Ask about

How do I file my income tax return?

How to file ITR Online - Step by Step Guide to Efile Income Tax Return, FY 2022-23 (AY 2023-24) Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal.

What is income tax form?

What are ITR forms? Income tax return is a form which is filed with the taxing authority. It reports income, expenses, and other relevant tax information. Tax returns make it easy for taxpayers to determine their tax liability, plan their tax payments and request refunds for its over payment.

What is a Form 1120 G?

Use Schedule G (Form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of the corporation's stock entitled to vote.

How much is federal tax income?

The federal income tax rates remain unchanged for the 2022 and 2023 tax years are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The income thresholds for each bracket, though, are adjusted slightly every year for inflation.

How do you calculate federal taxable income?

In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. What's left is taxable income. Then we apply the appropriate tax bracket (based on income and filing status) to calculate tax liability.

How much federal tax should I pay on $8000?

If you make $8,000 a year living in the region of California, USA, you will be taxed $700. That means that your net pay will be $7,300 per year, or $608 per month. Your average tax rate is 8.8% and your marginal tax rate is 8.8%.

How do I find my federal tax income?

Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

How do I file my own taxes step by step?

How to File Your Taxes This Year: 6 Simple Steps Step 1: Determine if You Need to File. First things first. Step 2: Gather Your Tax Documents. Step 3: Pick a Filing Status. Step 4: Choose Between the Standard Deduction or Itemizing. Step 5: Choose How to File. Step 6: File Your Taxes.

What is the correct way to file a federal income tax return?

Choose how to file taxes There are three main ways to file taxes: fill out IRS Form 1040 or Form 1040-SR by hand and mail it (not recommended), file taxes online using tax software, or hire a human tax preparer to do the work of tax filing.

How do I fill out a federal tax check?

Make sure your check or money order includes the following information: Your name and address. Daytime phone number. Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.

How do you calculate federal tax on taxable income?

The percentage of your taxable income that you pay in taxes is called your effective tax rate. To determine effective tax rate, divide your total tax owed (line 16) on Form 1040 by your total taxable income (line 15). Income thresholds for tax brackets are updated annually.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the federal tax form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign federal tax form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit federal tax form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share federal tax form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out federal tax form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your federal tax form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is REV-1549?

REV-1549 is a form used for reporting and remitting local earned income taxes in Pennsylvania.

Who is required to file REV-1549?

Individuals and businesses that have earned income in Pennsylvania and are subject to local earned income tax must file REV-1549.

How to fill out REV-1549?

To fill out REV-1549, you need to provide your personal information, the amount of earned income, calculations of local taxes owed, and any credits you may have.

What is the purpose of REV-1549?

The purpose of REV-1549 is to ensure proper reporting and payment of earned income taxes to local tax authorities in Pennsylvania.

What information must be reported on REV-1549?

The information that must be reported on REV-1549 includes personal identification details, total earned income, tax calculations, and any tax credits.

Fill out your federal tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.