Get the free Final: Business closed or

Show details

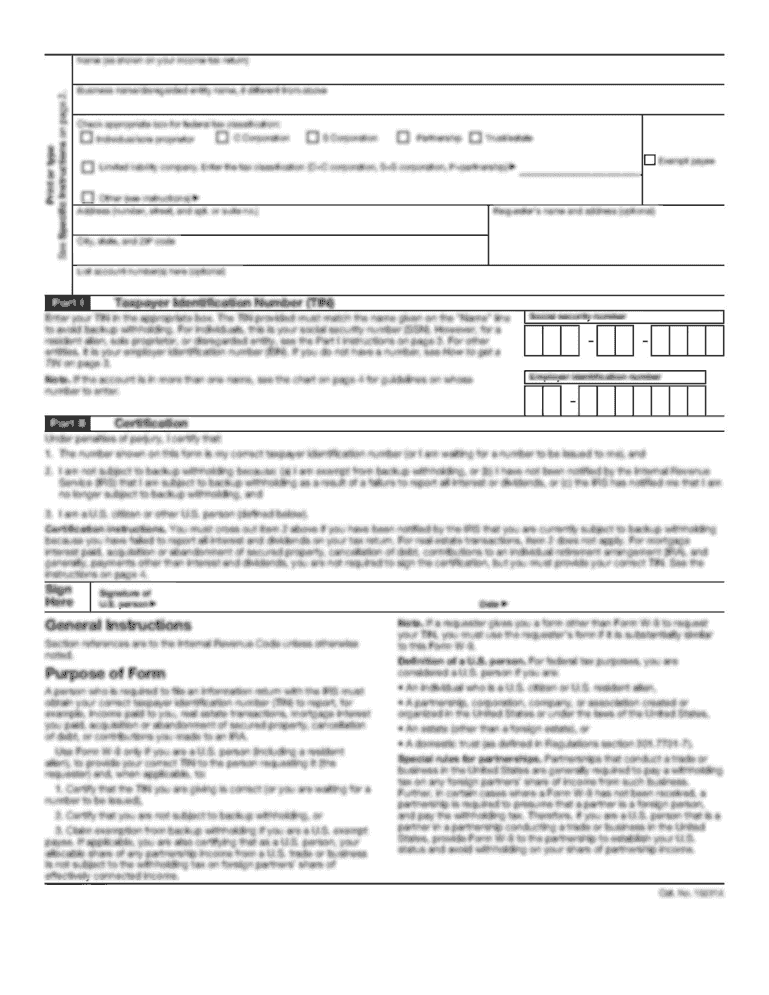

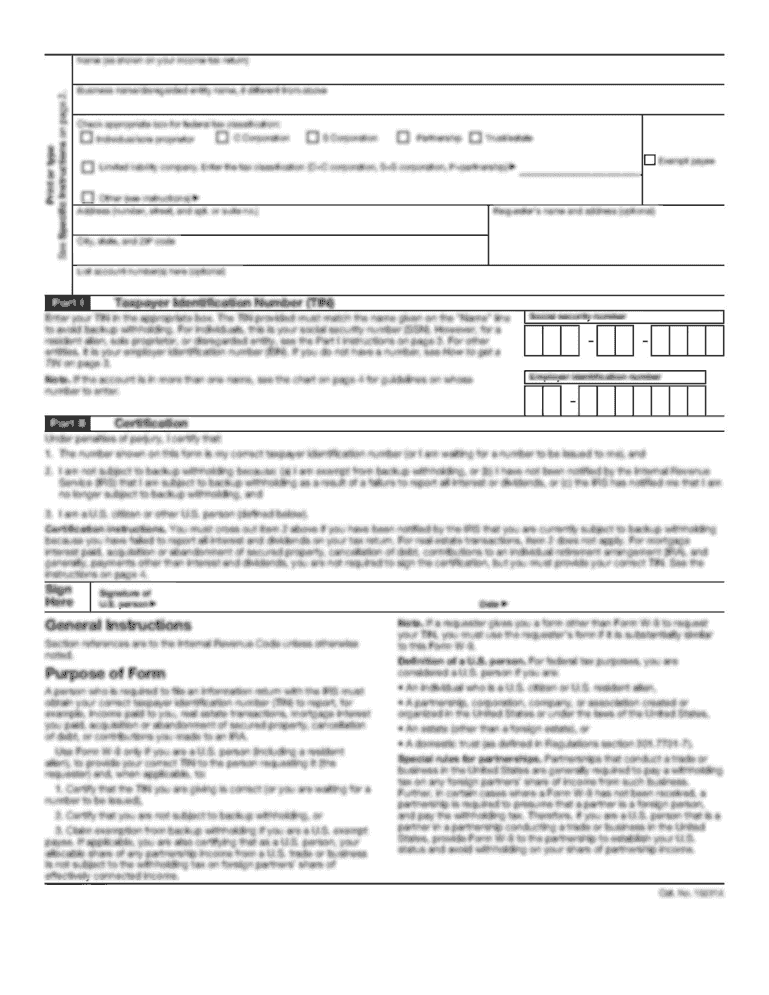

Form 940 for 2013: Employer's Annual Federal Unemployment (FTA) Tax Return Department of the Treasury Internal Revenue Service Employer identification number 850113 OMB No. 15450028 Type of Return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final business closed or

Edit your final business closed or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final business closed or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing final business closed or online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit final business closed or. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final business closed or

How to fill out final business closed or

01

Start by collecting all the necessary documents and paperwork related to your business closure.

02

Notify your employees, customers, and suppliers about the closure in advance, giving them enough time to make necessary arrangements.

03

Pay off all your outstanding debts and liabilities. Make sure to settle any pending payments to avoid legal complications.

04

Cancel any leases, contracts, or agreements associated with the business. Inform relevant parties about the termination.

05

File the necessary paperwork with the appropriate government agencies, such as tax authorities or licensing bodies.

06

Close all your business bank accounts and ensure that all financial matters are resolved.

07

Dispose of any remaining inventory, assets, or equipment according to legal requirements and regulations.

08

Inform your business partners, vendors, and other stakeholders about the closure, providing any necessary documentation or proof.

09

Conduct a final audit of your financial records and ensure that all taxes and dues are paid in full.

10

Consider seeking legal advice or consulting with a professional to ensure that you have fulfilled all your obligations.

11

Finally, formally dissolve your business entity as per the regulations in your jurisdiction. This may involve submitting specific forms or documents.

Who needs final business closed or?

01

Business owners who have decided to retire or move on to other ventures.

02

Entrepreneurs who have experienced significant financial losses or insurmountable challenges in their business.

03

Companies that have completed their intended lifespan or achieved their goals and objectives.

04

Businesses facing excessive legal issues, lawsuits, or regulatory fines, where closure is the most viable option.

05

Organizations undergoing mergers, acquisitions, or restructuring that render the original business redundant.

06

Individuals dealing with personal circumstances such as health issues or family emergencies that prevent them from continuing the business.

07

Companies in industries that are no longer profitable or relevant due to market changes or technological advancements.

08

Business owners or partners looking to dissolve a partnership or dissolve a company due to irreconcilable differences or disputes.

09

Startups or ventures that have failed to generate sufficient revenue or attract enough customers to sustain operations.

10

Businesses directly affected by natural disasters, economic crises, or other unforeseen circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my final business closed or directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your final business closed or along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I execute final business closed or online?

pdfFiller has made filling out and eSigning final business closed or easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out final business closed or using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign final business closed or and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your final business closed or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Business Closed Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.