Get the free Note to fiscal year taxpayers: File Form 40-EXT by the regular due date of your return

Show details

Apr 17, 2018 ... Note: If you are a fiscal year taxpayer, file Form OR-40-V, with the extension payment box checked, by the regular due date of your return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign note to fiscal year

Edit your note to fiscal year form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your note to fiscal year form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit note to fiscal year online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit note to fiscal year. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out note to fiscal year

How to fill out note to fiscal year

01

Review the instructions provided by your company or organization on how to fill out the note to fiscal year.

02

Start by providing the relevant details about the fiscal year, such as the start and end dates.

03

Include any significant events or changes that occurred during the fiscal year that should be noted.

04

Summarize the financial performance of the company during the fiscal year, highlighting key metrics and figures.

05

Address any risks or challenges that the company may have faced during the fiscal year.

06

Include any future projections or plans for the upcoming fiscal year.

07

Ensure that the note is clear, concise, and accurately reflects the financial and operational aspects of the fiscal year.

08

Proofread the note for any errors or inconsistencies before finalizing it.

09

Submit the completed note to the appropriate department or individual as per the instructions provided.

Who needs note to fiscal year?

01

Companies and organizations that prepare financial statements and reports.

02

Accountants and financial professionals responsible for documenting the fiscal year.

03

Regulatory bodies or government agencies that require the note as part of financial reporting.

04

Investors and shareholders who want to gain insights into the company's financial performance.

05

Internal and external auditors who review the company's financial statements.

06

Stakeholders interested in understanding the financial and operational aspects of the fiscal year.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send note to fiscal year to be eSigned by others?

To distribute your note to fiscal year, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute note to fiscal year online?

pdfFiller makes it easy to finish and sign note to fiscal year online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the note to fiscal year in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your note to fiscal year and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

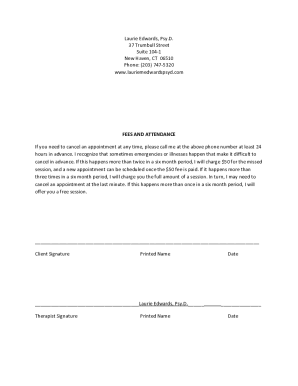

What is note to fiscal year?

Note to fiscal year is a disclosure typically included in financial statements to explain the reporting period used by the company.

Who is required to file note to fiscal year?

All companies that prepare financial statements are required to include a note to fiscal year.

How to fill out note to fiscal year?

To fill out a note to fiscal year, companies should state the beginning and ending dates of the fiscal year, any changes in accounting policies, and any other relevant information.

What is the purpose of note to fiscal year?

The purpose of note to fiscal year is to provide clarity on the reporting period used by the company and to explain any changes in accounting policies.

What information must be reported on note to fiscal year?

The note to fiscal year must include the beginning and ending dates of the fiscal year, any changes in accounting policies, and any other relevant information that may impact the financial statements.

Fill out your note to fiscal year online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Note To Fiscal Year is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.