DC D-4 2015 free printable template

Show details

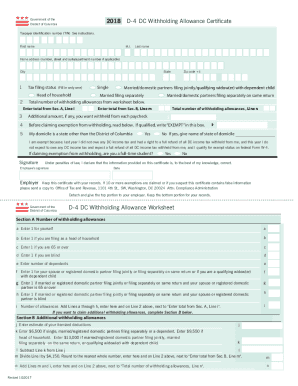

Print Clear This is a FILLING format. Please do not handwrite any data on this form other than your signature. Government of the 2015 District of Columbia D4 DC Withholding Allowance Certificate Social

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign d-4 dc withholding allowance

Edit your d-4 dc withholding allowance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your d-4 dc withholding allowance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing d-4 dc withholding allowance online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit d-4 dc withholding allowance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DC D-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out d-4 dc withholding allowance

How to fill out DC D-4

01

Obtain a copy of the DC D-4 form from the DC Office of Tax and Revenue website or in person.

02

Fill out the personal information section, including your name, address, and Social Security number.

03

Choose the appropriate tax year for which you are filing the DC D-4.

04

Complete the section regarding your income, detailing all sources of income earned during the tax year.

05

Fill out any deductions or credits that you may qualify for based on your income and filing status.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submitting it.

08

Submit the DC D-4 form either electronically or by mailing it to the appropriate address provided by the DC Office of Tax and Revenue.

Who needs DC D-4?

01

Individuals who are residents of Washington D.C. and need to report their income for tax purposes.

02

Anyone who is self-employed and needs to calculate and remit their taxes.

03

Individuals who have multiple sources of income and need to consolidate their tax reporting.

04

Foreign nationals who earn income in Washington D.C. and need to comply with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to fill out a de4 form?

You must file the state form Employee's Withholding Allowance Certificate (DE 4) to determine the appropriate California PIT withholding. If you do not provide your employer with a withholding certificate, the employer must use Single with Zero withholding allowance.

Should I fill out de 4 form?

New hires and existing employees making changes to their withholdings must submit both the Form W-4 and the Form DE 4. If a new employee does not submit state DE 4, the employer must withhold state income tax as if the employee were single and claiming zero withholding allowances.

Is de 4 the same as w4?

The W-4 is used for federal income tax and the DE 4 is used for California Personal Income Tax (PIT).

What is de 4 form filing status?

Filing status on Form DE-4 Available filing statuses include: Single or Married (filing separately, with 2 or more incomes) Married (filing together, 1 income) Head of Household.

How many allowances should I claim de4?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

How to fill out a de4 form in California?

0:33 5:03 Accountant Reads California DE4 Instructions - YouTube YouTube Start of suggested clip End of suggested clip Or had a household. So you'll use the single or married with more than with two or more incomes. IfMoreOr had a household. So you'll use the single or married with more than with two or more incomes. If both spouses work or even if just once both works but they've got two jobs.

What is the difference between W4 and de4?

The W-4 is used for federal income tax and the DE 4 is used for California Personal Income Tax (PIT). Starting in 2020, allowances are no longer included on the redesigned Form W-4 for PIT withholdings.

Who fills out de4 form?

The Franchise Tax Board or the Employment Development Department (EDD) may, by special direction in writing, require an employer to submit a DE 4 when such forms are necessary for the administration of the withholding tax programs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my d-4 dc withholding allowance directly from Gmail?

d-4 dc withholding allowance and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit d-4 dc withholding allowance straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing d-4 dc withholding allowance right away.

Can I edit d-4 dc withholding allowance on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share d-4 dc withholding allowance on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is DC D-4?

DC D-4 is a tax form used in the District of Columbia to report certain information related to business income and expenses. It is primarily used for reporting income allocated to the District from activities conducted within its jurisdiction.

Who is required to file DC D-4?

Businesses operating in the District of Columbia that have income sourced from within the city are required to file DC D-4. This includes corporations, partnerships, and individuals with business activities generating income.

How to fill out DC D-4?

To fill out DC D-4, businesses need to provide detailed information about their income, deductions, and credits, following the form’s instructions. It is important to report accurate figures and provide supporting documentation when necessary.

What is the purpose of DC D-4?

The purpose of DC D-4 is to ensure that businesses report their taxable income accurately to the District of Columbia, facilitating proper tax assessment and compliance with local tax laws.

What information must be reported on DC D-4?

DC D-4 requires information such as gross income, deductions, apportionment factors, tax credits, and any other relevant financial details that reflect the business's activities within the District.

Fill out your d-4 dc withholding allowance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

D-4 Dc Withholding Allowance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.