Get the free Arizona Schedule A(PY) Itemized Deductions for Part-Year Residents 2016

Show details

Arizona Schedule A(BY) Itemized Deductions 2016 For Part Year Residents Include with your return. Your Name as shown on Form 140PY Your Social Security Number Spouses Name as shown on Form 140PY (if

We are not affiliated with any brand or entity on this form

Instructions and Help about arizona schedule apy itemized

How to edit arizona schedule apy itemized

How to fill out arizona schedule apy itemized

Instructions and Help about arizona schedule apy itemized

How to edit arizona schedule apy itemized

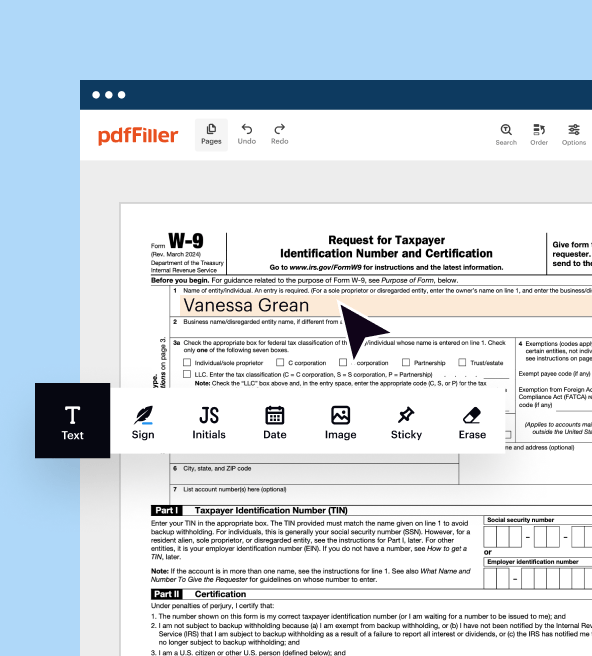

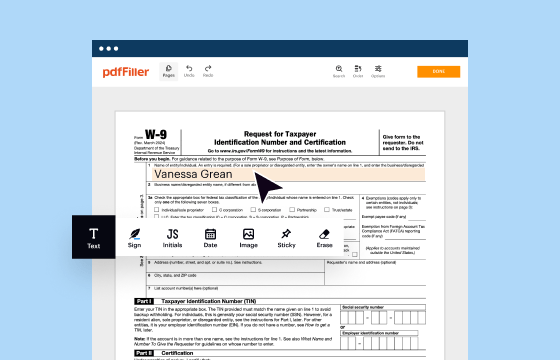

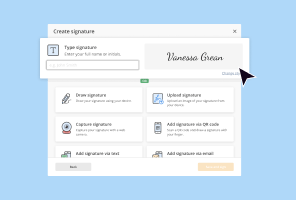

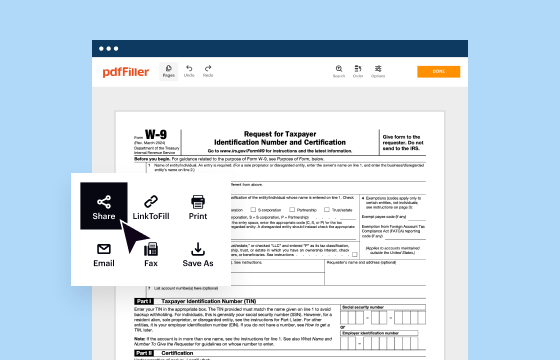

To edit the Arizona Schedule APY Itemized Tax Form, download the form from the Arizona Department of Revenue website. Once you have the printable version, use pdfFiller to upload and edit the document easily. With pdfFiller, you can add or remove information, correct any errors, and save the form in a digital format for submission.

How to fill out arizona schedule apy itemized

To fill out the Arizona Schedule APY Itemized Tax Form, follow these steps:

01

Begin with your personal identification information, including your name, address, and Social Security number.

02

List all applicable expenses and payments that qualify for itemization.

03

Calculate the total amounts for each category as instructed on the form.

04

Double-check all entries for accuracy and completeness before submission.

Latest updates to arizona schedule apy itemized

Latest updates to arizona schedule apy itemized

Stay informed about any changes to the Arizona Schedule APY Itemized Tax Form by regularly checking the Arizona Department of Revenue website. Updates may include changes in tax rates, eligibility requirements, or filing procedures.

All You Need to Know About arizona schedule apy itemized

What is arizona schedule apy itemized?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About arizona schedule apy itemized

What is arizona schedule apy itemized?

The Arizona Schedule APY Itemized Tax Form is a supplementary form used for reporting itemized deductions on an individual’s Arizona state income tax return. This form provides taxpayers the opportunity to detail eligible deductions that exceed the standard deduction amount.

What is the purpose of this form?

The purpose of the Arizona Schedule APY Itemized Tax Form is to allow taxpayers to claim specific deductions that may lower their overall taxable income. By itemizing, taxpayers may benefit from a larger reduction in their taxable income compared to taking the standard deduction, making it financially advantageous in some cases.

Who needs the form?

Taxpayers who wish to itemize deductions on their Arizona state income tax return must complete the Arizona Schedule APY Itemized form. This typically includes individuals with significant medical expenses, mortgage interest, or property taxes that exceed the standard deduction limit.

When am I exempt from filling out this form?

You are exempt from filling out the Arizona Schedule APY Itemized Tax Form if you choose to take the standard deduction instead of itemizing your deductions. Additionally, if your total itemizable deductions do not exceed the amount of the standard deduction, filing this form may not be beneficial.

Components of the form

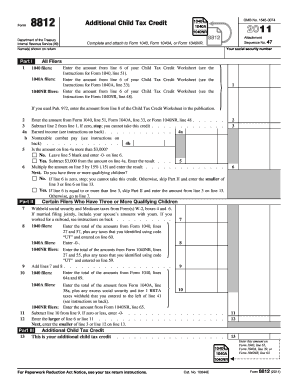

The Arizona Schedule APY Itemized form consists of sections for personal information, a detailed list of itemized deductions, and calculations for total deductible amounts. Common deduction categories include medical expenses, tax payments, mortgage interest, and charitable contributions.

Due date

The due date for submitting the Arizona Schedule APY Itemized Tax Form aligns with the standard Arizona state income tax deadline. Generally, this is April 15th, unless extended by the IRS or the state allowing for later submission.

What are the penalties for not issuing the form?

Failure to file the Arizona Schedule APY Itemized form when required can result in penalties from the Arizona Department of Revenue. These penalties may include fines based on the amount of unpaid taxes as well as interest accrued on that amount. It is essential to file accurately to avoid unnecessary penalties.

What information do you need when you file the form?

When filing the Arizona Schedule APY Itemized form, you will need various documentation including receipts for all itemized deductions, your Social Security number, and your total income details as reported on your federal income tax return. Keeping accurate records simplifies the filing process and ensures compliance.

Is the form accompanied by other forms?

Yes, the Arizona Schedule APY Itemized form is typically submitted alongside your main Arizona state income tax return and could be accompanied by federal forms supporting your itemized deductions, such as certain IRS forms that detail specific deductions claimed.

Where do I send the form?

You should send the completed Arizona Schedule APY Itemized form along with your state tax return to the Arizona Department of Revenue. Ensure that you check the latest mailing addresses on the Arizona Department of Revenue's website as they may change yearly.

See what our users say