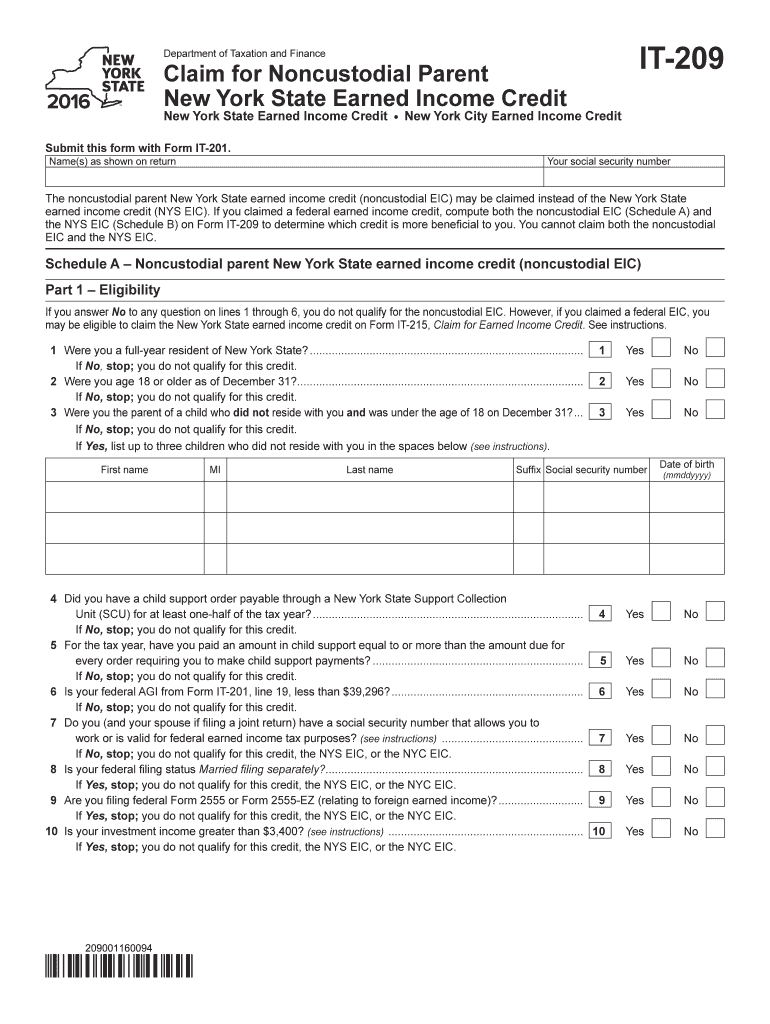

Get the free IT 209 Claim for Noncustodial Parent New York State Earned Income Credit 2016

Show details

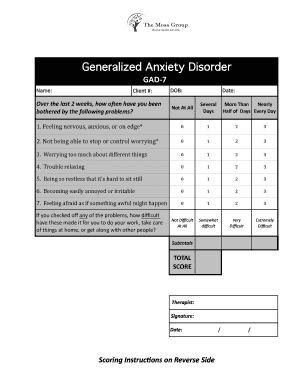

Department of Taxation and Finance Claim for Noncustodial Parent New York State Earned Income Credit IT209 New York State Earned Income Credit New York City Earned Income Credit Submit this form with

We are not affiliated with any brand or entity on this form

Instructions and Help about it 209 claim for

How to edit it 209 claim for

How to fill out it 209 claim for

Instructions and Help about it 209 claim for

How to edit it 209 claim for

To edit your it 209 claim form, you can utilize pdfFiller's editing features, which allow you to modify the text fields, add or remove information, and update your entries. Simply upload the completed form to pdfFiller, make the necessary changes directly in your document, and save your updated version. Ensure all edits are accurate and compliant with IRS requirements.

How to fill out it 209 claim for

Filling out the it 209 claim for requires collecting specific information, including your business details and payment data. Follow these steps:

01

Download the it 209 claim for from the IRS website or access it through pdfFiller.

02

Enter your name, address, and taxpayer identification number in the appropriate fields.

03

Provide details regarding the payments made and the purpose of those payments.

04

Review all information for accuracy before submission.

Using pdfFiller can facilitate this process by allowing you to fill out the form electronically, ensuring neatness and clarity.

Latest updates to it 209 claim for

Latest updates to it 209 claim for

Stay informed about new regulations or changes to the it 209 claim for by reviewing the IRS updates regularly. These changes can affect filing processes, deadlines, and other essential aspects of tax compliance.

All You Need to Know About it 209 claim for

What is it 209 claim for?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

Form vs. Form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About it 209 claim for

What is it 209 claim for?

The it 209 claim for is a tax form utilized by U.S. businesses to report specific payments made to independent contractors or for services rendered. This form assists in accurately reporting income and ensuring compliance with tax obligations.

What is the purpose of this form?

The purpose of the it 209 claim for is to provide the IRS with information about income paid to individuals or entities that are not employees. This helps the IRS track income sources and ensure that all relevant taxes are reported and paid.

Who needs the form?

Businesses that have made payments for services to independent contractors or non-employee individuals need to file the it 209 claim for. This includes various professions, such as freelancers, consultants, or service providers who do not receive a regular paycheck from the business.

When am I exempt from filling out this form?

You may be exempt from completing the it 209 claim for if your payments are below a certain threshold set by the IRS, or if they were made to a corporation. Review current IRS guidelines to determine if you meet criteria for exemption.

Components of the form

The it 209 claim for consists of key components including the payer's tax identification number, the recipient's details, and the total amount paid during the tax year. Each section must be completed with accurate information to avoid penalties.

Due date

The it 209 claim for must typically be submitted to the IRS by January 31 of the following year in which payments were made. Check IRS publications for any updates regarding changes in due dates or specific requirements.

Form vs. Form

Comparatively, the it 209 claim form is similar to other IRS forms used for reporting payments, such as Form 1099-MISC. However, it has specific uses and requirements tailored to different types of payments.

What payments and purchases are reported?

The it 209 claim for reports payments made to independent contractors for services rendered, as well as certain other payments like prizes or awards. It is essential to review IRS guidance on what qualifies as reportable payments.

How many copies of the form should I complete?

When filing the it 209 claim for, you should complete several copies: one for your records, one for the recipient, and one for submission to the IRS. Ensure all copies are filled out accurately to avoid discrepancies.

What are the penalties for not issuing the form?

Failing to issue the it 209 claim for may result in penalties, which can vary based on the duration of the delay and the amount of unreported income. The IRS typically imposes fines for late or missing submissions, emphasizing the importance of compliance.

What information do you need when you file the form?

When filing the it 209 claim for, gather essential information such as the payer’s and payee’s names, addresses, tax identification numbers, and total payment amounts. Accurate data is crucial for successful filing.

Is the form accompanied by other forms?

The it 209 claim for may need to be submitted alongside related tax forms, depending on your specific tax situation and the payments reported. It is important to consult the IRS guidelines for any additional forms that may be required.

Where do I send the form?

The it 209 claim for should be sent to the IRS at the address specified in the form instructions. Ensure that you are sending it to the correct address based on your business location and the nature of your submission.

See what our users say