I-113i 2016-2026 free printable template

Show details

Tab to navigate within form. Use mouse to check applicable boxes or press Enter. Schedule Print Explanation of Amended Return AR Wisconsin Department of Revenue Save Clear 2016 File with Amended Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign I-113i

Edit your I-113i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your I-113i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit I-113i online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit I-113i. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

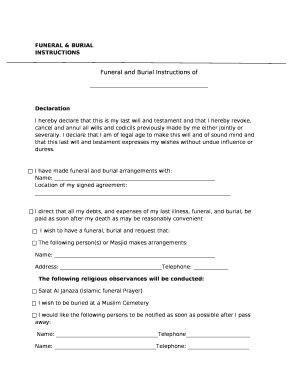

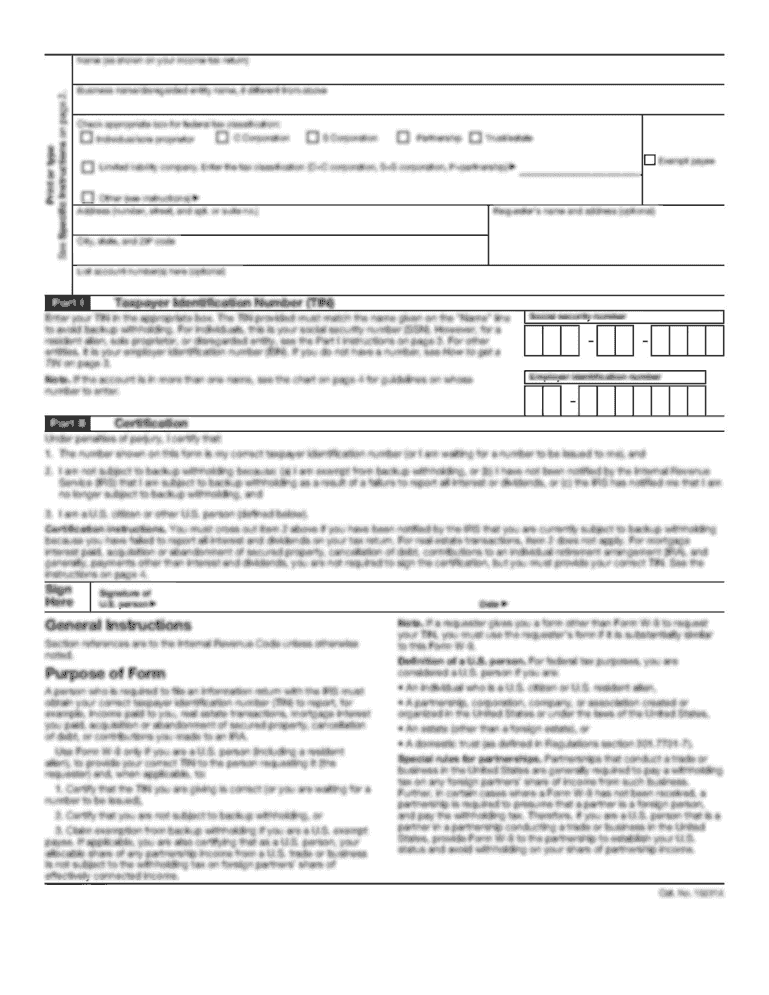

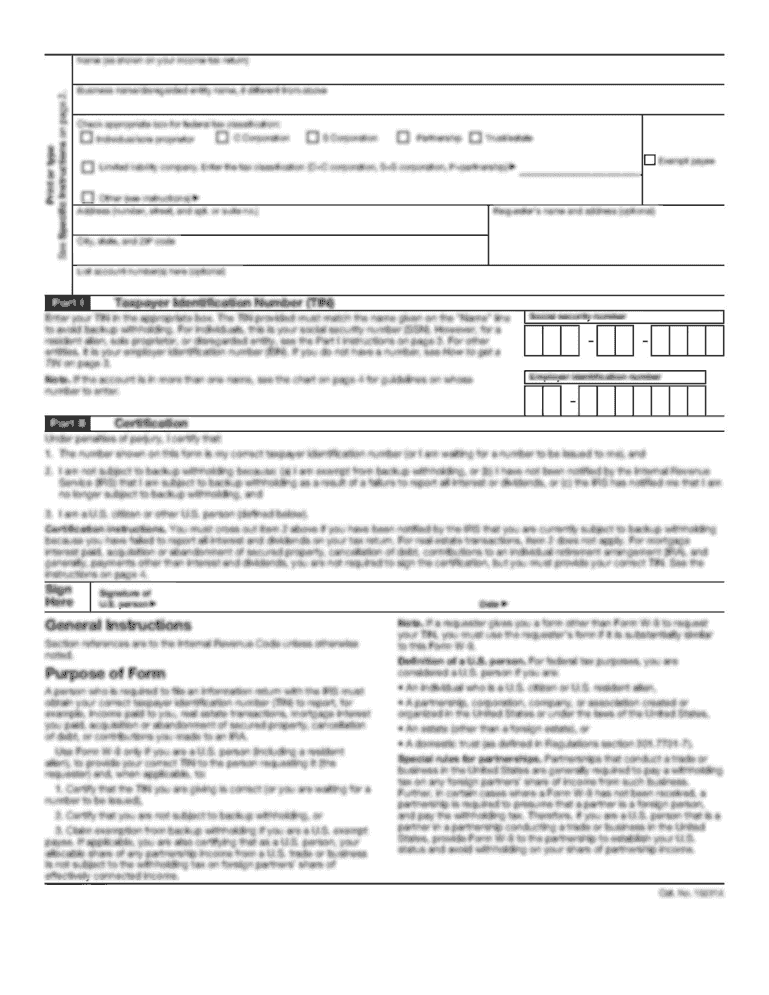

How to fill out I-113i

How to fill out I-113i

01

Step 1: Obtain Form I-113i from the official USCIS website or local immigration office.

02

Step 2: Read the instructions provided with the form carefully.

03

Step 3: Fill out Section 1 with your personal information, including your name, address, and date of birth.

04

Step 4: In Section 2, provide details about your immigration status or any relevant background info.

05

Step 5: Complete Section 3 if you are submitting documentation to support your application.

06

Step 6: Review the form for any errors or missing information.

07

Step 7: Sign and date the form at the bottom.

08

Step 8: Submit the completed form either by mailing it to the appropriate USCIS office or submitting it online if applicable.

Who needs I-113i?

01

Individuals seeking relief from removal proceedings in the United States.

02

Non-citizens who wish to request special immigration consideration due to specific circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is Schedule AD on Wisconsin income tax?

Purpose of Schedule AD Schedule AD is used to report differences between federal and Wisconsin income. These differences are called modifications and may affect the amount you report as an addition modification on line 4 of Form 1.

How long after amended return is adjusted do you get refund?

The current processing time is more than 20 weeks for both paper and electronically filed amended returns. See our operations page for more information about processing timeframes. Additionally, calling the IRS will not speed up return processing.

How long does it take to get adjusted refund from IRS?

We issue most refunds in less than 21 calendar days. However, if you filed on paper and expect a refund, it could take four weeks or more to process your return.

What happens if my amended return says adjusted?

If you amended return has an adjusted status this means "The processing of your Form 1040X- Amended Tax Return resulted in an adjustment to your account. An adjustment may result in a refund, balances due, or no tax change".

What are the tax brackets for 2023 for Wisconsin?

For single taxpayers in 2023, the bottom rate of 3.54% applies to taxable income below $13,810; the second rate of 4.65% applies to taxable income between $13,810 and $27,630; the third rate of 5.3% applies to taxable income between $27,630 and $304,170; the top rate of 7.65% applies to taxable income exceeding

When can I expect my Wisconsin tax refund?

A Wisconsin state tax refund can be expected within three weeks of electronically filing your tax return. If you elected to file via paper return, your refund processing may take longer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit I-113i from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including I-113i, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I edit I-113i on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign I-113i right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete I-113i on an Android device?

On an Android device, use the pdfFiller mobile app to finish your I-113i. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is I-113i?

I-113i is a form used by the U.S. government for reporting specific information related to alien employment certifications.

Who is required to file I-113i?

Employers who are seeking to employ foreign workers under certain visa categories are required to file I-113i.

How to fill out I-113i?

To fill out I-113i, applicants should follow the instructions provided on the form itself and ensure all required sections are completed accurately, including employer information, job details, and worker specifications.

What is the purpose of I-113i?

The purpose of I-113i is to collect information necessary for tracking and verifying employment of foreign workers and ensuring compliance with labor laws.

What information must be reported on I-113i?

Information that must be reported on I-113i includes employer details, job title, job description, wages, and the foreign worker's personal information such as name and immigration status.

Fill out your I-113i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

I-113i is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.