Get the free Form 1040EXT-ME (individual income tax extension payment voucher) 2016

Show details

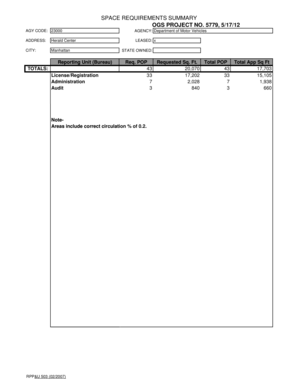

Maine EZ Pay your income tax electronically at www.maine.gov/revenue and eliminate the necessity of long Form

1040EXTME (individual income tax extension payment voucher).

Maine EZ Pay is an online

We are not affiliated with any brand or entity on this form

Instructions and Help about form 1040ext-me individual income

How to edit form 1040ext-me individual income

How to fill out form 1040ext-me individual income

Instructions and Help about form 1040ext-me individual income

How to edit form 1040ext-me individual income

To edit form 1040ext-me individual income, utilize pdfFiller's online tools that allow you to fill in or modify the form easily. You can upload the form to the platform, make necessary changes, and save or print the revised version. Ensure that all edits maintain the integrity of the required information for accurate submissions.

How to fill out form 1040ext-me individual income

Filling out form 1040ext-me individual income involves several essential steps to ensure accuracy. First, gather all relevant financial information, including income records and deductions. Next, follow the prompts on the form, entering details in the specified sections. Be cautious about both numeric entries and the associated documentation required.

01

Gather your financial documents.

02

Enter your personal information at the top of the form.

03

Document all sources of income.

04

Complete your deductions and credits section.

05

Review the form for any discrepancies before submission.

Latest updates to form 1040ext-me individual income

Latest updates to form 1040ext-me individual income

As of the latest tax year, form 1040ext-me individual income has seen adjustments that may impact how taxpayers report their income. It's essential to check for any changes in tax laws applicable to your filing. Refer to the IRS website or tax publications for the most accurate and up-to-date information.

All You Need to Know About form 1040ext-me individual income

What is form 1040ext-me individual income?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form 1040ext-me individual income

What is form 1040ext-me individual income?

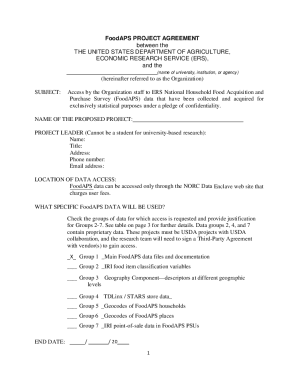

Form 1040ext-me individual income is an extension request for filing individual income tax returns in Maine. When taxpayers need additional time beyond the standard deadline to file their federal return, they can use this form to formally request an extension from the IRS. This allows them to maintain compliance while gathering necessary information.

What is the purpose of this form?

The primary purpose of form 1040ext-me individual income is to grant taxpayers an extension to file their federal income tax return. This is beneficial for filers who require more time to prepare their documentation, thereby avoiding potential penalties for late submission. However, it is important to note that this form does not provide an extension for payment of taxes owed.

Who needs the form?

Taxpayers who anticipate needing more time to gather documents or complete their federal income tax returns should file form 1040ext-me individual income. This includes individuals with complex financial situations such as multiple income streams, investments, or special deductions that require additional documentation.

When am I exempt from filling out this form?

You may be exempt from filling out form 1040ext-me individual income if you already filed your federal income tax return on time or if you do not require an extension for your filing. Additionally, if you have no tax liability or have already received an automatic extension, filing this form is unnecessary.

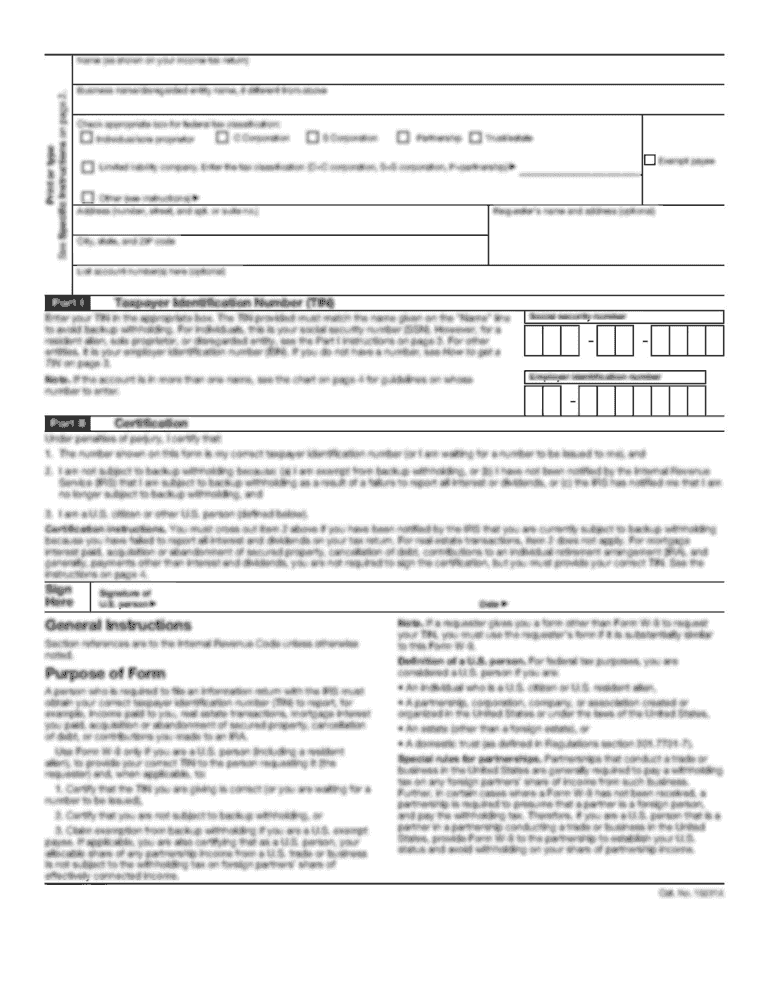

Components of the form

The components of form 1040ext-me individual income include sections for personal information, estimated tax payments, and tax liabilities. Fill out your name, address, and Social Security number at the beginning, followed by any relevant financial information that pertains to your federal income tax return.

What are the penalties for not issuing the form?

Failure to issue form 1040ext-me individual income when an extension is needed can result in penalties for late filing. This may include fines indicated by the IRS, as well as interest on any taxes owed. Taxpayers are encouraged to file for an extension to mitigate these potential costs and remain compliant.

What information do you need when you file the form?

When filing form 1040ext-me individual income, you need your personal identification details, including your name, address, and Social Security number. Additionally, prepare any financial documents that detail estimated tax payments or amounts owed based on your income situation for the reporting year.

Is the form accompanied by other forms?

Form 1040ext-me individual income may be submitted alongside other forms if you are also reporting additional income or claiming specific deductions. Be sure to verify whether your tax circumstances require the inclusion of supporting documentation or other extension forms.

Where do I send the form?

To submit form 1040ext-me individual income, send it to the designated IRS address based on your filing state and whether you are enclosing payment. Each tax year may have different mailing addresses, so check the current IRS guidelines or your state tax office to ensure proper submission.

See what our users say