TTB F 5000.24 2016-2025 free printable template

Show details

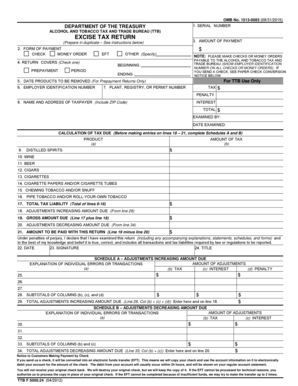

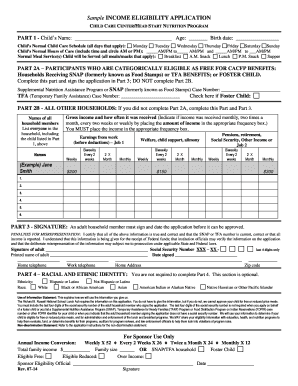

OMB No. 1513-0083 1. SERIAL NUMBER DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU TTB EXCISE TAX RETURN 3. AMOUNT OF PAYMENT Prepare in duplicate See instructions below 2. FORM OF PAYMENT CHECK MONEY ORDER EFT 4. RETURN COVERS Check one PREPAYMENT OTHER Specify NOTE PLEASE MAKE CHECKS OR MONEY ORDERS PAYABLE TO THE ALCOHOL AND TOBACCO TAX AND TRADE BUREAU SHOW EMPLOYER IDENTIFICATION NUMBER ON ALL CHECKS OR MONEY ORDERS. IF YOU SEND A CHECK SEE PAPER CHECK CONVERSION...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign treasury excise tax form

Edit your ttbf5000 24 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ttb excise tax pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ttb f500024 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ttb f5000 24 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TTB F 5000.24 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ttbf5000 24 form

How to fill out TTB F 5000.24

01

Obtain the TTB F 5000.24 form from the TTB website or your local TTB office.

02

Fill in the 'Applicant Information' section with your name, business name, and address.

03

Provide details regarding the type of alcohol beverage you are interested in, including brand names.

04

Include information on the production process and equipment used.

05

Specify the dates for the project, including start and expected completion dates.

06

Include any other applicable details or descriptions relevant to your application.

07

Review the form for accuracy and completeness.

08

Sign and date the form in the designated section.

09

Submit the completed form according to the submission instructions provided.

Who needs TTB F 5000.24?

01

Individuals or businesses seeking to produce or import alcohol beverages.

02

Those applying for permits related to the fermentation process.

03

Anyone who needs to report their alcohol production activity to the TTB.

Fill

f500024 printable

: Try Risk Free

People Also Ask about 24 excise online

What is the IRS form for excise tax?

Filing Excise Tax Returns To report your excise tax liability, you must: Complete Form 720, Quarterly Federal Excise Tax Return. File Form 720 electronically for immediate acknowledgement of receipt and faster service with an IRS-approved software provider.

What is tax form 720 used for?

Purpose of Form Use Form 720 and attachments to report your liability by IRS No. and pay the excise taxes listed on the form. If you report a liability on Part I or Part II, you may be eligible to use Schedule C to claim a credit.

How do I pay my TTB excise tax?

File and Pay Online Filing electronically is the fastest and most accurate way to file operational reports and excise tax returns with TTB and also provides a secure way to make excise tax payments.

What is a form 720 for excise tax?

IRS Form 720, the Quarterly Federal Excise Tax Return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. IRS Form 720 consists of three parts, as well as Schedule A, Schedule T and Schedule C sections and a payment voucher (called Form 720-V).

Who files a federal excise tax return?

Excise taxes are independent of income taxes. Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720. They may pass the cost of the excise tax on to the buyer. Some excise taxes are collected by a third party.

Who files form 720 excise tax?

Who files Form 720? Whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file a Quarterly Federal Excise Tax Return on Form 720 up to four times per year, depending on the circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my treasury excise tax directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your ttb 500024 pdf as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in ttb500024 form template?

The editing procedure is simple with pdfFiller. Open your f500024 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete ttb5000 24 print on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your ttb5000 24, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is TTB F 5000.24?

TTB F 5000.24 is a form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for reporting the loss of spirits, wine, or malt beverage in the beverage alcohol industry.

Who is required to file TTB F 5000.24?

Any person or entity that produces or processes distilled spirits, wines, or malt beverages and experiences a loss that is reportable must file TTB F 5000.24.

How to fill out TTB F 5000.24?

To fill out TTB F 5000.24, you need to provide accurate details regarding the nature of the loss, the types and quantities of alcoholic beverages involved, and the reasons for the loss. Ensure all required sections are completed and submit it to TTB as directed.

What is the purpose of TTB F 5000.24?

The purpose of TTB F 5000.24 is to notify the TTB of losses in the beverage alcohol industry, which may affect tax liability and ensure compliance with federal regulations.

What information must be reported on TTB F 5000.24?

TTB F 5000.24 requires reporting information such as the date of the loss, the type and quantity of alcoholic beverages, the reason for the loss, and any additional remarks pertinent to the loss.

Fill out your ttb f 500024 2016-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ttbf500024 Excise Tax Return is not the form you're looking for?Search for another form here.

Keywords relevant to f500024 pdf

Related to ttb 5000 printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.