TTB F 5000.24 2012 free printable template

Show details

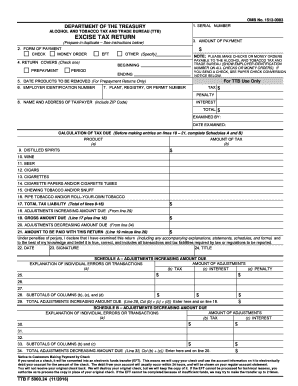

OMB No. 1513-0083 (08/31/2015) 1. SERIAL NUMBER DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TT) EXCISE TAX RETURN 3. AMOUNT OF PAYMENT (Prepare in duplicate See instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign TTB F 500024

Edit your TTB F 500024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TTB F 500024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TTB F 500024 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TTB F 500024. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TTB F 5000.24 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TTB F 500024

How to fill out TTB F 5000.24

01

Begin by downloading the TTB F 5000.24 form from the TTB website.

02

Fill in your business information including the name, address, and contact details.

03

Indicate the type of application (e.g., new, renewal).

04

Provide the details of the principal place of business and any alternate locations.

05

List the names and addresses of all owners, partners, or corporate officers.

06

Specify the types of alcoholic beverages to be produced or handled.

07

Complete any additional information sections as required by your specific circumstances.

08

Review the form for completeness and accuracy.

09

Sign and date the application in the designated area.

10

Submit the completed form to the TTB according to their submission guidelines.

Who needs TTB F 5000.24?

01

Businesses that intend to produce, import, or export alcoholic beverages.

02

Individuals or entities seeking to apply for a basic permit under the Federal Alcohol Administration Act.

03

Those involved in the alcohol industry who need to comply with federal regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is TTB reporting?

The TTB is trying to gauge the size of your distillery to ensure you have the correct storage and withdrawal bonds in place to cover your expected inventory levels. Estimate the total # of Proof Gallons you will be producing off your still daily.

Where do I mail my TTB excise tax return?

Mailing address for TTB Headquarters or for submitting comments only about a form is Alcohol and Tobacco Tax and Trade Bureau, 1310 G Street, NW, Stop 12, Washington, DC 20005.

What does the TTB do?

Our Mission. Our mission is to collect the taxes on alcohol, tobacco, firearms, and ammunition, protect the consumer by ensuring the integrity of alcohol products, ensure only qualified businesses enter the alcohol and tobacco industries, and prevent unfair and unlawful market activity for alcohol and tobacco products.

What does the TTB regulate?

TTB Regulated Industries Resources for Alcohol Fuel, Industrial Alcohol, Nonbeverage Products, and Tax-free Alcohol. Resources for Tobacco Manufacturers, Importers, and Export Warehouse Proprietors. Resources for Gunsmiths, Importers, Manufacturers, and Reloaders.

Do I need to file 720 Quarterly Federal excise?

Businesses that are subject to excise tax generally must file a Form 720, Quarterly Federal Excise Tax Return to report the tax to the IRS. Many excise taxes go into trust funds for projects related to the taxed product or service, such as highway and airport improvements. Excise taxes are independent of income taxes.

What is TTB approved?

In its simplest terms, TTB formula approval is required when an alcoholic beverage is produced using non-traditional methods or ingredients. The TTB requires formula approval so that it can: Verify that ingredients used meet FDA requirements and are considered safe. Assign an appropriate tax classification.

What is excise tax return in Washington?

This return is used for reporting your business income, sales tax, and use tax. Monthly. Quarterly.

Can I claim excise tax on my federal return?

An excise tax isn't deductible if it's for a personal expense. You can deduct as a business expense excise taxes that are ordinary and necessary expenses of carrying on your trade or business.

What is a TTB audit?

Tax Audit Division. ALCOHOL AND TOBACCO TAX AND TRADE BUREAU. 4. TAD's mission is to ensure the proper payment of Federal excise taxes and compliance with laws and regulations in a manner that protects the tax revenue and prevents unlawful activity in the commodities TTB regulates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit TTB F 500024 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your TTB F 500024 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in TTB F 500024 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing TTB F 500024 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit TTB F 500024 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign TTB F 500024. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is TTB F 5000.24?

TTB F 5000.24 is a form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for reporting and claiming tax on alcohol production, specifically for certain permits and applications.

Who is required to file TTB F 5000.24?

Producers of alcohol, including wineries, breweries, and distilleries, who wish to apply for certain permits or submit claims related to tax on alcohol production are required to file TTB F 5000.24.

How to fill out TTB F 5000.24?

To fill out TTB F 5000.24, applicants should provide information regarding their business, the type of permit they are applying for, and any related tax information. Detailed instructions are provided on the TTB website and with the form.

What is the purpose of TTB F 5000.24?

The purpose of TTB F 5000.24 is to facilitate tax reporting and compliance for alcohol producers, ensuring accurate claims and permitting under federal regulations.

What information must be reported on TTB F 5000.24?

The information reported on TTB F 5000.24 includes the applicant's business information, type of product, tax-related details, and other pertinent data required by the TTB for processing the application or claim.

Fill out your TTB F 500024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TTB F 500024 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.