Get the free 40A100 Kentucky APPLICATION FOR REFUND OF INCOME TAXES AND LLET

Show details

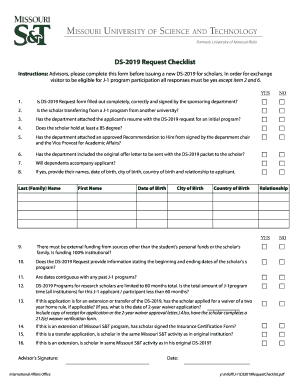

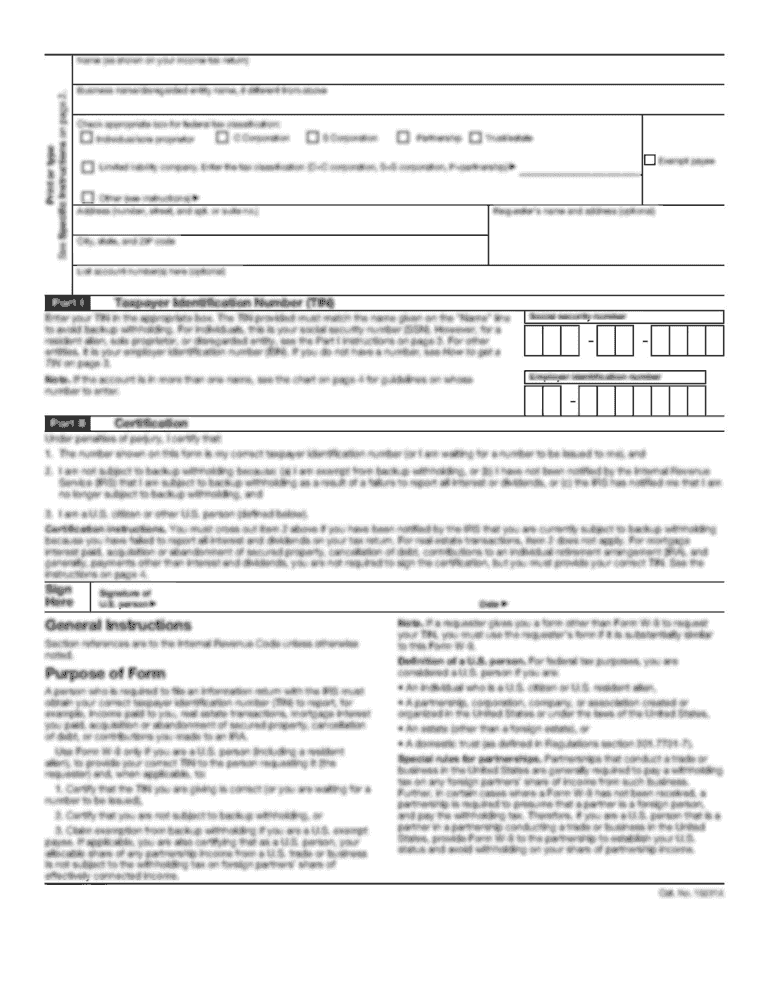

40A100 (1016) Commonwealth of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR REFUND OF INCOME TAXES *1600010027* AND LET For Use by Individuals, Fiduciaries, Corporations, and Walkthrough Entities

We are not affiliated with any brand or entity on this form

Instructions and Help about 40a100 kentucky application for

How to edit 40a100 kentucky application for

How to fill out 40a100 kentucky application for

Instructions and Help about 40a100 kentucky application for

How to edit 40a100 kentucky application for

To edit the 40a100 kentucky application for, you can use tools like pdfFiller that allow you to modify the document digitally. Simply upload your completed form into the pdfFiller platform where you can add or remove information as needed. Ensure that you save the changes before downloading or submitting your edited form.

How to fill out 40a100 kentucky application for

Filling out the 40a100 kentucky application for requires specific steps to ensure accuracy and compliance. Begin by gathering all necessary information such as your personal details, tax identification number, and any relevant financial data. Consider following these structured steps:

01

Obtain the 40a100 application through the Kentucky Department of Revenue website or a reliable tax service provider.

02

Carefully read any accompanying instructions for completing the form.

03

Input your information accurately in each designated section, ensuring no fields are left blank unless specified.

04

Review the completed form for any errors or omissions before submission.

05

Submit the form in accordance with the filing instructions provided.

Latest updates to 40a100 kentucky application for

Latest updates to 40a100 kentucky application for

It’s essential to stay informed about any updates related to the 40a100 kentucky application for. Changes may occur regarding filing procedures or eligibility criteria. Regularly check the Kentucky Department of Revenue’s official website or reliable tax information sources for the most current information.

All You Need to Know About 40a100 kentucky application for

What is 40a100 kentucky application for?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 40a100 kentucky application for

What is 40a100 kentucky application for?

The 40a100 kentucky application for is a specific tax form used by individuals and entities in Kentucky to report certain tax-related information. This form is crucial for ensuring compliance with state tax laws and for accurately reporting financial data to the Kentucky Department of Revenue.

What is the purpose of this form?

The purpose of the 40a100 kentucky application for is to collect necessary information regarding tax liabilities and compliance with state tax regulations. Proper completion of this form helps facilitate the assessment and collection of taxes owed to the state.

Who needs the form?

The 40a100 kentucky application for is typically required for businesses and certain individuals in Kentucky who have specific tax reporting obligations. If you are engaged in business activities subject to state taxation or are required to file detailed tax information, you will need this form.

When am I exempt from filling out this form?

You may be exempt from filling out the 40a100 kentucky application for if you do not have any taxable transactions within the tax year or if your income falls below the threshold established by the state. Verify your exempt status directly with the Kentucky Department of Revenue to ensure compliance.

Components of the form

The components of the 40a100 kentucky application for include sections for personal or business identification, details of income or sales, and areas for additional disclosures required by tax regulations. Each section must be completed thoroughly to avoid processing delays.

Due date

The due date for submitting the 40a100 kentucky application for typically aligns with the state’s tax filing deadlines. It is important to check with the Kentucky Department of Revenue for the specific due date each year to avoid penalties or late fees.

What are the penalties for not issuing the form?

Failure to issue the 40a100 kentucky application for when required can result in significant penalties, which may include financial fines or interest on unpaid taxes. Additionally, non-compliance could lead to further investigation by tax authorities.

What information do you need when you file the form?

When filing the 40a100 kentucky application for, you will need essential information, including your tax identification number, details of income and business activities, and any other relevant financial documentation. Ensure that all data is accurate and up-to-date for a smooth filing process.

Is the form accompanied by other forms?

The 40a100 kentucky application for may need to be filed alongside other tax forms depending on your specific fiscal situation. If additional documentation is required, it is advisable to consult the instructions accompanying the form or the Kentucky Department of Revenue.

Where do I send the form?

The completed 40a100 kentucky application for should be sent to the Kentucky Department of Revenue as indicated in the filing instructions. Ensure that you use the proper mailing address or electronic submission portal specified by the department to ensure timely processing.

See what our users say