IRS 1040-ES 2017 free printable template

Instructions and Help about IRS 1040-ES

How to edit IRS 1040-ES

How to fill out IRS 1040-ES

About IRS 1040-ES 2017 previous version

What is IRS 1040-ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

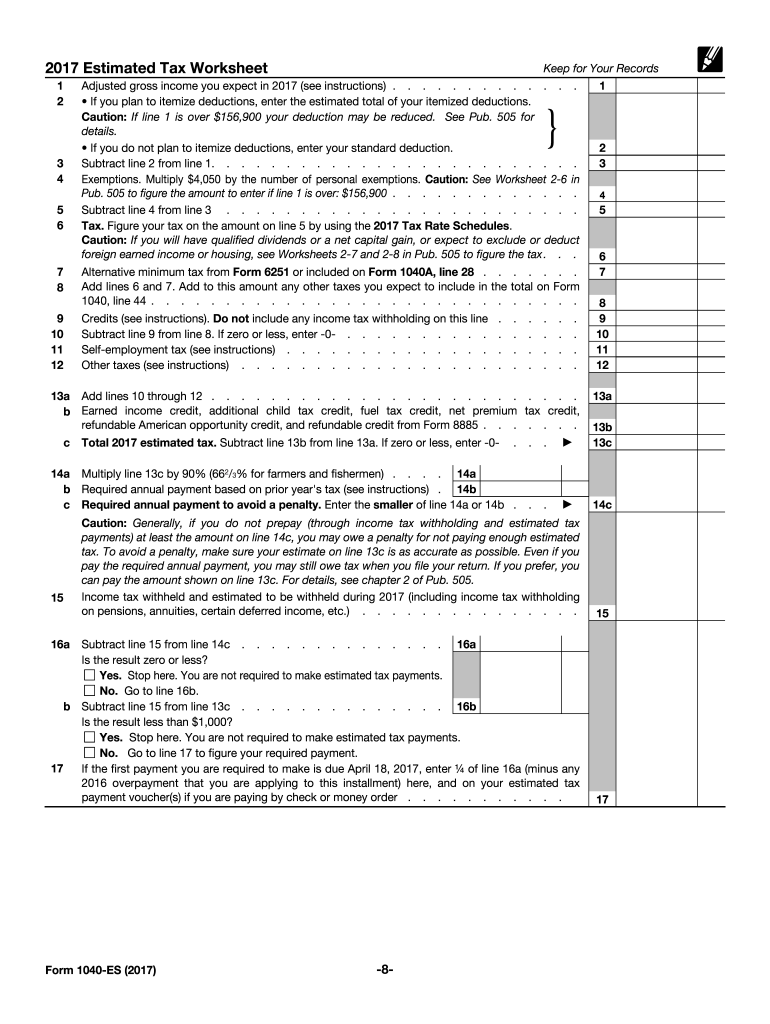

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-ES

What should I do if I need to correct mistakes on my IRS 1040-ES?

If you need to correct an error on your IRS 1040-ES, you can submit an amended return using Form 1040-X. Ensure that you correct only the specific errors and attach any relevant documentation. Keep a copy for your records to track changes and ensure compliance.

How can I verify the receipt of my IRS 1040-ES submission?

To verify the receipt of your IRS 1040-ES, you can check your bank account for the payment withdrawal if you e-filed. If you submitted by mail, consider using certified mail for tracking. Keep an eye on your IRS account for updates regarding processing status.

Are there specific errors that commonly occur when filing IRS 1040-ES and how can I avoid them?

Common errors while filing IRS 1040-ES include incorrect Social Security numbers and calculation mistakes. Double-check all entries against documentation. Using tax software can also help mitigate errors with prompts for necessary checks along the way.

How can I ensure my electronic signature is accepted when e-filing IRS 1040-ES?

To ensure your electronic signature is accepted when e-filing IRS 1040-ES, follow the specific guidelines provided by your e-filing software. Typically, it involves creating a 5-digit PIN or using your prior year Adjusted Gross Income for identity verification.

See what our users say