RI T69-ESBE 2011 free printable template

Show details

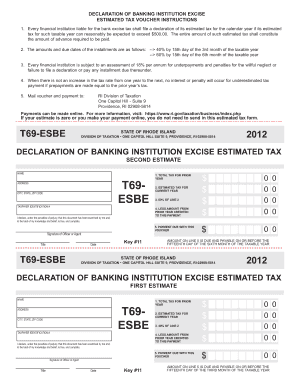

DECLARATION OF BANKING INSTITUTION EXCISE ESTIMATED TAX VOUCHER INSTRUCTIONS FT RA 010 D 2 7/ /2 09 1. Every financial institution liable for the bank excise tax shall file a declaration of its estimated

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI T69-ESBE

Edit your RI T69-ESBE form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI T69-ESBE form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing RI T69-ESBE online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit RI T69-ESBE. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI T69-ESBE Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI T69-ESBE

How to fill out RI T69-ESBE

01

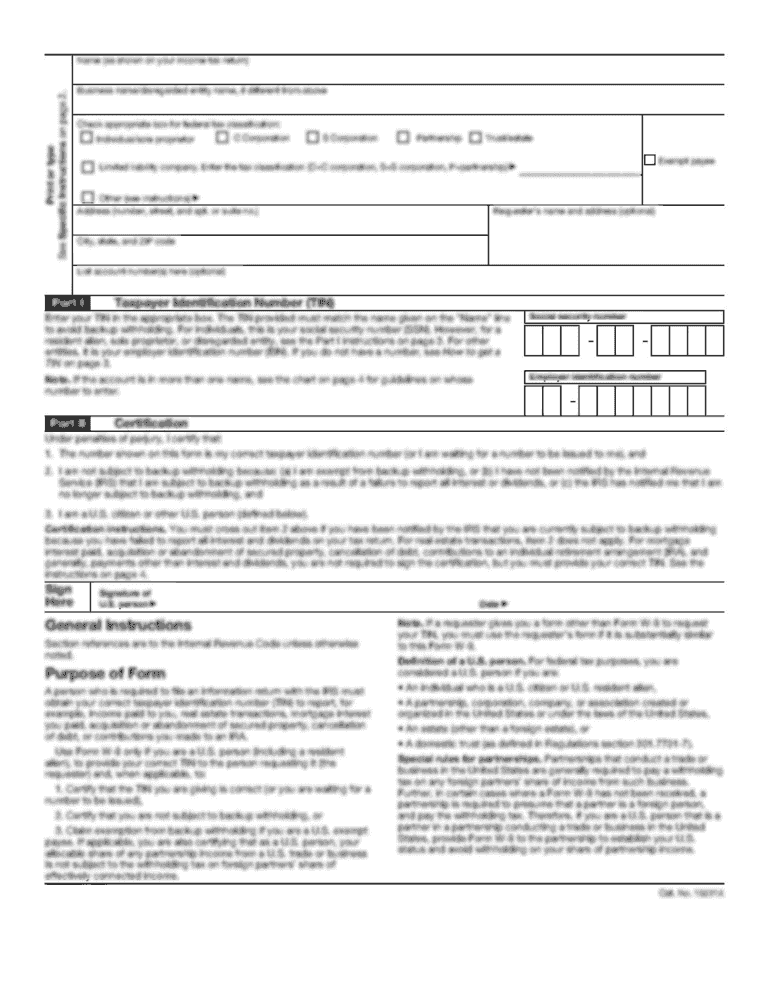

Begin by downloading the RI T69-ESBE form from the official website.

02

Fill in your personal information at the top of the form, including name, address, and contact details.

03

In Section 1, provide details regarding your income sources for the applicable year.

04

Accurately report your business income, if any, and any rental income received.

05

Move to Section 2 and list your deductions, ensuring each entry is backed by appropriate documentation.

06

Complete Section 3 regarding credits by following the instructions provided, detailing any eligible tax credits.

07

Review all completed sections for accuracy to prevent any errors that could delay processing.

08

Once confirmed, sign and date the form at the designated areas.

09

Submit the form to the relevant tax authority by the due date specified.

Who needs RI T69-ESBE?

01

Individuals or businesses that need to report certain income and claim deductions or credits in the state of Rhode Island.

02

Taxpayers seeking special treatment or abatement for specific types of income or financial circumstances may need this form.

03

Professionals and self-employed individuals who need to disclose their earnings and claim business-related expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is a notice of entry of Judgement in Los Angeles?

Notice of Entry of Judgment or Order (CIV-130) Tells the parties that a judgment has been entered in a case. Service of this notice sets the start date of important deadlines regarding the ability to set-aside or challenge the judgment.

What is a ra010 notice of remote appearance?

Notice of Remote Appearance (RA-010) Tells the court that you or a witness intends to appear at a court proceeding remotely, either by telephone or video, rather than in person.

What is the California Code of Civil Procedure for remote appearance?

Section 367.75(d) provides that a court may conduct a trial or evidentiary hearing in whole or in part through the use of remote technology, upon the motion of a party or the court's own motion—absent a showing as to why the remote testimony or appearance should not be allowed.

Can you request to change court location?

An application for a change of venue must be filed at least 10 days before the date set for trial. The Judicial Council of California plays a role after the court grants a change of venue. The Judicial Council of California does not decide whether a change of venue should occur.

What is form MC 40?

Notice of Change of Address or Other Contact (MC-040) Give the court and the other parties your new address or other contact information.

How do I notify the court of a change of address in California?

How do I tell the Court that my address has changed? The Notice of Change of Address form is a state form, MC-040 . You can access it and complete it online. File the completed original and the copy at the Court where your case was heard - see list of courthouses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit RI T69-ESBE straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing RI T69-ESBE right away.

How do I fill out the RI T69-ESBE form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign RI T69-ESBE. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit RI T69-ESBE on an iOS device?

Use the pdfFiller mobile app to create, edit, and share RI T69-ESBE from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is RI T69-ESBE?

RI T69-ESBE is a tax form used in Rhode Island for reporting employee income and calculating the state's withholding tax.

Who is required to file RI T69-ESBE?

Employers who have employees that earn income in Rhode Island are required to file the RI T69-ESBE form.

How to fill out RI T69-ESBE?

To fill out the RI T69-ESBE, employers should provide information about their employees' wages, the total amount of state income tax withheld, and other required details as specified by the form's instructions.

What is the purpose of RI T69-ESBE?

The purpose of RI T69-ESBE is to report the amounts withheld from employees' paychecks for state income tax, ensuring compliance with Rhode Island tax laws.

What information must be reported on RI T69-ESBE?

The information that must be reported on RI T69-ESBE includes employee names, social security numbers, total wages paid, and the amount of state income tax withheld.

Fill out your RI T69-ESBE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI t69-ESBE is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.