Get the free Business Credits

Show details

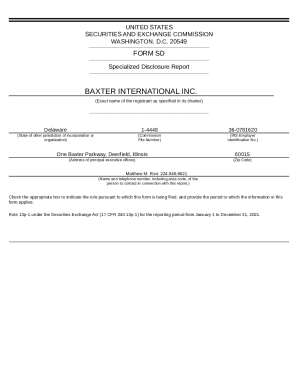

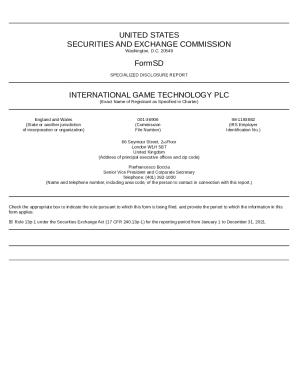

Government of the District of Columbia 2014 SCHEDULE UP Business Credits *142300210000* Important: Print in CAPITAL letters using black ink. Attach to your Form D20 or D30. OFFICIAL USE ONLY Vendor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credits

Edit your business credits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business credits online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business credits. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credits

How to fill out business credits

01

Start by gathering all necessary documents and information required by the credit application.

02

Research different lenders and compare their terms and interest rates to choose the best option for your business.

03

Complete the credit application form accurately and provide all requested information.

04

Include details about your business, such as its legal structure, industry, and years in operation.

05

Provide financial statements, including balance sheets, income statements, and cash flow statements.

06

Include any collateral that you are willing to offer to secure the credit.

07

Outline the purpose of the credit and how it will benefit your business.

08

Submit the completed application along with any supporting documents to the chosen lender.

09

Wait for the lender to review your application and make a decision.

10

If approved, carefully review the terms and conditions of the credit agreement before accepting.

11

Once accepted, use the credit responsibly and make timely repayments to build a positive credit history for your business.

Who needs business credits?

01

Small businesses looking to expand their operations or fund new projects.

02

Entrepreneurs starting a new business and in need of startup capital.

03

Established businesses seeking working capital to manage cash flow fluctuations.

04

Businesses experiencing rapid growth and needing additional funds for expansion.

05

Businesses in need of new equipment, inventory, or technology upgrades.

06

Companies looking to improve their credit profile and establish a positive track record.

07

Businesses facing unexpected expenses or emergencies.

08

Companies looking to take advantage of investment opportunities.

09

Startups and entrepreneurs with limited personal funds or collateral.

10

Businesses looking to consolidate existing debts or refinance existing credit arrangements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the business credits electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your business credits in minutes.

Can I create an eSignature for the business credits in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your business credits right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the business credits form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign business credits and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is business credits?

Business credits are tax incentives offered to businesses to encourage certain activities such as research and development, renewable energy investment, and hiring certain workers.

Who is required to file business credits?

Businesses that qualify for specific tax credits outlined by the government are required to file business credits.

How to fill out business credits?

Businesses can fill out business credits by providing the necessary information on the designated tax forms provided by the IRS.

What is the purpose of business credits?

The purpose of business credits is to incentivize businesses to engage in certain activities that benefit the economy or society.

What information must be reported on business credits?

Businesses must report specific details related to the activities that qualify for the tax credits, such as expenses incurred or investments made.

Fill out your business credits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.