NC DoR E-589CI 2017 free printable template

Show details

The Devalue Manual for agricultural, horticultural, and forest land. The Use

Values Advisory Board Manual is published yearly to communicate the North...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR E-589CI

Edit your NC DoR E-589CI form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR E-589CI form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC DoR E-589CI online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NC DoR E-589CI. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR E-589CI Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR E-589CI

How to fill out NC DoR E-589CI

01

Begin by downloading the NC DoR E-589CI form from the North Carolina Department of Revenue website.

02

Fill out your name and address at the top of the form.

03

Enter your taxpayer identification number or Social Security number.

04

Provide details about the type of exemption you are claiming.

05

Complete the designated sections based on the exemptions applicable to your situation.

06

If applicable, list any additional information or documents that need to be submitted.

07

Review the form for accuracy and completeness.

08

Sign and date the form to certify that the information is correct.

09

Submit the completed form to the appropriate tax authority as indicated.

Who needs NC DoR E-589CI?

01

Individuals or businesses in North Carolina seeking tax exemptions.

02

Nonprofit organizations that qualify for certain tax exemptions.

03

Purchasers of specific goods or services eligible for sales tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

Who qualifies for sales tax exemption in NC?

In North Carolina, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several examples of exemptions to the state sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals which are used in research and development.

How to get a sales tax exemption certificate in North Carolina?

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

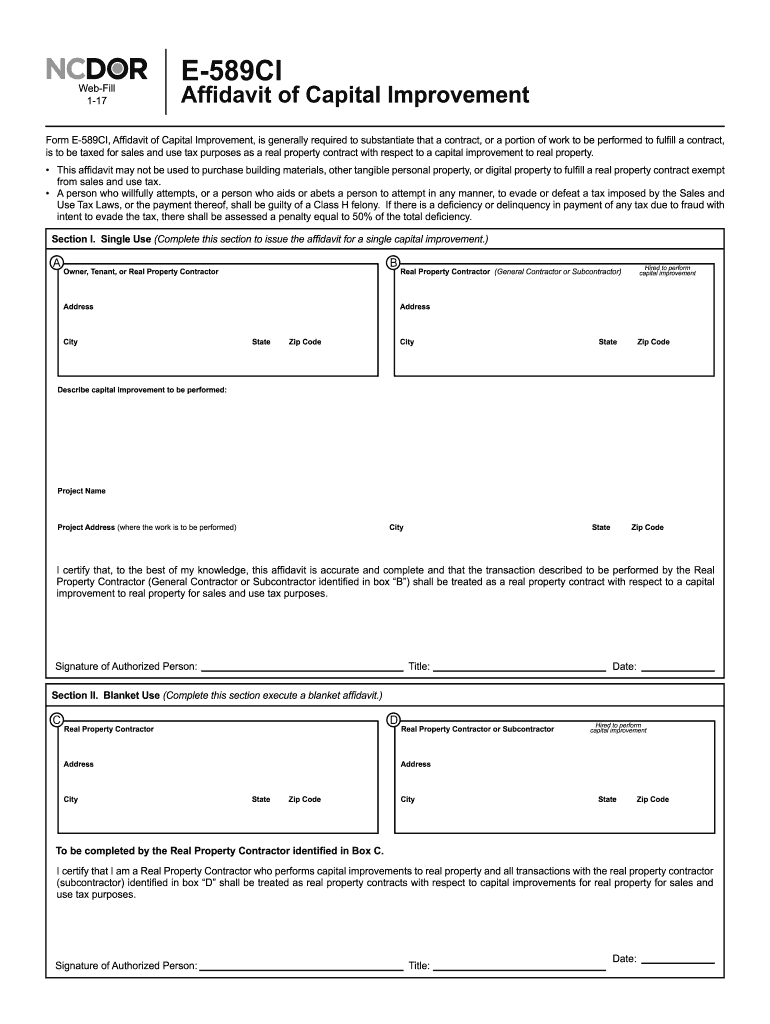

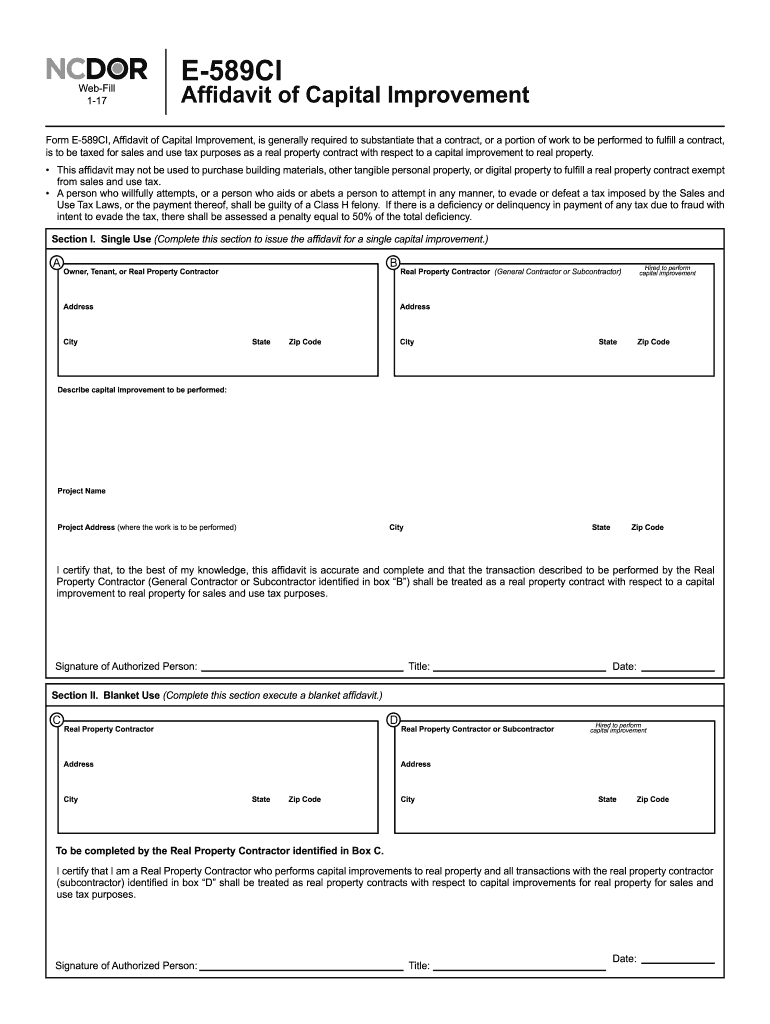

What is NCDOR E-589CI?

Form E-589CI, Affidavit of Capital Improvement, may be used to substantiate that a contract, or a portion of work to be performed to fulfill a contract, is to be taxed for sales and use tax purposes, as a real property contract for a capital improvement to real property.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NC DoR E-589CI online?

Completing and signing NC DoR E-589CI online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the NC DoR E-589CI electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your NC DoR E-589CI in minutes.

Can I edit NC DoR E-589CI on an Android device?

You can edit, sign, and distribute NC DoR E-589CI on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is NC DoR E-589CI?

NC DoR E-589CI is a form used in North Carolina for reporting certain tax-related information regarding sales and use tax exemptions.

Who is required to file NC DoR E-589CI?

Any business or entity that claims a sales and use tax exemption under specific circumstances in North Carolina is required to file NC DoR E-589CI.

How to fill out NC DoR E-589CI?

To fill out NC DoR E-589CI, provide accurate information about the exempt transaction, including the purchaser's details, the nature of the exemption, and supporting documentation as needed.

What is the purpose of NC DoR E-589CI?

The purpose of NC DoR E-589CI is to certify transactions that qualify for sales and use tax exemptions, thereby ensuring compliance with North Carolina tax regulations.

What information must be reported on NC DoR E-589CI?

Information required on NC DoR E-589CI includes the name and address of the purchaser, the type of exemption claimed, a description of the property or service being purchased, and any relevant supporting documentation.

Fill out your NC DoR E-589CI online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR E-589ci is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.