Get the free SCHEDULE OC (FORM 40 OR 40NR) Alabama Department of Revenue Other Available Credits ...

Show details

SCHEDULE OC (FORM 40 OR 40NR) *160010OC* Alabama Department of Revenue Other Available Credits 2016 ATTACH TO FORM 40 OR 40NR Name(s) as shown on Form 40 or 40NR PART A Credit For Taxes Paid To Other

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule oc form 40

How to edit schedule oc form 40

How to fill out schedule oc form 40

Instructions and Help about schedule oc form 40

How to edit schedule oc form 40

To edit the Schedule OC Form 40, you need to access the PDF version of the form. You can utilize pdfFiller's editing tools to make necessary changes to the form fields. Ensure that you save your edits before proceeding to the next step. Once you have completed your edits, review the form for accuracy.

How to fill out schedule oc form 40

Filling out the Schedule OC Form 40 involves several key steps. Begin by entering your basic information, including your name, address, and Social Security number. Next, provide the financial details pertinent to your income and deductions. Ensure that all entries match your documentation for accuracy. Finally, double-check your work before submission to avoid any mistakes.

Latest updates to schedule oc form 40

Latest updates to schedule oc form 40

Stay informed of the latest updates regarding Schedule OC Form 40 by regularly checking the IRS website or trusted tax resources. Updates may include changes to filing procedures, deadlines, or form components. Tax forms are occasionally revised, reflecting changes in tax law that can impact your filing process.

All You Need to Know About schedule oc form 40

What is schedule oc form 40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule oc form 40

What is schedule oc form 40?

Schedule OC Form 40 is an IRS tax form used to report specific types of income or deductions. This form is relevant for certain taxpayers who need to disclose additional financial information that is not reported on the standard tax return. Understanding the implications of the form is essential for accurate tax compliance.

What is the purpose of this form?

The primary purpose of Schedule OC Form 40 is to provide the IRS with detailed financial information necessary for accurate tax calculation. It allows taxpayers to report additional income, claim deductions, and fulfill any specific reporting requirements mandated by the IRS. Filling out this form correctly can impact overall tax liability.

Who needs the form?

Taxpayers who have specific types of income or deductions must file Schedule OC Form 40. This includes individuals who have received certain benefits, engaged in specific transactions, or need to disclose additional financial activities that are not captured on the standard Form 1040. Evaluating your tax situation can help determine if you need this form.

When am I exempt from filling out this form?

You may be exempt from filing Schedule OC Form 40 if your income does not meet the reporting thresholds or if you do not have the types of financial activities that require disclosure. Additionally, if you qualify for certain deductions or credits that do not pertain to this form, you might not need to file it. Always consult current IRS guidelines to ensure compliance.

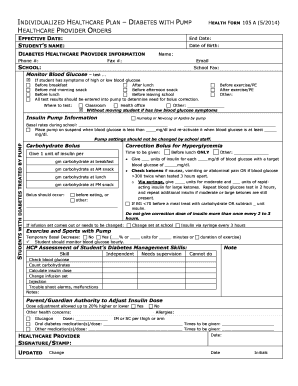

Components of the form

Schedule OC Form 40 consists of various sections designed to capture different categories of income, deductions, and taxpayer information. Typical components include personal identification details, financial data regarding the taxpayer, and sections for reporting specific deductions or credits. Review each section carefully to ensure complete and accurate reporting.

What are the penalties for not issuing the form?

Failure to issue Schedule OC Form 40 when required can result in penalties from the IRS. These penalties may include monetary fines, interest on unpaid taxes, and potential audits. It is crucial to understand the requirements for this form to avoid unnecessary complications in your tax filing process.

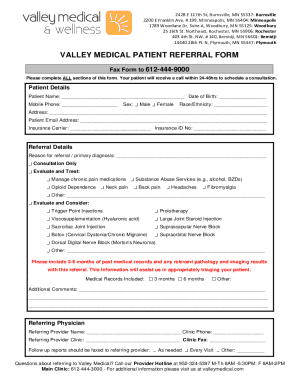

What information do you need when you file the form?

When filing Schedule OC Form 40, you need to gather specific information, including your Social Security number, details of any income not reported elsewhere, and documentation for any deductions claimed. Preparation of records can help ensure that you have all necessary information at hand during the filing process.

Is the form accompanied by other forms?

Schedule OC Form 40 may need to be submitted alongside other tax forms depending on your financial situation. Commonly, it is submitted with the main Form 1040 and potentially other schedules or attachments related to your overall tax return. Review your specific circumstances to determine if additional forms are required.

Where do I send the form?

Schedule OC Form 40 should be sent to the IRS at the address designated in the instructions at the top of the form. Ensure that you check the latest regulations for any updates to mailing addresses, depending on your state or whether you are filing electronically. Timely submission is critical to avoid any potential penalties.

See what our users say