Get the free Typical prepayment plans

Show details

Typical prepayment plans

Insurance plansPreneed insurance is a whole life policy offered by funeral providers, with installments paid

to an intermediary insurance company. Burial insurance is a life

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign typical prepayment plans

Edit your typical prepayment plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your typical prepayment plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit typical prepayment plans online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit typical prepayment plans. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out typical prepayment plans

How to fill out typical prepayment plans

01

Start by gathering all the necessary information such as your income, expenses, and savings.

02

Understand the terms and conditions of the prepayment plan you are considering. This includes the interest rate, repayment period, and any additional fees or charges.

03

Calculate your budget to determine how much you can afford to prepay each month. Consider your other financial obligations and prioritize your prepayment plan accordingly.

04

Contact the lender or financial institution offering the prepayment plan. Provide them with your details and express your interest in filling out the plan.

05

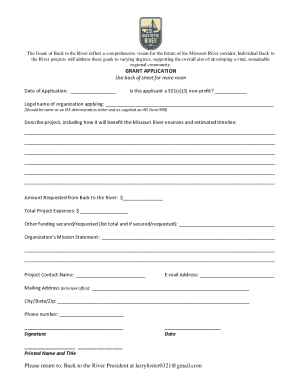

Complete the application form provided by the lender. Make sure to accurately fill in all the required information and provide any supporting documents if necessary.

06

Review the prepayment plan proposal provided by the lender. Check if all the terms and conditions align with your expectations and financial capabilities.

07

If everything looks satisfactory, sign the prepayment plan agreement. Ensure that you understand all the obligations and responsibilities outlined in the agreement.

08

Set up a system to make regular prepayments according to the agreed terms. This can be done through automatic transfers, online payments, or any other convenient method offered by the lender.

09

Monitor your progress and keep track of the prepayments made. Stay disciplined and committed to fulfilling your prepayment plan.

10

Periodically assess your financial situation and make adjustments as needed. If there are any changes in your income or expenses, communicate them to the lender and discuss possible modifications to the prepayment plan.

Who needs typical prepayment plans?

01

Individuals who want to pay off their debts faster and save on interest payments.

02

People with a stable income and sufficient financial resources to make regular prepayments.

03

Borrowers who aim to improve their credit score by demonstrating responsible and proactive financial behavior.

04

Individuals who anticipate a future increase in their income and want to leverage prepayment plans to clear their debts sooner.

05

Those who have a specific financial goal in mind, such as purchasing a home or starting a business, and wish to reduce their existing debt burden.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit typical prepayment plans in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your typical prepayment plans, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit typical prepayment plans on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share typical prepayment plans on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete typical prepayment plans on an Android device?

Use the pdfFiller mobile app to complete your typical prepayment plans on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is typical prepayment plans?

Typical prepayment plans are payment schedules that allow borrowers to pay off a loan early, usually with a penalty.

Who is required to file typical prepayment plans?

Typical prepayment plans are typically filed by borrowers who want to pay off a loan before the maturity date.

How to fill out typical prepayment plans?

To fill out typical prepayment plans, borrowers must contact their lender to discuss the prepayment options and potential penalties.

What is the purpose of typical prepayment plans?

The purpose of typical prepayment plans is to provide borrowers with the flexibility to pay off a loan early and save on interest costs.

What information must be reported on typical prepayment plans?

Typical prepayment plans may require information such as the loan amount, interest rate, prepayment penalty, and the borrower's payment schedule.

Fill out your typical prepayment plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Typical Prepayment Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.