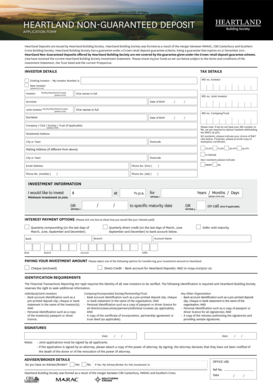

GA DoR 500 ES 2017 free printable template

Get, Create, Make and Sign 500es 2017 form

How to edit 500es 2017 form online

Uncompromising security for your PDF editing and eSignature needs

GA DoR 500 ES Form Versions

How to fill out 500es 2017 form

How to fill out GA DoR 500 ES

Who needs GA DoR 500 ES?

Instructions and Help about 500es 2017 form

Hunter Elliott here range huh calm I'm actually trying out a Smith camp; Wesson 500 Magnum and I guess what they would call a snub nose revolver these are a couple three hundred grains Workaday lever revolution okay my buddy Clinton with range shot stop by this afternoon he bought a Smith camp; Wesson Model BS 500 Magnum chambered in 501 Magnum and you saw we shot a couple Clinton shot a couple three hundred grain and 500 grain and I shot a couple three under grain those were liberal revolutions, and it was actually pretty brutal I mean it was I could see we're using this handgun would be a life-or-death situation this is absolutely nothing that you would want to go out and shoot for fun unless you drastically downloaded it and still I feel like this is more of a utilitarian type tool something that if you were you know in the damn backwoods of Alaska and you were concerned about some pack of wild rabid mutated grizzly bears from Mars we're stalking you, and you had to have something you could pack in and pack out that would stop a critter like that, and I feel pretty confident if you could stand to shoot it they probably couldn't stand to get shot by it if you know what I mean, so anyway we did not shoot this off arrest because honestly, and truly I don't know how you would, I mean the recall is brutal as it is and trying to arrest this thing it's nothing we shot it out you know at 2530 feet, and we're able to consistently hit you know a six-inch target no problem and I feel like that's probably about what this gun was designed to do it's its minute of you've heard a minute a bad guy I think this would be minute of angry bear accuracy here we are at the end of the lesson 500 BS revolvers review I've had a little more time at the range with it obviously I don't have revolvers here it's already gone home, but I've had time to collect my thoughts over the 500 BS is actually a five-shot revolver jammed into 500 Smith camp; Wesson Magnum handgun cartridge the most powerful commercially available handgun cartridge today this particular revolver has a two and three-quarter inch barrel and as you can see by the videos it was pretty brutal shoot as most all revolvers it did prove to be reliable over the 60 some rounds that we shot through it then heavy troubles for us that the single action trigger pull was really nice breaking under five pounds the double action trigger pull was a little heavier it was over 12 pounds but still not bad the revolver was accurate like I said earlier we didn't shoot it off a bench, but you know I was able to stay back anywhere from 30 and 40 feet and put five shots into you know a six-inch circle pretty easy just that the sheer recall and the design of that particular little stubby made it almost impossible for me to shoot from arrest, so it's its a nice revolver it's very well-built the thing about it is cut it is so small and so such a powerful handgun cartridge that it really is difficult to shoot for most of all of us...

People Also Ask about

What is the Virginia income tax extension form?

How to avoid California tax underpayment penalty?

What is the safe harbor rule for taxes?

What forms to include with Virginia tax return?

Are estimated tax payments required?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 500es 2017 form for eSignature?

How do I fill out the 500es 2017 form form on my smartphone?

How do I fill out 500es 2017 form on an Android device?

What is GA DoR 500 ES?

Who is required to file GA DoR 500 ES?

How to fill out GA DoR 500 ES?

What is the purpose of GA DoR 500 ES?

What information must be reported on GA DoR 500 ES?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.