Get the free INVOICE REVIEW CHECKLIST

Show details

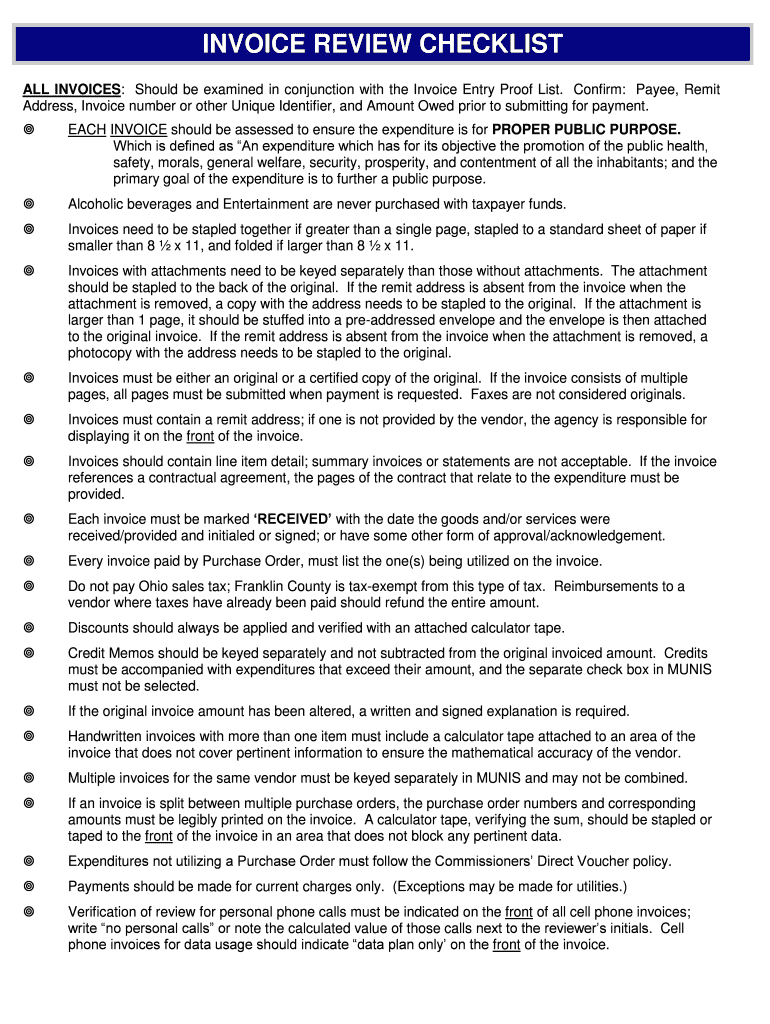

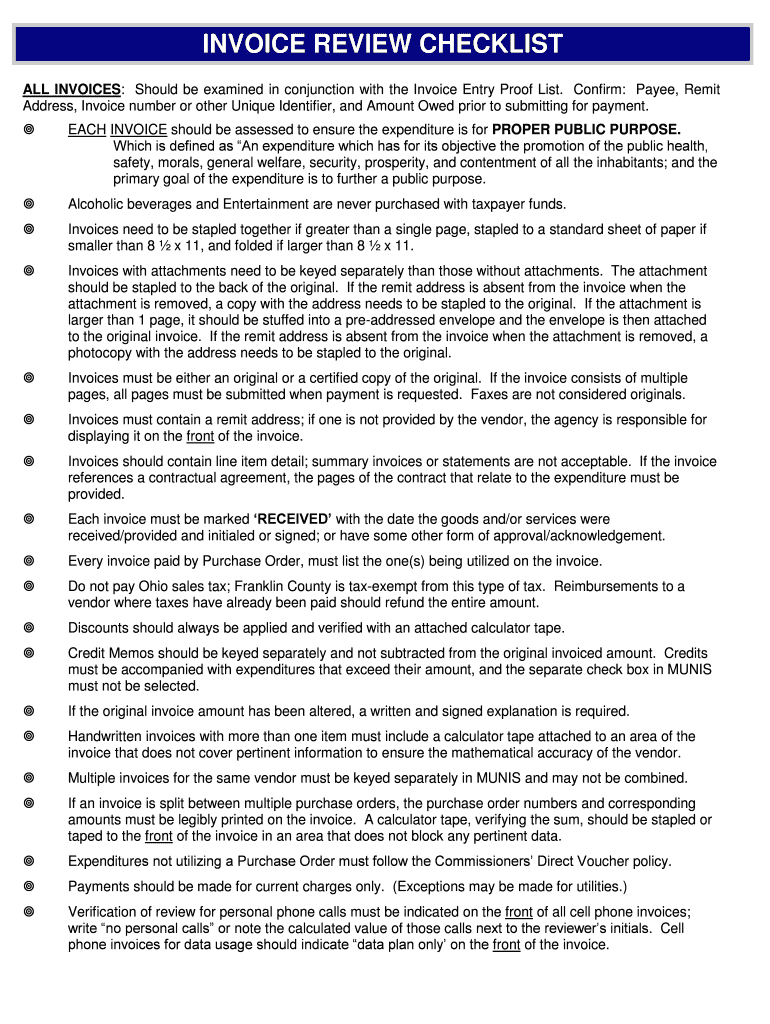

INVOICE REVIEW CHECKLIST

ALL INVOICES: Should be examined in conjunction with the Invoice Entry Proof List. Confirm: Payee, Remit

Address, Invoice number or other Unique Identifier, and Amount Owed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign invoice review checklist

Edit your invoice review checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your invoice review checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit invoice review checklist online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit invoice review checklist. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out invoice review checklist

How to fill out an invoice review checklist:

01

Gather all necessary documentation: Make sure you have the invoice, any supporting documents, and any relevant purchase orders or contracts.

02

Check the accuracy of the invoice details: Verify that the invoice includes the correct billing address, vendor information, and payment terms. Double-check the pricing and quantities to ensure they match the agreement.

03

Review the supporting documents: Cross-reference the invoice with any supporting documents, such as delivery receipts or timesheets, to ensure that the services or goods were provided as stated.

04

Confirm the calculations: Verify the mathematical accuracy of the invoice, including any discounts, taxes, or shipping charges. Use a calculator if needed.

05

Determine the appropriateness of expenses: Analyze the expenses listed on the invoice to ensure they are relevant and align with the agreed-upon terms. Flag any potential discrepancies or unauthorized charges.

06

Check for duplicate invoices: Look for any duplicates of the same invoice or any overlapping charges to avoid overpayment.

07

Assess compliance with company policies and procedures: Ensure that the invoice adheres to your company's guidelines and policies, including any required approvals or department codes.

08

Resolve discrepancies: If any discrepancies are found, communicate with the vendor to resolve them promptly. This may involve requesting revised invoices, negotiating pricing adjustments, or reconciling any differences.

09

Obtain necessary approvals: If the invoice review checklist requires approvals before payment, route the invoice to the appropriate individuals or departments according to your company's authorization process.

10

Maintain accurate records: After completing the review and approval process, file the invoice and all associated documents in an organized manner for future reference and audit purposes.

Who needs an invoice review checklist?

01

Small businesses: Small businesses often have limited resources and rely on accurate invoicing for financial stability. Implementing an invoice review checklist can help ensure that payments are accurate and minimize the risk of overpayment or fraudulent charges.

02

Accounts payable departments: Accounts payable departments are responsible for processing invoices and making payments on behalf of the company. Having an invoice review checklist enables them to efficiently review and verify the accuracy of invoices before processing payment.

03

Purchasing departments: Purchasing departments handle procurement activities and oversee vendor relationships. They can benefit from an invoice review checklist to ensure proper authorization, pricing accuracy, and adherence to contractual agreements.

04

Auditors: Auditors may use an invoice review checklist during financial audits to examine the accuracy and integrity of a company's invoices. This helps evaluate the effectiveness of internal controls and ensures compliance with regulations and policies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the invoice review checklist in Gmail?

Create your eSignature using pdfFiller and then eSign your invoice review checklist immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit invoice review checklist straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit invoice review checklist.

How do I fill out the invoice review checklist form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign invoice review checklist and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is invoice review checklist?

Invoice review checklist is a document that outlines the steps and factors to consider when reviewing invoices for accuracy and compliance before payment is made.

Who is required to file invoice review checklist?

It is typically the responsibility of accounts payable or finance department to file the invoice review checklist.

How to fill out invoice review checklist?

To fill out the invoice review checklist, one must carefully review the invoice for accuracy, check for any discrepancies, and ensure all necessary information is included.

What is the purpose of invoice review checklist?

The purpose of the invoice review checklist is to prevent errors, fraud, and discrepancies in the payment process, and ensure that invoices are processed efficiently and accurately.

What information must be reported on invoice review checklist?

The invoice review checklist should include details such as invoice number, date, vendor information, item description, quantity, price, and any approvals or authorizations.

Fill out your invoice review checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Invoice Review Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.