GP5479US 2016 free printable template

Show details

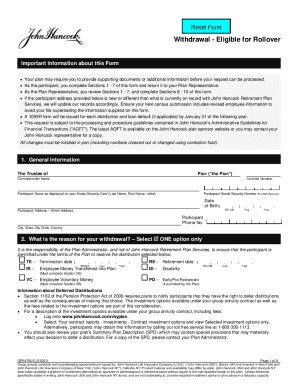

Includes... Withdrawal Eligible for Rollover Form Withdrawal Eligible for Rollover A Guide to Withdrawing Money From Your Retirement Plan Whether you re changing jobs or retiring or taking a withdrawal for other reasons removing your money from a 401 k or other qualified retirement plan means you ll need to review your distribution options so you can make an informed decision* This brief guide highlights the steps you can take today to help make the process easier and includes...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GP5479US

Edit your GP5479US form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GP5479US form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GP5479US online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit GP5479US. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GP5479US Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GP5479US

How to fill out GP5479US

01

Obtain a blank copy of the GP5479US form.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information in the designated sections, including your name, address, and contact details.

04

Provide any necessary identification or reference numbers as required.

05

Complete any additional sections that pertain to your specific situation.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as per the instructions provided, either online or by mail.

Who needs GP5479US?

01

Individuals applying for certain government programs or services that require documentation.

02

Businesses or organizations that need to provide information regarding eligibility or compliance.

03

Anyone who has been instructed by a government entity or agency to fill out the GP5479US form.

Fill

form

: Try Risk Free

People Also Ask about

What are the new 401k COVID withdrawal rules?

401(k) and IRA Withdrawals for COVID Reasons Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes both workplace plans, like a 401(k) or 403(b), and individual plans, like an IRA.

What are the 401k withdrawal rules for 2023?

The SECURE Act 2.0 changes the age for when savers must begin taking required minimum distributions (RMDs) from retirement plans, not once but twice. The age to start taking RMDs has now become 73, as of 2023, up from age 72. Then starting on Jan. 1, 2033, the age for beginning to take RMDs jumps to 75.

Can I still withdraw from my 401k without penalty in 2023?

You can avoid the early withdrawal penalty by waiting until at least age 59 1/2 to start taking distributions from your 401(k). Once you turn 59 1/2, you can withdraw any amount from your 401(k) without paying the 10% penalty.

What are 401k withdrawal requirements?

Generally, if your account balance exceeds $5,000, the plan administrator must obtain your consent before making a distribution. Depending on the type of benefit distribution provided under your 401(k) plan, the plan may also require the consent of your spouse before making a distribution.

What are the COVID changes to 401k withdrawals?

The CARES Act waives the 10% penalty for early withdrawals from account holders of 401(k) and IRAs if they qualify as coronavirus distributions. If you qualify under the stimulus package (see above) and your company permits hardship withdrawals, you'll be able to access your 401(k) funds without penalty.

What is the new law for 401k withdrawal?

Currently, Americans must start receiving required minimum distributions from their 401(k) and IRA accounts starting at age 72 (or 70 and a half if you turned that age before Jan. 1, 2020). The Secure 2.0 Act of 2022 raises the age for RMDs to 73, starting on Jan. 1, 2023, and then further to 75, starting on Jan.

Is a withdrawal from John Hancock eligible for rollover?

Note: If you wish to complete a direct rollover, you must provide John Hancock with the proper paperwork from the financial institution that holds your IRA or from the other eligible retirement plan. distribution, the withdrawal is not treated as an eligible rollover distribution subject to 20% withholding.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify GP5479US without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your GP5479US into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the GP5479US in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your GP5479US in seconds.

How do I edit GP5479US straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing GP5479US.

What is GP5479US?

GP5479US is a tax form used in the United States for reporting certain transactions and activities related to tax obligations.

Who is required to file GP5479US?

Individuals or entities that engage in specified transactions or meet certain criteria outlined by the IRS are required to file GP5479US.

How to fill out GP5479US?

To fill out GP5479US, gather the required information as specified in the form instructions, complete all relevant sections accurately, and submit the form to the appropriate tax authority.

What is the purpose of GP5479US?

The purpose of GP5479US is to ensure compliance with tax regulations by requiring the disclosure of specific financial activities or transactions.

What information must be reported on GP5479US?

Information that must be reported on GP5479US includes details about the taxpayer, the nature of the transactions, and any financial data specified by the IRS guidelines.

Fill out your GP5479US online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

gp5479us is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.