OSU FAQS about 1098-T 2016-2025 free printable template

Show details

FAQs about Form 1098T

Q: What is a Form 1098T?

A: Colleges and universities are required under Internal Revenue Code Section 6050S

to issue the Form 1098T for the purpose of determining a taxpayers'

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign osu 1098 t form

Edit your ohio state university 1098 t form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio 1098 faqs pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ohio state university 1098 t online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oh 1098t pdffiller form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

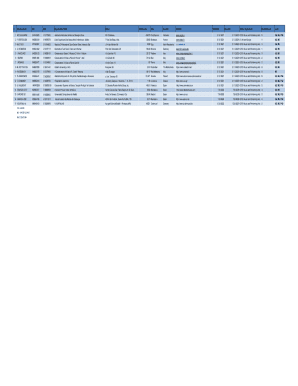

OSU FAQS about 1098-T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ohio state 1098 form

How to fill out OSU FAQS about 1098-T

01

Visit the OSU official website.

02

Navigate to the FAQ section related to the 1098-T form.

03

Read through the provided information regarding eligibility and requirements.

04

Locate the section that details the process for filling out the 1098-T form.

05

Follow the step-by-step instructions to complete the form accurately.

06

Ensure all required fields are filled out, including your personal details and tax identification number.

07

Review the completed form for accuracy before submitting or printing.

Who needs OSU FAQS about 1098-T?

01

Current OSU students who are eligible for tax credits or deductions related to education expenses.

02

Parents or guardians of students who need to understand the tax implications of the 1098-T form.

03

Anyone seeking information on financial aid or tax benefits in relation to educational costs at OSU.

Fill

ohio state university form 1098 t

: Try Risk Free

People Also Ask about osu 1098 form

Can I file my taxes without my 1098-T form?

Yes, you CAN file your tax return without the 1098-T information. However, it may not be in your best interest to do so. Entering in the 1098-T data will enable you to find out if you qualify for certain higher education credits (ex: American Opportunity Tax Credit and the Lifetime Learning Credit).

How much is the 1098-T credit?

It is a tax credit of up to $2,500 of the cost of tuition, certain required fees and course materials needed for attendance and paid during the tax year.

Does my 1098-T form give me money?

A form 1098-T, Tuition Statement, is used to help figure education credits (and potentially, the tuition and fees deduction) for qualified tuition and related expenses paid during the tax year. The Lifetime Learning Credit offers up to $2,000 for qualified education expenses paid for all eligible students per return.

How do I get my 1098-T from Ohio State?

1098-Ts are issued by January 31 each year. You will receive an email to your Ohio State email address address when it is available. Once issued, you can access the form on demand through your My Buckeye Link account .

Do you get money back for a 1098-T?

This is a credit of up to $2,000, and while it's not refundable, it's still a great way to reduce the tax you owe. Tuition and Fees Deduction. Allows up to $4,000 deduction for qualified higher education expenses.

How can I get a copy of my 1098-T?

Your college or career school will provide your 1098-T form electronically or by postal mail if you paid any qualified tuition and related education expenses during the previous calendar year.

What happens if my school doesn't give me a 1098-T form?

You can still claim an education credit if your school that closed did not provide you a Form 1098-T if: The student and/or the person able to claim the student as a dependent meets all other eligibility requirements to claim the credit. The student can show he or she was enrolled at an eligible educational institution.

Can I get my 1098-T form online?

What do I need to do? You can access your 1098-T form by visiting the Tab Service 1098t website. UC has contracted with Tab Service to electronically produce your 1098-T form.

How does a student 1098-T affect my taxes?

The IRS Form 1098-T is an information form filed with the Internal Revenue Service. You, or the person who may claim you as a dependent, may be able to claim an education tax credit on IRS Form 1040 for the qualified tuition and related expenses that were actually paid during the calendar year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my osu 1098 faqs make in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your osu form faqs online and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit oh 1098t edit in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your ohio form 1098 t, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my ohio state 1098 t in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your ohio osu 1098 template and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is OSU FAQS about 1098-T?

The OSU FAQs about 1098-T provides information regarding the 1098-T form, which is used by eligible educational institutions to report to the IRS information regarding qualified tuition and related expenses paid by students.

Who is required to file OSU FAQS about 1098-T?

Individuals or entities involved in handling the financial or tax-related information of students at OSU, such as financial aid officers and accounting personnel, are required to be familiar with the OSU FAQs about 1098-T.

How to fill out OSU FAQS about 1098-T?

To fill out the OSU FAQs about 1098-T, one must follow the guidelines provided on the OSU website, ensuring all required information is accurately reported according to IRS regulations.

What is the purpose of OSU FAQS about 1098-T?

The purpose of the OSU FAQs about 1098-T is to clarify the purpose, requirements, and reporting practices associated with the 1098-T form, and to assist students and staff in understanding its significance for tax purposes.

What information must be reported on OSU FAQS about 1098-T?

The information that must be reported on the OSU FAQs about 1098-T includes the amount of qualified tuition and related expenses billed, scholarships or grants received, and student information such as name and social security number.

Fill out your osu 1098 t form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oh Form 1098t Template is not the form you're looking for?Search for another form here.

Keywords relevant to ohio form 1098t online

Related to state osu 1098 create

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.