Get the free Pre-Authorized Tax Payment Plan Form - Township of Severn

Show details

THE CORPORATION OF THE TOWNSHIP OF SEVERN The Township implemented a Preauthorized Payment Plan for Taxes which has proved very successful with many ratepayers participating in the various options.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-authorized tax payment plan

Edit your pre-authorized tax payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-authorized tax payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pre-authorized tax payment plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pre-authorized tax payment plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre-authorized tax payment plan

How to fill out a pre-authorized tax payment plan:

01

Gather the necessary information: Start by collecting all the essential details you'll need to fill out the pre-authorized tax payment plan. This includes your social security number, tax identification number, and any relevant tax forms or documents.

02

Decide on the payment schedule: Determine how often you want to make your tax payments. Most pre-authorized tax payment plans offer options for monthly, quarterly, or annual payments. Choose the frequency that best suits your financial situation.

03

Contact the tax authority: Reach out to the appropriate tax authority, such as the Internal Revenue Service (IRS) in the United States, or your local tax agency. They will provide you with the necessary forms to fill out for the pre-authorized tax payment plan.

04

Complete the required forms: Fill in the forms with accurate and up-to-date information. Make sure to double-check all the details to avoid any errors or delays in your payment plan approval.

05

Submit the forms: Once you have completed the forms, submit them to the tax authority through the specified channels. This may include mailing them, submitting them online, or visiting a local tax office in person.

06

Await confirmation and approval: After submitting your forms, you will need to wait for the tax authority to review and approve your pre-authorized tax payment plan. This process may take some time, so be patient and ensure you have provided all necessary information.

07

Implement the payment plan: Once your pre-authorized tax payment plan is approved, you will receive confirmation of its acceptance. Take note of the payment dates, amounts, and any other specific details outlined in the agreement.

Who needs a pre-authorized tax payment plan:

01

Self-employed individuals: If you work for yourself and do not have taxes automatically deducted from your income, a pre-authorized tax payment plan can ensure that you meet your tax obligations throughout the year.

02

Individuals with fluctuating income: Those who have irregular or variable incomes may find it challenging to make lump sum tax payments. A pre-authorized tax payment plan allows for easier budgeting by spreading the tax liability over consistent, manageable payments.

03

Individuals with a history of late or missed tax payments: If you have experienced difficulties meeting tax deadlines in the past, a pre-authorized tax payment plan can help you avoid penalties and interest charges by automatically deducting the owed amount.

04

Individuals seeking convenience and peace of mind: For those who prefer to automate their financial responsibilities and eliminate the stress of remembering tax payment due dates, a pre-authorized tax payment plan provides ease and convenience.

Note: The requirements and procedures for pre-authorized tax payment plans may vary depending on your jurisdiction. It is always advisable to consult with a tax professional or contact your local tax authority for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pre-authorized tax payment plan?

The pre-authorized tax payment plan is a method where taxpayers authorize the government to automatically withdraw tax payments from their bank account at regular intervals.

Who is required to file pre-authorized tax payment plan?

Individuals or businesses who want to make their tax payments easier and more convenient may choose to file a pre-authorized tax payment plan.

How to fill out pre-authorized tax payment plan?

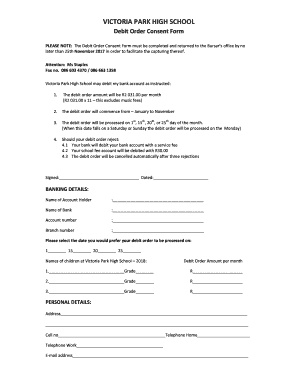

To fill out a pre-authorized tax payment plan, taxpayers must provide their banking information, tax identification number, and authorize the frequency and amount of the payments.

What is the purpose of pre-authorized tax payment plan?

The purpose of pre-authorized tax payment plan is to help taxpayers steadily pay their taxes over time, avoiding large lump sum payments and potential penalties for late or missed payments.

What information must be reported on pre-authorized tax payment plan?

The pre-authorized tax payment plan must include the taxpayer's bank account information, tax identification number, payment frequency, and amount to be withdrawn.

How do I modify my pre-authorized tax payment plan in Gmail?

pre-authorized tax payment plan and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit pre-authorized tax payment plan online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your pre-authorized tax payment plan to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I fill out pre-authorized tax payment plan on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your pre-authorized tax payment plan. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your pre-authorized tax payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Authorized Tax Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.