Canada P121 free printable template

Show details

De Conan TRE LE campus o TU suites courseware TES tubes : Edmundson, ... pas l'admission Au program DE premier choir (pour LE 1er cycle element). ... second about s TES droids DE solaria loss DE ta

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign en franais

Edit your en franais form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your en franais form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit en franais online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit en franais. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out en franais

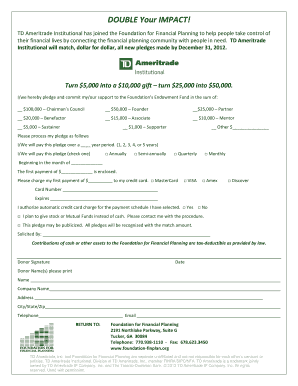

How to fill out Canada P121

01

Obtain a copy of the Canada P121 form from the official website or your local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Indicate your status as a resident or non-resident in Canada.

04

Provide details of any income earned during the tax year, including sources and amounts.

05

If applicable, list any deductions or credits you're claiming.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form to the appropriate tax authority by the required deadline.

Who needs Canada P121?

01

Individuals who earn income in Canada and need to report it for tax purposes.

02

Non-residents who have income from Canadian sources and are required to file a tax return.

03

Those claiming deductions or credits related to their income in Canada.

Fill

form

: Try Risk Free

People Also Ask about

Qu'est-ce que ça veut dire à en anglais ?

A et An sont les équivalents anglais de Un et Une en français.

Qu'est-ce que ça veut dire en français ?

Locution latine empruntée à l'anglais et signifiant c'est-à-dire.

Ou bien traduction en français ?

ou bien Principales traductionsFrançaisAnglaisou bien conj(ou, soit)or conjor else conjOn va au cinéma ou bien à la patinoire ; c'est comme tu veux.4 more rows

Comment dire en anglais ?

comment! what! et comment! and how!

Où est Charlie en anglais ?

Où est Charlie ? (Where's Wally?

Ou bien signification ?

Locution qui offre la possibilité d'un choix. Cette locution se place presque toujours entre deux options possibles et réalisables. Mais celles-ci ne peuvent pas être choisies en même temps. Exemple : Charles, tu prends les bonbons ou bien la tarte, mais pas les deux !

Comment traduire les mots en français ?

Traduire du texte Sur votre téléphone ou tablette Android, ouvrez l'application Traduction . Définissez la langue source (depuis laquelle vous voulez traduire) et la langue cible (dans laquelle vous voulez traduire). Saisissez le mot ou l'expression à traduire. Le texte traduit s'affiche.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit en franais online?

With pdfFiller, the editing process is straightforward. Open your en franais in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit en franais on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share en franais from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete en franais on an Android device?

On an Android device, use the pdfFiller mobile app to finish your en franais. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Canada P121?

Canada P121 is a tax form used by Canadian residents to report certain income and make calculations related to their income tax obligations.

Who is required to file Canada P121?

Individuals who have earned income subject to Canadian taxation, or who need to report specific tax credits or deductions, are required to file Canada P121.

How to fill out Canada P121?

To fill out Canada P121, gather all relevant income documents, follow the instructions provided with the form, enter your income details, deductions, and credits accurately, and ensure all necessary signatures are included before submission.

What is the purpose of Canada P121?

The purpose of Canada P121 is to ensure that individuals report their income accurately to the Canadian tax authorities and to calculate the correct amount of taxes owed or refunds due.

What information must be reported on Canada P121?

Canada P121 requires reporting on various types of income, including employment income, self-employment income, investment income, tax credits, and deductions applicable to the taxpayer.

Fill out your en franais online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

En Franais is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.