Get the free Life and Annuity Division Protective Life Insurance ...

Show details

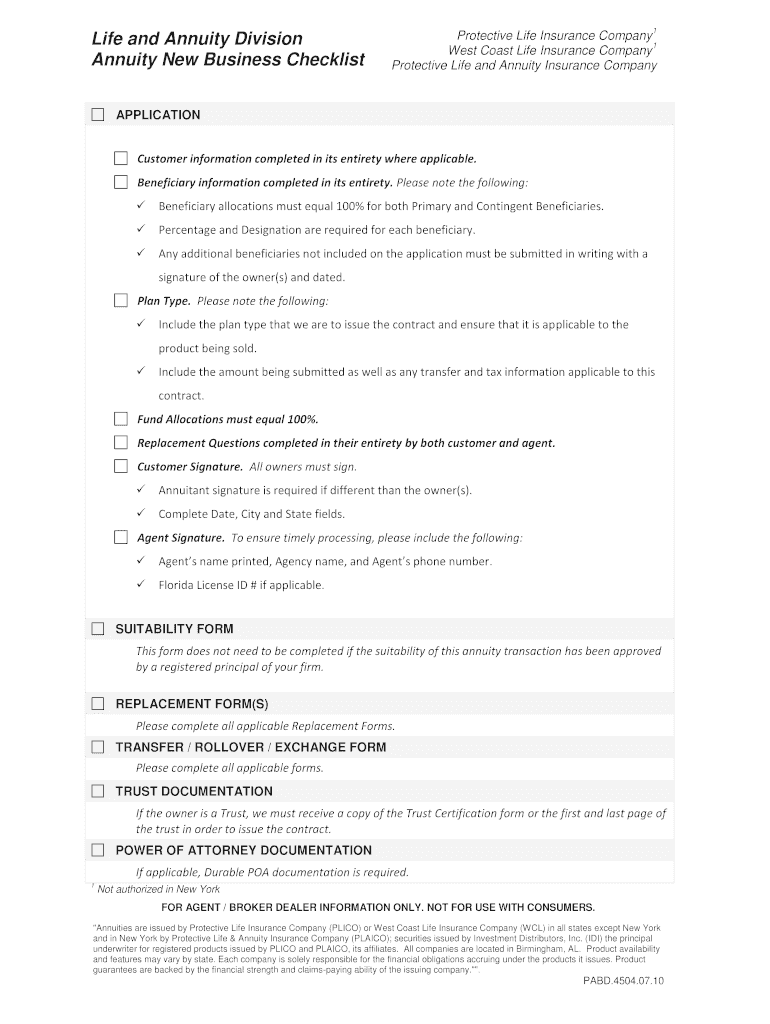

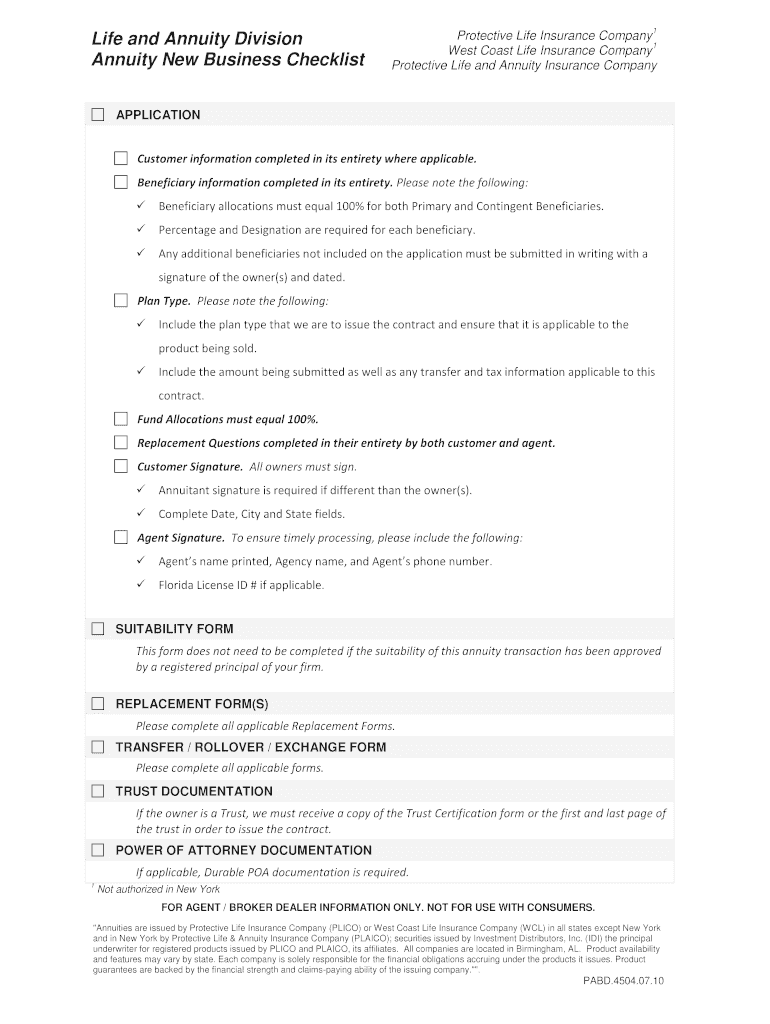

Life and Annuity Division Annuity New Business Checklist 1 Protective Life Insurance Company 1 West Coast Life Insurance Company Protective Life and Annuity Insurance Company APPLICATION Customer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life and annuity division

Edit your life and annuity division form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life and annuity division form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life and annuity division online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit life and annuity division. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life and annuity division

How to fill out life and annuity division

01

Step 1: Start by gathering all the necessary information such as your personal details, financial information, and any existing policies or contracts related to life and annuity division.

02

Step 2: Review the terms and conditions of your life and annuity division carefully. Understand the benefits, features, and potential risks associated with it.

03

Step 3: Determine the appropriate coverage and annuity options that best suit your financial goals and needs. Consider factors like your age, current financial situation, and future plans.

04

Step 4: Fill out the application form accurately and completely. Provide all the required information, ensuring its correctness to avoid any issues later on.

05

Step 5: Double-check your application before submission. Make sure you have included all the necessary supporting documents and signatures.

06

Step 6: Submit your completed application to the life and annuity division provider or agent. Keep a copy of the application and any supporting documents for your records.

07

Step 7: Wait for the review and approval process. The provider may contact you for any additional information or clarification if needed.

08

Step 8: Upon approval, carefully review the final policy or contract. Understand the terms, conditions, premiums, and payout options.

09

Step 9: Make the necessary payments as per the chosen premium payment schedule and keep track of the due dates.

10

Step 10: If you have any questions or need assistance, don't hesitate to contact the life and annuity division provider or agent for guidance and support.

Who needs life and annuity division?

01

Individuals who want to secure their financial future and protect their loved ones financially in case of unfortunate events like death or disability.

02

Individuals who seek regular income or financial stability during their retirement years.

03

Those with dependents or potential beneficiaries who would benefit from a life insurance or annuity payout.

04

Business owners or entrepreneurs who want to safeguard their businesses and ensure continuity despite unexpected circumstances.

05

People who wish to accumulate savings or build a cash value over time through an annuity.

06

Anyone who wants to have peace of mind knowing they have a financial safety net in place.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send life and annuity division to be eSigned by others?

To distribute your life and annuity division, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute life and annuity division online?

pdfFiller has made it simple to fill out and eSign life and annuity division. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the life and annuity division form on my smartphone?

Use the pdfFiller mobile app to fill out and sign life and annuity division. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is life and annuity division?

Life and annuity division refers to a department within an insurance company that focuses on selling and managing life insurance policies and annuities.

Who is required to file life and annuity division?

Insurance companies are required to file life and annuity division as part of their regulatory reporting requirements.

How to fill out life and annuity division?

To fill out life and annuity division, insurance companies need to gather information on their life insurance policies and annuities, including policyholder details, coverage amounts, and premium payments.

What is the purpose of life and annuity division?

The purpose of life and annuity division is to provide regulators with information on the insurance company's life insurance and annuity business, ensuring compliance with regulations and protecting policyholders.

What information must be reported on life and annuity division?

Information that must be reported on life and annuity division includes details on policies issued, premiums collected, claims paid, and reserves held for future obligations.

Fill out your life and annuity division online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life And Annuity Division is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.