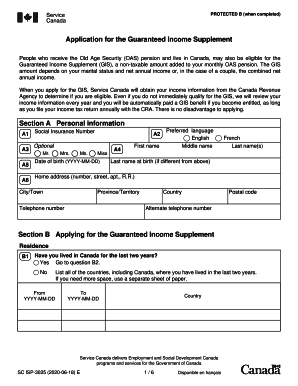

Canada SC ISP-3025 2017 free printable template

Show details

Any benefits you received or obtained to which there was no entitlement would have to be repaid. GIS or Allowance for the Survivor applicant Signatures H If one or both sign with a mark a witness friend member of the family etc. must complete this section. Name Relationship FOR OFFICE USE ONLY Effective date Certified by Date Service Canada delivers Employment and Social Development Canada programs and services for the Government of Canada SC ISP-3025 2017-01-27 E 1/2 Disponible en fran ais...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada SC ISP-3025

Edit your Canada SC ISP-3025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada SC ISP-3025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada SC ISP-3025 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada SC ISP-3025. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada SC ISP-3025 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada SC ISP-3025

How to fill out Canada SC ISP-3025

01

Gather all required documents, including identification and proof of residence.

02

Visit the official Canada government website to download the SC ISP-3025 form.

03

Carefully read the instructions provided in the form.

04

Fill out personal information such as name, address, and contact details in the designated sections.

05

Provide any required financial information as specified in the form.

06

Double-check all entered information for accuracy.

07

Sign and date the form where indicated.

08

Submit the completed form through the specified method, either online or via mail.

Who needs Canada SC ISP-3025?

01

Individuals applying for certain government services in Canada.

02

Residents seeking to update their personal information with government agencies.

03

Those needing to prove their residency status for specific applications.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get the guaranteed income supplement?

You'll receive it the month after you turn age 65. For your GIS payments to continue uninterrupted, you must file your income taxes on time every year.

What income is calculated for GIS?

To qualify for the GIS, your income must be below $20,832 if you're single, widowed, or divorced. If you have a spouse or common-law partner, your combined income has to be below: $27,552 if your partner receives the full OAS pension. $49,920 if your partner does not receive an OAS pension or the Allowance.

Is GIS included in taxable income?

The Supplement is based on income and is available to low-income Old Age Security pensioners. It is not taxable.

Who qualifies for GIS?

To be eligible for the GIS, you must: Be receiving the OAS pension. Make your home in Canada and normally live in Canada (although temporary absences of up to six months are allowed) Have an income lower than maximum allowed (see current amounts here)

What is maximum income for guaranteed income?

What is the maximum income to qualify for GIS in 2022? Your income must be less than $20,208 per year if you're a single senior. Senior couples in which one spouse does not receive an OAS pension can qualify if their mutual income is less than $48,432 and less than $26,688 if one spouse does receive a full OAS pension.

Is GIS Included in net income?

No, the GIS is non-taxable, which means that it won't be considered as part of your taxable income when you file your taxes. That being said, you should still report your GIS earnings when filing your return, because it's used to determine if you're eligible for other government benefits as well.

What income is used for GIS?

Investment income including interest. Dividends and capital gains income. Other income including alimony and workers' compensation benefits. Employment net income minus the $3,500 earnings exemption, CPP or QPP contributions and Employment Insurance premiums.

How much can I earn without losing my GIS?

You can also earn up to $5,000 and still receive the full benefit amount if you're employed or self-employed. When earnings fall between $5,000 and $15,000, your GIS payment will be reduced by 50 cents for every dollar of income you make.

Does CPP count as income for GIS?

To estimate your GIS eligibility, you will need to report income and deductions, including: Benefits from a Canada Pension Plan (CPP) or a Quebec Pension Plan (QPP) Additional pension income, including private pensions or foreign pensions.

Does everyone get GIS?

The GIS is a monthly benefit available to anyone receiving, or eligible to receive the Old Age Security (OAS) pension, whose annual income (or combined annual income for couples) is below the maximum annual threshold.

Do I qualify for guaranteed income?

To qualify for the GIS, your income must be below $20,832 if you're single, widowed, or divorced. If you have a spouse or common-law partner, your combined income has to be below: $27,552 if your partner receives the full OAS pension. $49,920 if your partner does not receive an OAS pension or the Allowance.

What is the GIS limit?

What is the maximum income to qualify for GIS in 2022? Your income must be less than $20,208 per year if you're a single senior. Senior couples in which one spouse does not receive an OAS pension can qualify if their mutual income is less than $48,432 and less than $26,688 if one spouse does receive a full OAS pension.

Is GIS based on net income?

This is because the GIS amount payable is calculated based on your net income before adjustments on line 23400 (line 234 prior to 2019) of your tax return.

How do you qualify for guaranteed income supplement?

The Guaranteed Income Supplement (GIS) is a monthly payment you can get if: you are 65 or older. you live in Canada. you get the Old Age Security (OAS) pension.When payments start your Social Insurance Number. your income information from the year before. your spouse or common-law partner's income from the year before.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada SC ISP-3025 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your Canada SC ISP-3025 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit Canada SC ISP-3025 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing Canada SC ISP-3025.

How can I fill out Canada SC ISP-3025 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your Canada SC ISP-3025. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is Canada SC ISP-3025?

Canada SC ISP-3025 is a form used for reporting specific financial information related to the importation of goods into Canada.

Who is required to file Canada SC ISP-3025?

Any individual or business that imports goods into Canada and meets certain criteria regarding the value or nature of those goods is required to file Canada SC ISP-3025.

How to fill out Canada SC ISP-3025?

To fill out Canada SC ISP-3025, you must provide details such as the importer’s information, description of goods, value, and any other required financial data according to the guidelines provided by the Canada Border Services Agency.

What is the purpose of Canada SC ISP-3025?

The purpose of Canada SC ISP-3025 is to ensure compliance with Canadian laws regarding the importation of goods and to collect necessary information for tax and customs purposes.

What information must be reported on Canada SC ISP-3025?

The information that must be reported on Canada SC ISP-3025 includes the importer's details, a description of the imported goods, their declared value, and any relevant financial or transactional data.

Fill out your Canada SC ISP-3025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada SC ISP-3025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.