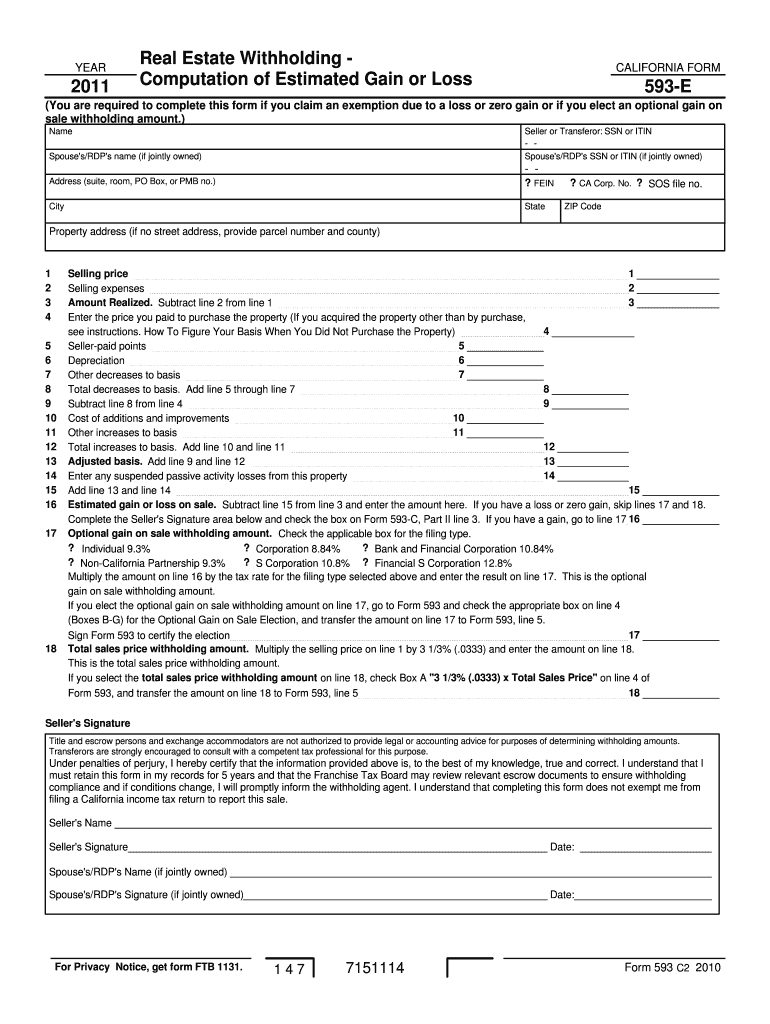

Who needs a form 593-E?

This form is required if you sell real estate property during a certain tax year in California. It’s completed by the seller and helps to calculate the amount of your gain or loss for withholding purposes. The withholding is not required if the total sales price is less than $100; the property is foreclosed upon, and some other cases.

What is the purpose of the 593-E form?

The Real Estate Withholding — Computation of Estimated Gain or Loss has some instructions for calculating an optional gain on the sale withholding amount. The information is required for calculating the seller’s taxes.

What documents must accompany the 593-E form?

This form is a part of the Real Estate Withholding Certificate.

Does the 593-E form have a validity period?

The computation form should be kept by the Real Estate Escrow Person (KEEP) for 5 years. The Real Estate Withholding Certificate is completed together with the 593-E form after the selling of the real estate property or at the end of the tax year.

What information should be provided in the 593-E form?

The form consists of two parts which must be filled in:

Part I — Information about the seller or transferor:

-

Name of the seller

-

SSN or ITIN

-

Spouse’s/RDP’s name (if it’s a jointly owned property)

-

Address of the seller

-

Property address

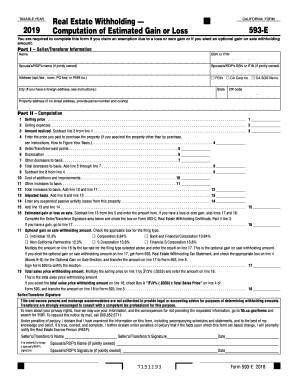

Part II — Computation: this part contains the instructions for calculating the total sales price withholding amount.

The form should be also signed by the seller and the spouse and dated.

The second and the third pages of the form are instructions.

What do I do with the form after its completion?

The signed and completed Computation form is forwarded to the KEEP. This person must provide the form at the demand of the California Franchise Tax Board.