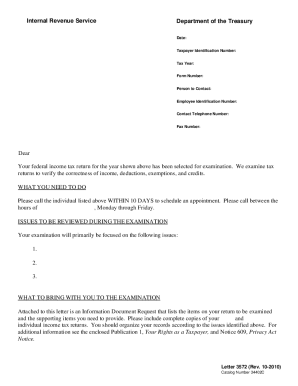

IRS Letter 3572 2003 free printable template

Show details

This IRS Audit Notice 3572 Letter sample is provided by TaxAudit.com, the nations leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Internal Revenue Service Small Business

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Letter 3572

Edit your IRS Letter 3572 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Letter 3572 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Letter 3572 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS Letter 3572. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Letter 3572 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Letter 3572

How to fill out irs audit letter example:

01

Start by carefully reading the instructions provided in the audit letter. Make sure you understand what is being asked of you.

02

Gather all the necessary documents that are requested in the audit letter. This may include financial statements, receipts, and any other relevant records.

03

Review your own records and compare them to the audit letter requirements. Ensure that all the information matches and is accurate.

04

Fill out the audit letter forms or provide the requested information in the designated format. Use clear and concise language to provide the necessary details.

05

Double-check all the information you have provided in the audit letter to minimize errors or discrepancies.

06

Attach any supporting documentation that may be required to validate your claims or information provided.

07

Before submitting the audit letter, make a copy for your own records. This will serve as proof of your compliance and can be helpful if there are any future inquiries or clarifications.

08

Follow the instructions provided on how to submit the completed audit letter. This may involve mailing it to a specific address or filing it electronically.

09

If you have any questions or concerns regarding the audit letter, reach out to the IRS or a tax professional for guidance.

Who needs irs audit letter example:

01

Individuals or businesses who have received an audit letter from the IRS.

02

Taxpayers who want to understand the process of filling out an IRS audit letter.

03

Individuals or businesses who want to ensure they are providing the necessary information accurately and completely to the IRS during an audit.

Fill

form

: Try Risk Free

People Also Ask about

Are IRS audit letters always sent certified?

Some IRS notices are sent via certified mail, such as the Notice of Intent to Levy, while others are mailed via regular post, like changes made to your tax return. Read all IRS letters and notices you receive, both certified and via regular mail. Do not ignore any of them.

What does an audit letter look like IRS?

The IRS audit letter will arrive via certified mail and list your full name, taxpayer ID or social security number, the form number, and the Information they are reviewing. It will also provide the IRS agent's contact information for more information or questions on the process or specific case.

What not to say in an IRS audit?

Do not lie or make misleading statements: The IRS may ask questions they already know the answers to in order to see how much they can trust you. It is best to be completely honest, but do not ramble and say anything more than is required.

What are red flags for IRS audits?

Some red flags for an audit are round numbers, missing income, excessive deductions or credits, unreported income and refundable tax credits. The best defense is proper documentation and receipts, tax experts say.

What's the worst that can come from an audit?

For most people who fail an audit, the result is a bigger tax bill. Not only will you owe more taxes than you thought — you'll also owe interest on those taxes. This can make the bill quite high, but remember: You definitely won't get sent to prison for being unable to pay your additional taxes.

What does an IRS audit letter say?

The IRS will provide all contact information and instructions in the letter you will receive. If we conduct your audit by mail, our letter will request additional information about certain items shown on the tax return such as income, expenses, and itemized deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the IRS Letter 3572 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit IRS Letter 3572 on an iOS device?

Create, modify, and share IRS Letter 3572 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit IRS Letter 3572 on an Android device?

You can make any changes to PDF files, like IRS Letter 3572, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is IRS Letter 3572?

IRS Letter 3572 is a correspondence sent by the Internal Revenue Service to inform taxpayers about certain tax-related issues, especially regarding their tax obligations or status.

Who is required to file IRS Letter 3572?

Taxpayers who receive this letter from the IRS are typically required to respond or take action as indicated in the letter, which may include individuals or businesses with specific tax filing obligations.

How to fill out IRS Letter 3572?

To fill out IRS Letter 3572, carefully follow the instructions provided in the letter regarding the required information and documentation. Ensure all information is accurate and complete before submitting.

What is the purpose of IRS Letter 3572?

The purpose of IRS Letter 3572 is to communicate with taxpayers regarding their tax situation, provide necessary information, and request action if needed to comply with tax laws.

What information must be reported on IRS Letter 3572?

The information that must be reported on IRS Letter 3572 includes personal identification details, tax year(s) in question, any relevant financial information, and responses to specific inquiries made by the IRS.

Fill out your IRS Letter 3572 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Letter 3572 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.