IRS Letter 3572 2010-2025 free printable template

Show details

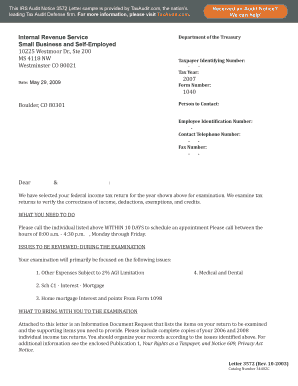

Internal Revenue ServiceDepartment of the Treasury Date: Taxpayer Identification Number: Tax Year: Form Number: Person to Contact: Employee Identification Number: Contact Telephone Number: Fax Number:Dear

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs audit letter 2010-2025

Edit your irs audit letter 2010-2025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs audit letter 2010-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs audit letter 2010-2025 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs audit letter 2010-2025. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Letter 3572 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs audit letter 2010-2025

How to fill out letter 3572 rev 10-2010

01

Start by entering the tax year in question at the top of the form.

02

Provide your contact information including your name, address, and phone number.

03

Fill in the details of the tax office that issued the letter 3572.

04

Write a brief explanation of why you are filling out the form and any additional information requested.

05

Double-check all the information provided for accuracy before submitting the form.

Who needs letter 3572 rev 10-2010?

01

Individuals who have received letter 3572 rev 10-2010 from the tax office in relation to their tax return or tax payment.

Fill

form

: Try Risk Free

People Also Ask about

Are IRS audit letters always sent certified?

Some IRS notices are sent via certified mail, such as the Notice of Intent to Levy, while others are mailed via regular post, like changes made to your tax return. Read all IRS letters and notices you receive, both certified and via regular mail. Do not ignore any of them.

What does an audit letter look like IRS?

The IRS audit letter will arrive via certified mail and list your full name, taxpayer ID or social security number, the form number, and the Information they are reviewing. It will also provide the IRS agent's contact information for more information or questions on the process or specific case.

What not to say in an IRS audit?

Do not lie or make misleading statements: The IRS may ask questions they already know the answers to in order to see how much they can trust you. It is best to be completely honest, but do not ramble and say anything more than is required.

What are red flags for IRS audits?

Some red flags for an audit are round numbers, missing income, excessive deductions or credits, unreported income and refundable tax credits. The best defense is proper documentation and receipts, tax experts say.

What's the worst that can come from an audit?

For most people who fail an audit, the result is a bigger tax bill. Not only will you owe more taxes than you thought — you'll also owe interest on those taxes. This can make the bill quite high, but remember: You definitely won't get sent to prison for being unable to pay your additional taxes.

What does an IRS audit letter say?

The IRS will provide all contact information and instructions in the letter you will receive. If we conduct your audit by mail, our letter will request additional information about certain items shown on the tax return such as income, expenses, and itemized deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irs audit letter 2010-2025 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your irs audit letter 2010-2025 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in irs audit letter 2010-2025 without leaving Chrome?

irs audit letter 2010-2025 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the irs audit letter 2010-2025 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign irs audit letter 2010-2025. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is letter 3572 rev 10-2010?

Letter 3572 rev 10-2010 is a tax form used by the IRS for reporting information related to certain transactions.

Who is required to file letter 3572 rev 10-2010?

Individuals or entities who engaged in the specified transactions are required to file letter 3572 rev 10-2010.

How to fill out letter 3572 rev 10-2010?

Letter 3572 rev 10-2010 can be filled out by providing the required information in the designated fields on the form.

What is the purpose of letter 3572 rev 10-2010?

The purpose of letter 3572 rev 10-2010 is to report information to the IRS about certain transactions.

What information must be reported on letter 3572 rev 10-2010?

Information about the specific transactions, including amounts and dates, must be reported on letter 3572 rev 10-2010.

Fill out your irs audit letter 2010-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Audit Letter 2010-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.